Free Operating Agreement Template for the State of Georgia

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Georgia Limited Liability Company Act, O.C.G.A. § 14-11-101 et seq. |

| Members | It defines the rights and responsibilities of the members involved in the LLC. |

| Flexibility | The agreement allows for customization based on the specific needs of the LLC and its members. |

| Dispute Resolution | It often includes provisions for resolving disputes among members to avoid litigation. |

| Amendments | Members can amend the Operating Agreement, but typically require a majority vote or unanimous consent. |

| Not Mandatory | While not legally required, having an Operating Agreement is highly recommended for LLCs in Georgia. |

Sample - Georgia Operating Agreement Form

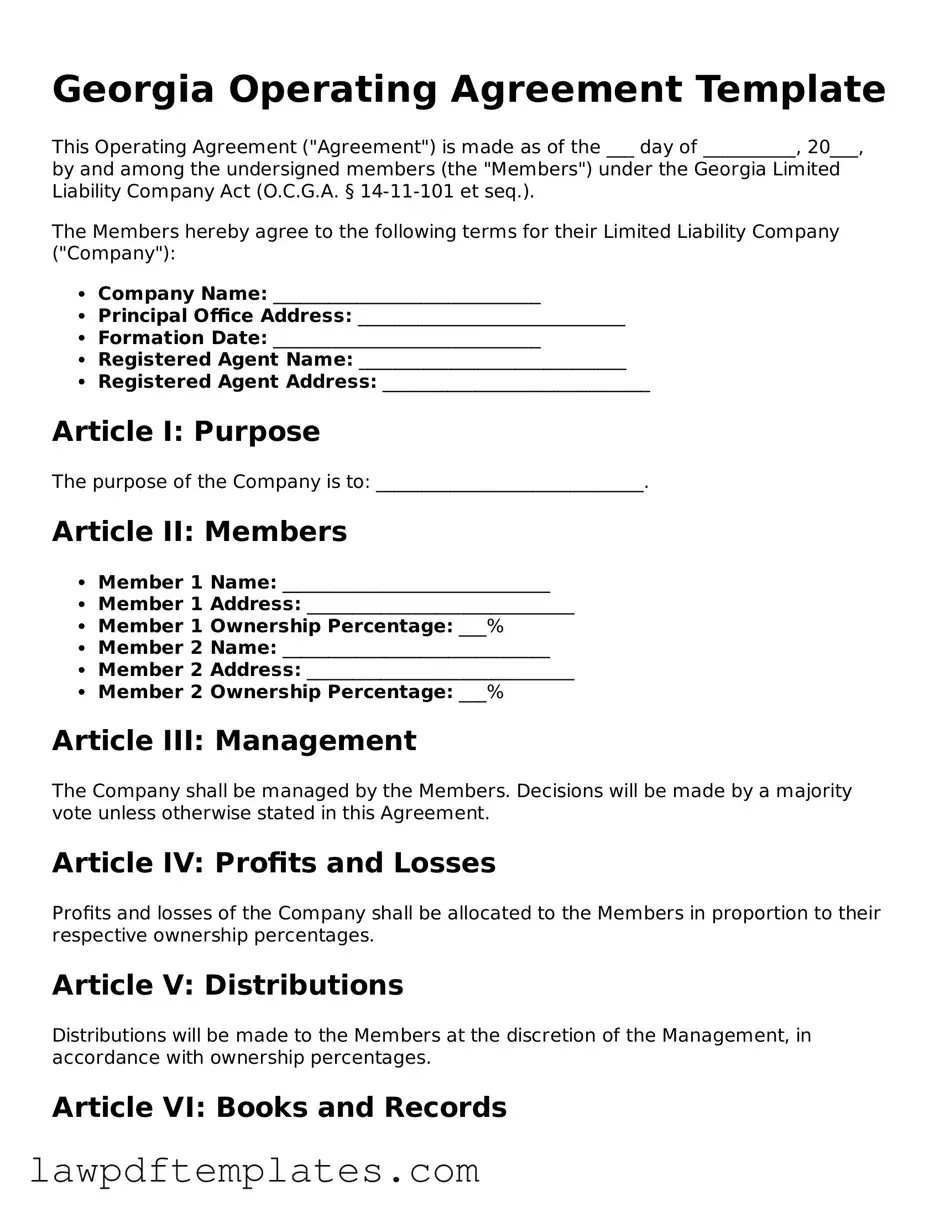

Georgia Operating Agreement Template

This Operating Agreement ("Agreement") is made as of the ___ day of __________, 20___, by and among the undersigned members (the "Members") under the Georgia Limited Liability Company Act (O.C.G.A. § 14-11-101 et seq.).

