Free Tractor Bill of Sale Template for the State of Georgia

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor. |

| Governing Law | The sale of tractors in Georgia is governed by state law, specifically O.C.G.A. § 10-1-680. |

| Parties Involved | The form includes sections for the seller and buyer to provide their information. |

| Vehicle Information | Details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Purchase Price | The agreed purchase price for the tractor must be clearly stated on the form. |

| Signatures | Both the seller and buyer must sign the form to validate the sale. |

| Date of Sale | The date when the sale takes place should be recorded on the form. |

| Notarization | Notarization is not required but can add an extra layer of authenticity. |

| Record Keeping | Both parties should keep a copy of the completed form for their records. |

| Use for Registration | This form can be used as proof of ownership when registering the tractor with the state. |

Sample - Georgia Tractor Bill of Sale Form

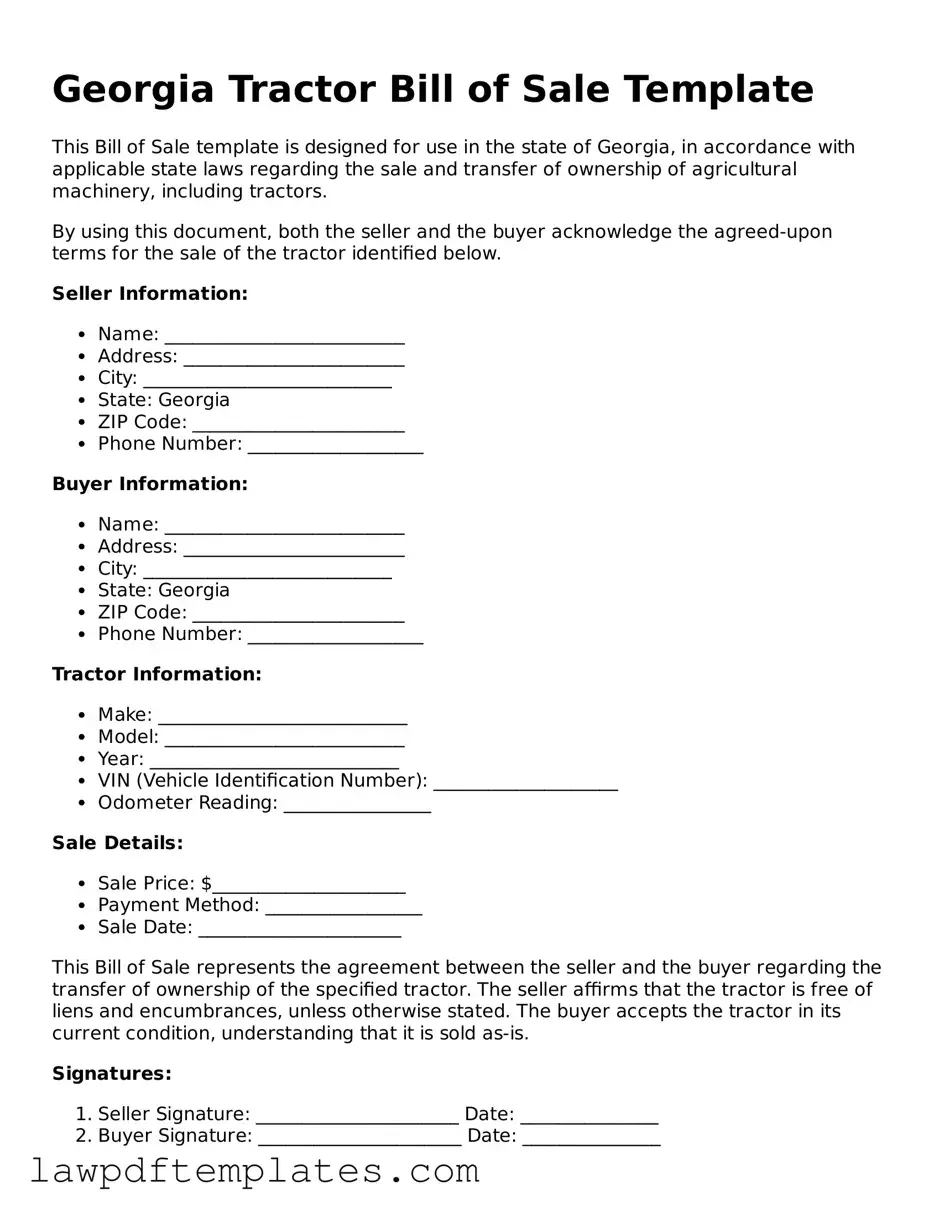

Georgia Tractor Bill of Sale Template

This Bill of Sale template is designed for use in the state of Georgia, in accordance with applicable state laws regarding the sale and transfer of ownership of agricultural machinery, including tractors.

By using this document, both the seller and the buyer acknowledge the agreed-upon terms for the sale of the tractor identified below.

Seller Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: Georgia

- ZIP Code: _______________________

- Phone Number: ___________________

Buyer Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: Georgia

- ZIP Code: _______________________

- Phone Number: ___________________

Tractor Information:

- Make: ___________________________

- Model: __________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): ____________________

- Odometer Reading: ________________

Sale Details:

- Sale Price: $_____________________

- Payment Method: _________________

- Sale Date: ______________________

This Bill of Sale represents the agreement between the seller and the buyer regarding the transfer of ownership of the specified tractor. The seller affirms that the tractor is free of liens and encumbrances, unless otherwise stated. The buyer accepts the tractor in its current condition, understanding that it is sold as-is.

Signatures:

- Seller Signature: ______________________ Date: _______________

- Buyer Signature: ______________________ Date: _______________

By signing this document, both parties acknowledge and agree to the terms outlined herein.

