Free Loan Agreement Template for the State of Georgia

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Loan Agreement is governed by the laws of the State of Georgia. |

| Purpose | This form is used to outline the terms of a loan between a lender and a borrower. |

| Parties Involved | The agreement identifies the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement. |

| Interest Rate | The document specifies the interest rate applicable to the loan, whether fixed or variable. |

| Repayment Terms | Details about how and when the borrower will repay the loan are included. |

| Default Conditions | The agreement outlines the conditions under which the borrower would be considered in default. |

| Signatures Required | Both parties must sign the agreement to make it legally binding. |

| Amendment Clause | The form may include provisions for how changes to the agreement can be made in the future. |

Sample - Georgia Loan Agreement Form

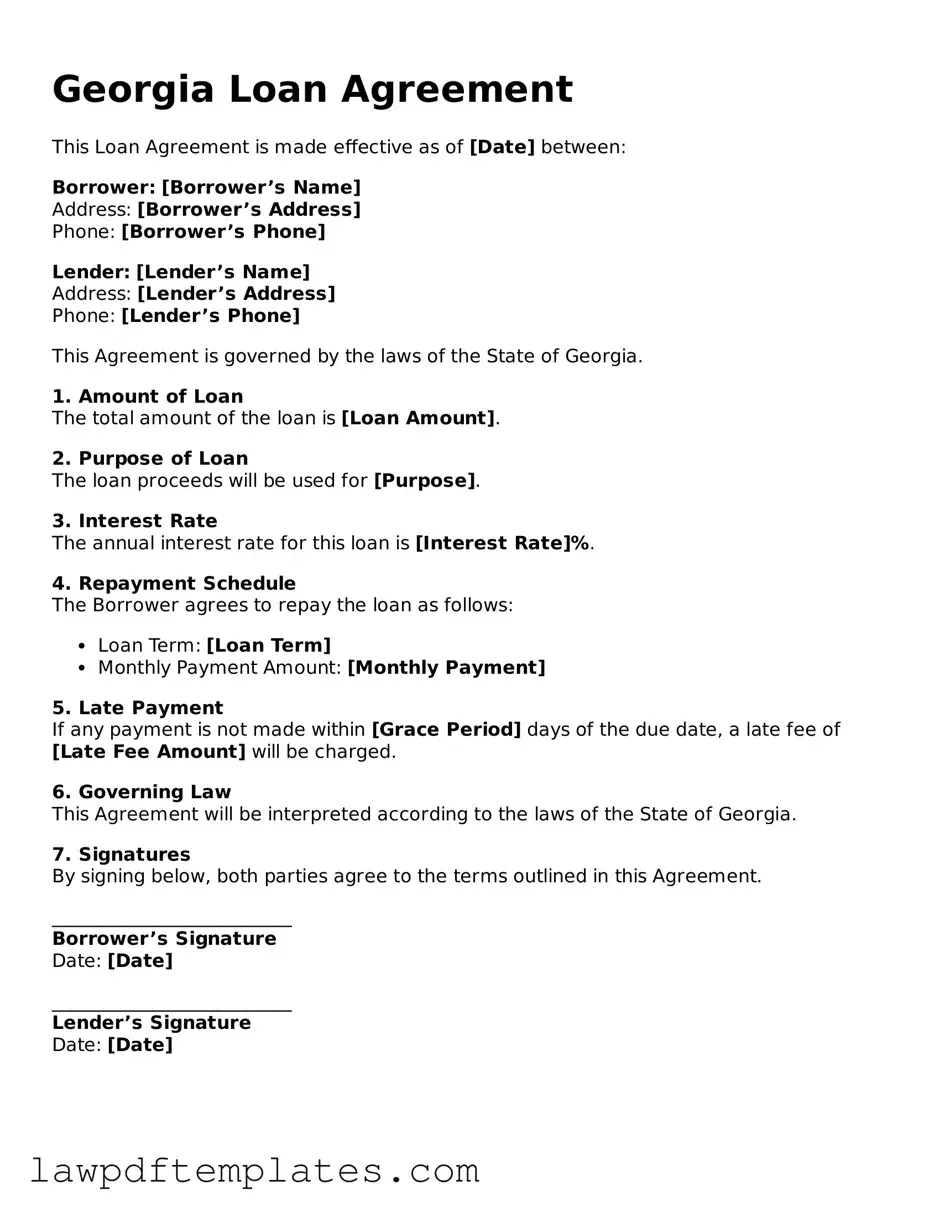

Georgia Loan Agreement

This Loan Agreement is made effective as of [Date] between:

Borrower: [Borrower’s Name]

Address: [Borrower’s Address]

Phone: [Borrower’s Phone]

Lender: [Lender’s Name]

Address: [Lender’s Address]

Phone: [Lender’s Phone]

This Agreement is governed by the laws of the State of Georgia.

1. Amount of Loan

The total amount of the loan is [Loan Amount].

2. Purpose of Loan

The loan proceeds will be used for [Purpose].

3. Interest Rate

The annual interest rate for this loan is [Interest Rate]%.

4. Repayment Schedule

The Borrower agrees to repay the loan as follows:

- Loan Term: [Loan Term]

- Monthly Payment Amount: [Monthly Payment]

5. Late Payment

If any payment is not made within [Grace Period] days of the due date, a late fee of [Late Fee Amount] will be charged.

6. Governing Law

This Agreement will be interpreted according to the laws of the State of Georgia.

7. Signatures

By signing below, both parties agree to the terms outlined in this Agreement.

__________________________

Borrower’s Signature

Date: [Date]

__________________________

Lender’s Signature

Date: [Date]

Common mistakes

Filling out a loan agreement form can be a daunting task, especially in Georgia where specific requirements must be met. One common mistake is failing to read the entire document carefully. Many people skim through the terms and conditions, missing critical information that could impact their loan. Taking the time to understand each section is essential to avoid misunderstandings later.

Another frequent error is providing inaccurate personal information. This includes misspellings of names, incorrect addresses, or wrong Social Security numbers. Such mistakes can lead to delays in processing the loan and may even result in a denial. Always double-check your details before submitting the form.

Some individuals neglect to disclose all necessary financial information. Lenders require a complete picture of your financial situation, including income, debts, and assets. Omitting this information, whether intentional or accidental, can raise red flags and jeopardize your loan approval.

Additionally, failing to sign and date the form is a mistake that can easily be overlooked. A signature is a critical part of the agreement, signifying your acceptance of the terms. Without it, the document is incomplete and cannot be processed.

People often underestimate the importance of providing supporting documentation. Many lenders require additional paperwork, such as proof of income or bank statements. Not including these documents can lead to delays or even rejection of the loan application.

Another common pitfall is not asking questions when something is unclear. If any part of the loan agreement is confusing, reaching out for clarification is crucial. Ignoring these uncertainties can lead to signing an agreement that is not fully understood, which may have long-term consequences.

Lastly, some individuals fail to keep copies of the completed loan agreement and related documents. Having a personal record is important for future reference and can help resolve any disputes that may arise. Always ensure you have a copy of everything you submit.

Discover More Loan Agreement Templates for Specific States

Illinois Promissory Note - A clear Loan Agreement can facilitate easier future negotiations for loans.

To streamline the process further, you can visit PDF Documents Hub, where you will find the necessary template to facilitate the completion of your Texas Motorcycle Bill of Sale, ensuring all required information is accurately recorded.

Promissory Note California - The form may include default terms if payments are missed.