Free Promissory Note Template for the State of Georgia

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money at a designated time. |

| Governing Law | The Georgia Promissory Note is governed by the Georgia Uniform Commercial Code (UCC), specifically O.C.G.A. § 11-3-104. |

| Parties Involved | The note involves two parties: the maker (borrower) and the payee (lender). |

| Required Elements | The note must include the principal amount, interest rate, payment schedule, and maturity date. |

| Interest Rate | Georgia law allows for a maximum interest rate of 7% per annum unless otherwise agreed. |

| Enforceability | A properly executed promissory note is legally enforceable in court if it meets all requirements. |

| Default Consequences | If the borrower defaults, the lender may pursue legal action to recover the owed amount. |

Sample - Georgia Promissory Note Form

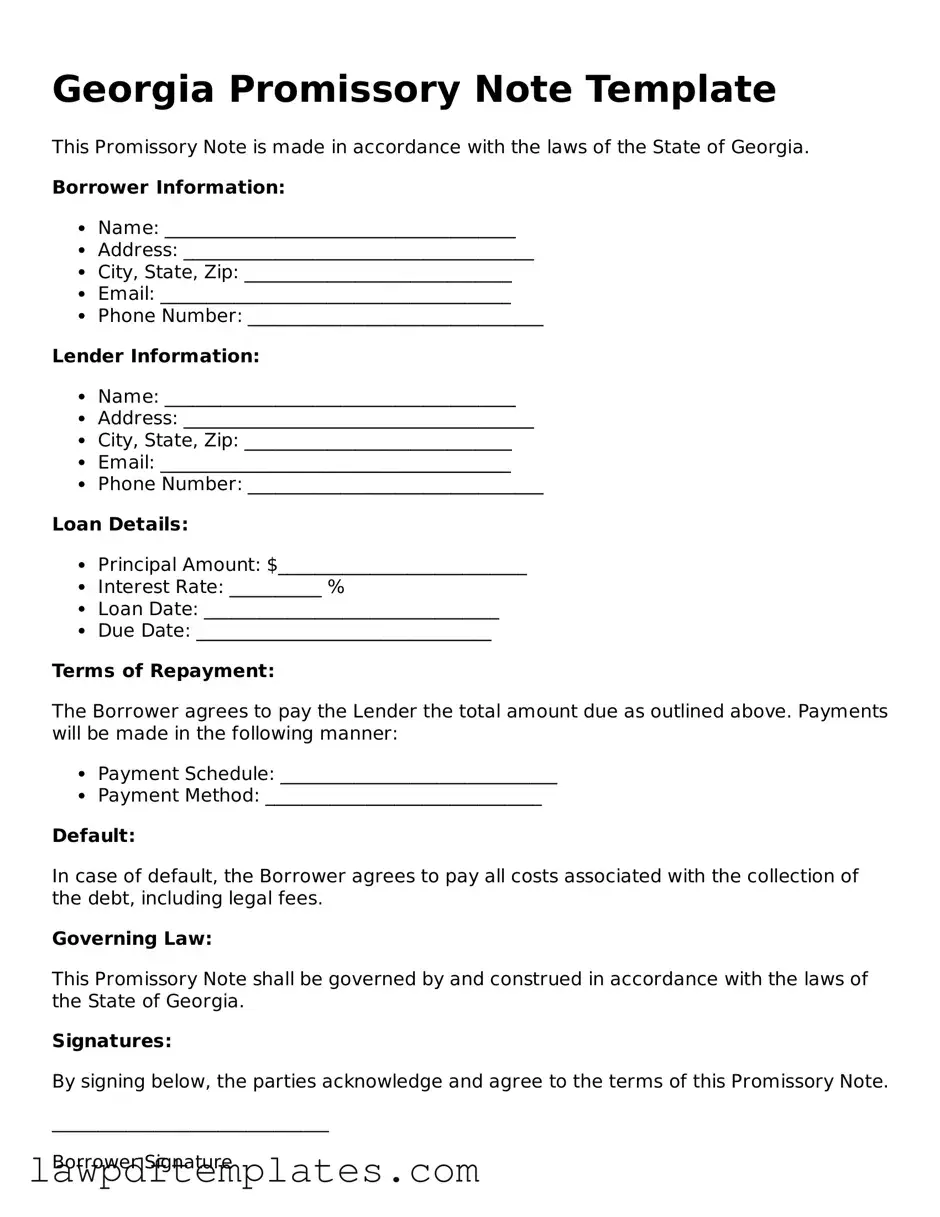

Georgia Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of Georgia.

Borrower Information:

- Name: ______________________________________

- Address: ______________________________________

- City, State, Zip: _____________________________

- Email: ______________________________________

- Phone Number: ________________________________

Lender Information:

- Name: ______________________________________

- Address: ______________________________________

- City, State, Zip: _____________________________

- Email: ______________________________________

- Phone Number: ________________________________

Loan Details:

- Principal Amount: $___________________________

- Interest Rate: __________ %

- Loan Date: ________________________________

- Due Date: ________________________________

Terms of Repayment:

The Borrower agrees to pay the Lender the total amount due as outlined above. Payments will be made in the following manner:

- Payment Schedule: ______________________________

- Payment Method: ______________________________

Default:

In case of default, the Borrower agrees to pay all costs associated with the collection of the debt, including legal fees.

Governing Law:

This Promissory Note shall be governed by and construed in accordance with the laws of the State of Georgia.

Signatures:

By signing below, the parties acknowledge and agree to the terms of this Promissory Note.

______________________________

Borrower Signature

Date: _________________________

______________________________

Lender Signature

Date: _________________________

Common mistakes

Filling out a Georgia Promissory Note form can seem straightforward, but many individuals make critical mistakes that can lead to complications down the line. One common error is failing to include all necessary parties. The note should clearly identify both the borrower and the lender. Omitting one of these parties can render the document unenforceable.