Common mistakes

When completing the Georgia Tractor Bill of Sale form, many people make common mistakes that can lead to complications later. One frequent error is failing to include all necessary information about the tractor. This includes details such as the make, model, year, and Vehicle Identification Number (VIN). Missing this information can create confusion and may lead to issues with registration or ownership verification.

Another mistake is not providing accurate seller and buyer information. It is crucial to include full names, addresses, and contact details. Omitting or misspelling any of this information can create problems down the line, especially if disputes arise regarding the sale.

People often overlook the importance of signing the document. Both the seller and the buyer must sign the Tractor Bill of Sale to make it legally binding. Without these signatures, the document may not hold up in court or during a transaction, leaving both parties vulnerable.

Additionally, failing to date the bill of sale is another common oversight. The date indicates when the transaction took place, which is important for record-keeping and can affect tax obligations. Leaving this field blank can lead to misunderstandings about when ownership was transferred.

Some individuals forget to include the purchase price. This amount is not only essential for the buyer and seller but also for tax purposes. Not stating the price can raise red flags during inspections or audits by tax authorities.

Lastly, neglecting to keep a copy of the completed bill of sale is a mistake that can have lasting consequences. Both parties should retain a copy for their records. This document serves as proof of the transaction and can be vital if any issues arise in the future.

Discover More Tractor Bill of Sale Templates for Specific States

Farm Tractor Bill of Sale - Simplifies the paperwork involved in selling a tractor.

How to Transfer Ownership of a Tractor - Teaches new farmers about formal sales processes.

The FedEx Bill of Lading form is a crucial document used in freight transport. It serves as a receipt for the goods being shipped and outlines the terms under which the carrier will transport these goods. For those looking to simplify their shipping processes, resources like Fast PDF Templates are invaluable in ensuring that all necessary documentation is correctly filled out and accessible.

How to Transfer Ownership of a Tractor - Provides a straightforward framework for the transaction.

Bill of Sale Tractor - Offers reassurance for both parties by formalizing their understanding of the sale.