The Members hereby agree to the following terms for their Limited Liability Company ("Company"):

- Company Name: _____________________________

- Principal Office Address: _____________________________

- Formation Date: _____________________________

- Registered Agent Name: _____________________________

- Registered Agent Address: _____________________________

Article I: Purpose

The purpose of the Company is to: _____________________________.

Article II: Members

- Member 1 Name: _____________________________

- Member 1 Address: _____________________________

- Member 1 Ownership Percentage: ___%

- Member 2 Name: _____________________________

- Member 2 Address: _____________________________

- Member 2 Ownership Percentage: ___%

Article III: Management

The Company shall be managed by the Members. Decisions will be made by a majority vote unless otherwise stated in this Agreement.

Article IV: Profits and Losses

Profits and losses of the Company shall be allocated to the Members in proportion to their respective ownership percentages.

Article V: Distributions

Distributions will be made to the Members at the discretion of the Management, in accordance with ownership percentages.

Article VI: Books and Records

The Company shall maintain complete and accurate books and records. Members shall have access to these records upon request.

Article VII: Amendments

This Agreement may be amended only with the written consent of all Members.

Article VIII: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

- Member 1 Signature: _____________________________

- Member 2 Signature: _____________________________

- Date: _____________________________

Common mistakes

Filling out the Georgia Operating Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to clearly define the roles and responsibilities of each member. Without this clarity, misunderstandings may arise, potentially causing conflicts among members.

Another common mistake is neglecting to include the capital contributions of each member. This section is crucial as it outlines how much each member is investing in the business. Omitting this information can lead to disputes about ownership and profit distribution later on.

Some individuals also overlook the importance of specifying the management structure of the business. Whether it’s a member-managed or manager-managed LLC, this decision should be clearly stated. Not doing so can create confusion about who has the authority to make decisions on behalf of the company.

Additionally, many people fail to update the Operating Agreement when changes occur. Life events, such as new members joining or existing members leaving, should prompt a review and possible revision of the agreement. Keeping the document current is essential for maintaining clarity and legal protection.

Another mistake is not including a dispute resolution clause. This clause is vital for outlining how disagreements will be handled. Without it, members may find themselves in lengthy and costly legal battles, which could have been avoided with a clear plan in place.

Furthermore, some individuals do not take the time to properly date and sign the agreement. A lack of signatures can render the document ineffective. Ensuring that all members sign and date the agreement is a simple but crucial step in making it legally binding.

Many also forget to address the process for adding or removing members. This oversight can lead to confusion and resentment among members if changes need to be made in the future. Clearly outlining this process helps ensure smooth transitions.

Lastly, individuals sometimes fail to consider the tax implications of their chosen structure. Each business structure has different tax responsibilities, and not understanding these can lead to unexpected financial burdens. It’s important to consult with a tax professional to ensure the Operating Agreement aligns with the business's financial strategy.

Discover More Operating Agreement Templates for Specific States

Operating Agreement Florida - A key component for LLCs to establish internal rules.

Llc Operating Agreement Michigan - The Operating Agreement clarifies the decision-making process within the LLC.

The Employment Verification form is a crucial document used to confirm an individual's employment status and history. This form serves a key role in various processes, including loan applications and background checks. For those seeking a reliable template for this purpose, Fast PDF Templates provides an excellent resource. Accurate completion is essential to ensure that the verification process proceeds smoothly and efficiently.

Operating Agreement Llc Ohio Template - The agreement fosters a professional operating environment.

Llc Operating Agreement Massachusetts - Use this form to formally document operating procedures.