Free Transfer-on-Death Deed Template for the State of Georgia

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The TOD deed is governed by Georgia Code § 44-6-31 through § 44-6-35. |

| Eligibility | Only individuals can create a TOD deed; entities such as corporations or partnerships cannot be named as beneficiaries. |

| Revocability | The property owner can revoke the TOD deed at any time before their death without the beneficiary's consent. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals or notarized to be valid. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the property can be divided among them in specified shares. |

| Transfer Process | The transfer occurs automatically upon the death of the owner, with no need for probate proceedings. |

| Tax Implications | Beneficiaries may be subject to capital gains tax based on the property’s value at the time of the owner's death. |

| Filing Requirement | The TOD deed must be recorded in the county where the property is located to be effective against third parties. |

| Limitations | Transfer-on-Death deeds cannot be used for all types of property; for example, they do not apply to personal property or property held in a trust. |

Sample - Georgia Transfer-on-Death Deed Form

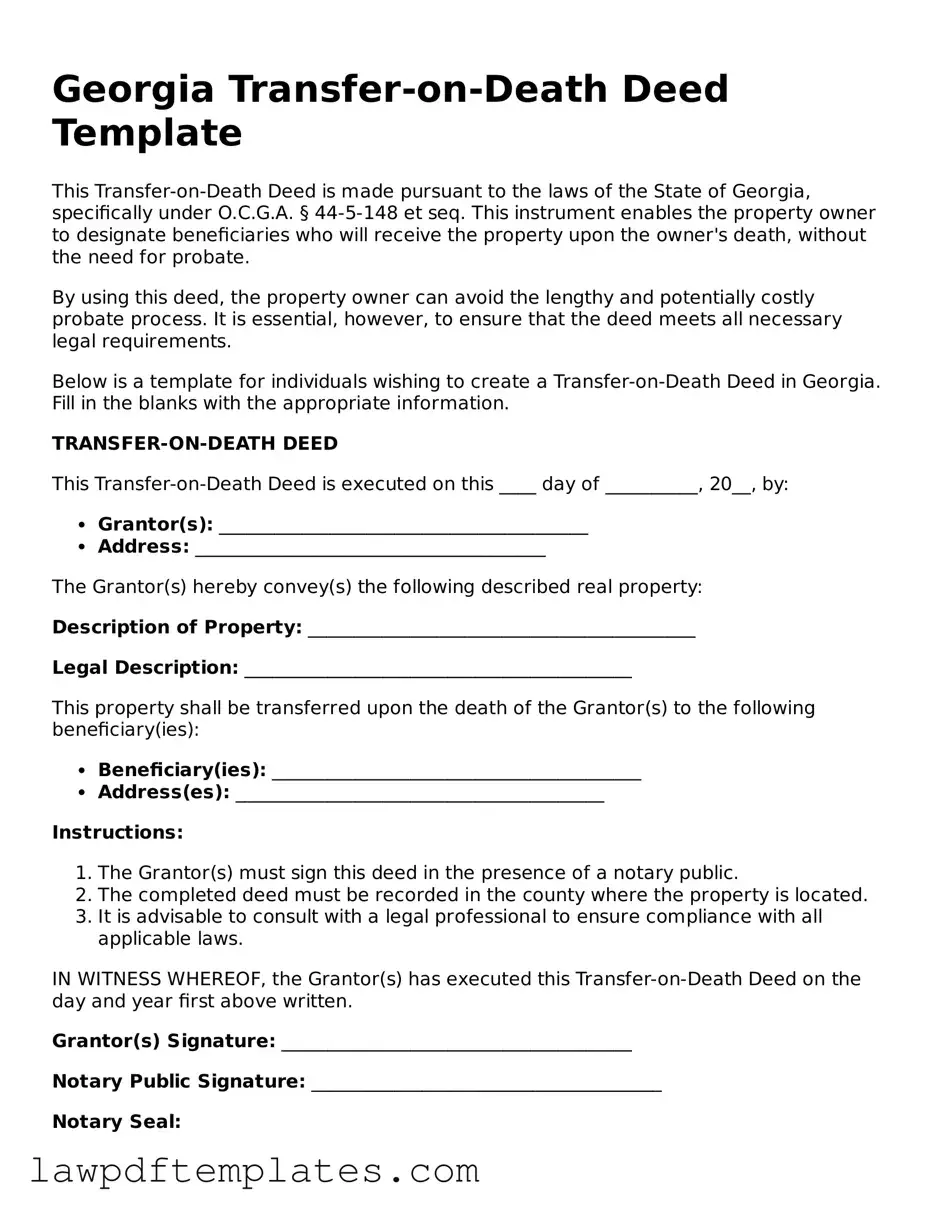

Georgia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the laws of the State of Georgia, specifically under O.C.G.A. § 44-5-148 et seq. This instrument enables the property owner to designate beneficiaries who will receive the property upon the owner's death, without the need for probate.

By using this deed, the property owner can avoid the lengthy and potentially costly probate process. It is essential, however, to ensure that the deed meets all necessary legal requirements.

Below is a template for individuals wishing to create a Transfer-on-Death Deed in Georgia. Fill in the blanks with the appropriate information.

TRANSFER-ON-DEATH DEED

This Transfer-on-Death Deed is executed on this ____ day of __________, 20__, by:

- Grantor(s): ________________________________________

- Address: ______________________________________

The Grantor(s) hereby convey(s) the following described real property:

Description of Property: __________________________________________

Legal Description: __________________________________________

This property shall be transferred upon the death of the Grantor(s) to the following beneficiary(ies):

- Beneficiary(ies): ________________________________________

- Address(es): ________________________________________

Instructions:

- The Grantor(s) must sign this deed in the presence of a notary public.

- The completed deed must be recorded in the county where the property is located.

- It is advisable to consult with a legal professional to ensure compliance with all applicable laws.

IN WITNESS WHEREOF, the Grantor(s) has executed this Transfer-on-Death Deed on the day and year first above written.

