Attorney-Approved Gift Deed Document

State-specific Gift Deed Forms

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that allows one person to give property to another without any exchange of money. |

| Governing Law | In the United States, the laws governing Gift Deeds vary by state. Generally, they are governed by state property laws. |

| Requirements | Most states require the Gift Deed to be in writing, signed by the donor, and often notarized. |

| Tax Implications | Gifts may have tax implications. In the U.S., the donor may need to file a gift tax return if the value exceeds a certain amount. |

Sample - Gift Deed Form

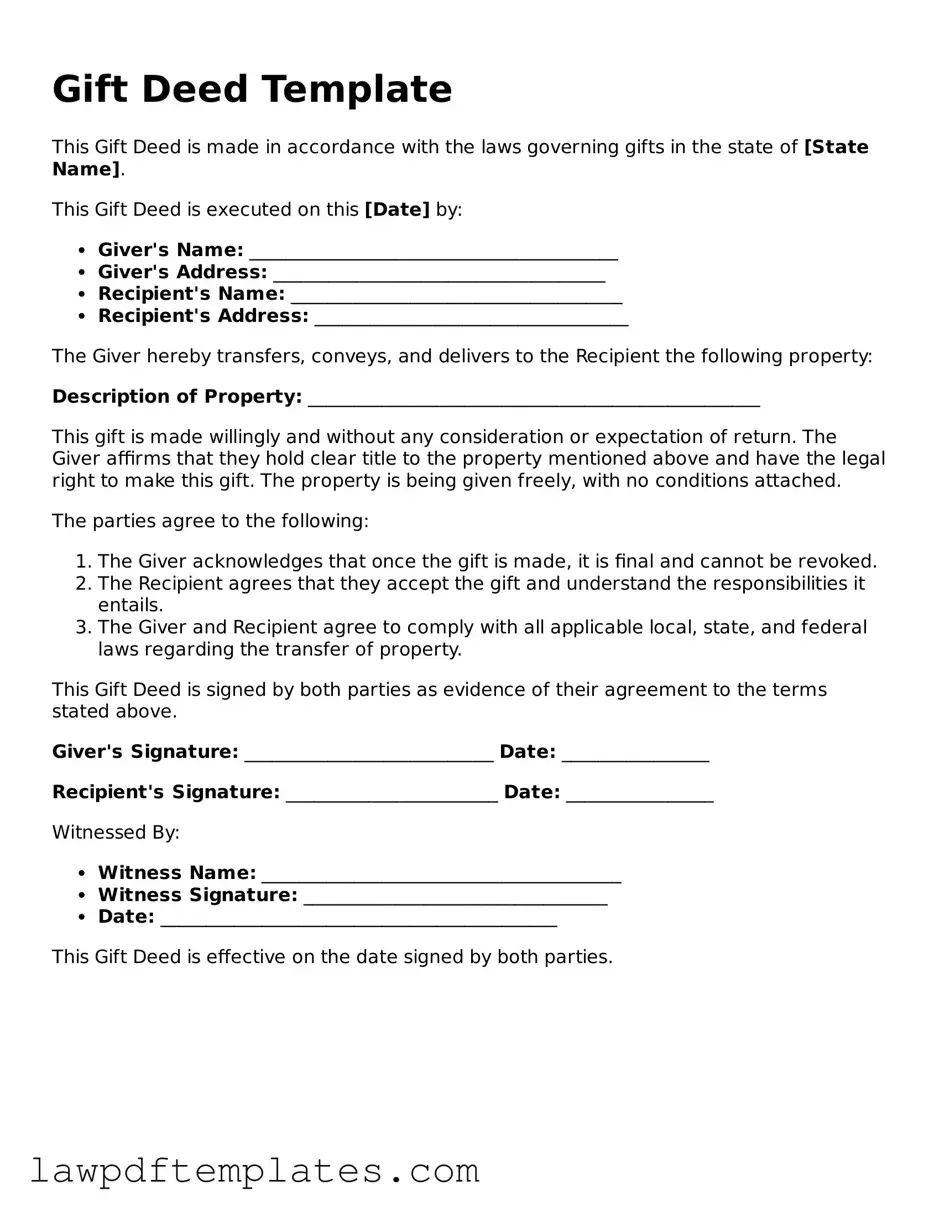

Gift Deed Template

This Gift Deed is made in accordance with the laws governing gifts in the state of [State Name].

This Gift Deed is executed on this [Date] by:

- Giver's Name: ________________________________________

- Giver's Address: ____________________________________

- Recipient's Name: ____________________________________

- Recipient's Address: __________________________________

The Giver hereby transfers, conveys, and delivers to the Recipient the following property:

Description of Property: _________________________________________________

This gift is made willingly and without any consideration or expectation of return. The Giver affirms that they hold clear title to the property mentioned above and have the legal right to make this gift. The property is being given freely, with no conditions attached.

The parties agree to the following:

- The Giver acknowledges that once the gift is made, it is final and cannot be revoked.

- The Recipient agrees that they accept the gift and understand the responsibilities it entails.

- The Giver and Recipient agree to comply with all applicable local, state, and federal laws regarding the transfer of property.

This Gift Deed is signed by both parties as evidence of their agreement to the terms stated above.

Giver's Signature: ___________________________ Date: ________________

Recipient's Signature: _______________________ Date: ________________

Witnessed By:

- Witness Name: _______________________________________

- Witness Signature: _________________________________

- Date: ___________________________________________

This Gift Deed is effective on the date signed by both parties.

Common mistakes

Filling out a Gift Deed form can seem straightforward, but many people make common mistakes that can lead to complications later. One frequent error is not including all required details about the donor and the recipient. This includes full names, addresses, and any relevant identification numbers. Omitting even one piece of information can render the document incomplete.

Another mistake is failing to accurately describe the property being gifted. It’s essential to provide a clear and precise description of the property, including its location and any distinguishing features. Vague descriptions can create confusion and disputes in the future.

Many individuals overlook the necessity of having the Gift Deed signed by witnesses. Most states require at least one witness to sign the document. Without this step, the deed may not be legally valid. Additionally, some people forget to include a date on the form, which is crucial for establishing when the gift was made.

Another common pitfall is not consulting local laws. Each state has specific requirements regarding Gift Deeds. Ignoring these can lead to issues with enforceability. It's wise to verify that the form complies with local regulations.

People often neglect to consider tax implications when completing a Gift Deed. Gifts above a certain value may trigger gift tax obligations. It's important to understand these potential consequences to avoid unexpected financial burdens.

Additionally, some individuals mistakenly believe that a verbal agreement is sufficient. A Gift Deed must be in writing to be legally enforceable. Relying on verbal promises can lead to misunderstandings and disputes down the line.

Lastly, not keeping a copy of the completed Gift Deed can create problems. After signing and executing the document, it’s vital to retain a copy for personal records. This ensures that all parties have access to the terms of the gift if needed in the future.

Consider Popular Types of Gift Deed Documents

Problems With Transfer on Death Deeds California - Ensure any previous deeds are revoked properly to prevent conflicting claims on the property.

By utilizing the Texas RV Bill of Sale, you ensure that the transaction is documented correctly and legally, making it easier for both parties involved. To facilitate this process, resources like the PDF Documents Hub provide access to the necessary forms and guidance, ensuring a smooth transfer of ownership.

Deed in Lieu Meaning - Signing a Deed in Lieu typically involves negotiating terms with the lender to satisfy the outstanding loan obligation.