Another frequent mistake is neglecting to specify the loan amount. The amount should be clearly stated in both numerical and written form. This dual representation helps avoid misunderstandings. If the amount is unclear, disputes may arise regarding how much is owed.

Additionally, many people overlook the importance of the interest rate. The note must explicitly state whether interest will be charged and, if so, at what rate. Failing to include this detail can lead to confusion about the terms of repayment and can complicate legal proceedings if the borrower defaults.

Another mistake involves the repayment schedule. Some individuals may simply state that the loan will be repaid "on demand" without detailing a specific timeline or payment structure. A well-defined repayment schedule is crucial for both parties to understand their obligations clearly.

People also often forget to include a default clause. This clause outlines what happens if the borrower fails to make payments. Without this provision, the lender may find it challenging to enforce their rights in the event of a default.

Not signing the document is a critical error that can invalidate the entire agreement. Both the borrower and lender must sign the note for it to be legally binding. Even if the terms are clear, without signatures, the document lacks enforceability.

In some cases, individuals may fail to date the note. A date is essential as it establishes when the agreement takes effect. Without a date, questions may arise regarding the timeline of the loan and repayment obligations.

Lastly, many overlook the need for witnesses or notarization. While not always required, having a witness or notary can add an extra layer of legitimacy to the document. This step can be crucial in protecting the interests of both parties in case of a dispute.

Discover More Promissory Note Templates for Specific States

Illinois Promissory Note - A well-crafted note minimizes the risks associated with lending money.

For those looking to legally document their vehicle sale, the Texas Vehicle Purchase Agreement form is essential, and you can find it on platforms such as PDF Documents Hub, which provides easy access to this important document.

Loan Note Template - Understanding the implications of a promissory note is crucial for anyone involved in lending or borrowing money.

Promissory Note Template Massachusetts - The note may also include collateral information if the loan is secured.

Promissory Note Template California Word - This document outlines the terms of repayment for a loan between two parties.