Grantor(s) Signature: ______________________________________

Notary Public Signature: ______________________________________

Notary Seal:

Common mistakes

Filling out the Georgia Transfer-on-Death Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the road. One significant error is failing to include the correct legal description of the property. This description must be precise and can often be found on the property deed or tax records. If the description is incorrect or incomplete, it may result in confusion or disputes regarding ownership after the individual passes away.

Another frequent mistake involves not properly identifying the beneficiaries. It’s essential to clearly state the names of those who will inherit the property. Omitting a beneficiary or misspelling a name can create legal hurdles, potentially leading to challenges in executing the deed. Always double-check names and consider including middle initials or full names to avoid any ambiguity.

Additionally, many people neglect to sign the deed in front of a notary public. In Georgia, notarization is a crucial step in making the document legally binding. Without this notarization, the deed may be considered invalid, which can complicate the transfer of property upon the owner's death. Ensuring that the document is signed and notarized correctly can prevent future legal disputes.

People also often overlook the importance of recording the deed with the appropriate county office. Even if the deed is filled out correctly, it must be filed with the local clerk of court or land records office to take effect. Failing to record the deed can result in the property not being transferred as intended, leaving the estate to go through probate, which can be a lengthy and costly process.

Lastly, individuals sometimes forget to review their Transfer-on-Death Deed after significant life events, such as marriage, divorce, or the birth of a child. Changes in family dynamics can necessitate updates to the beneficiaries listed in the deed. Regularly reviewing and updating the deed ensures that it reflects current wishes and prevents potential conflicts among heirs.

Discover More Transfer-on-Death Deed Templates for Specific States

Problems With Transfer on Death Deeds in Virginia - It's advisable to keep a copy of the recorded deed with other important estate planning documents.

The process of completing the USCIS I-864 form can be daunting, but resources are available to assist you, including guidance from PDF Documents Hub, which offers helpful information and templates to streamline your application and ensure that you meet all necessary criteria for a successful submission.

Problems With Transfer on Death Deeds in Indiana - Eligible to apply for primary, secondary, or rental properties owned as an individual.

How to File a Transfer on Death Deed - Consider discussing this option with a trusted advisor to ensure it's right for you.