Free Gift Deed Template for the State of Georgia

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Laws | The transfer of property via a gift deed in Georgia is governed by the Georgia Code, particularly Title 44, Chapter 5. |

| Requirements | The deed must be in writing, signed by the donor, and should be notarized to be legally valid. |

| Tax Implications | Gift deeds may have tax implications for both the donor and the recipient, potentially subjecting them to federal gift tax regulations. |

Sample - Georgia Gift Deed Form

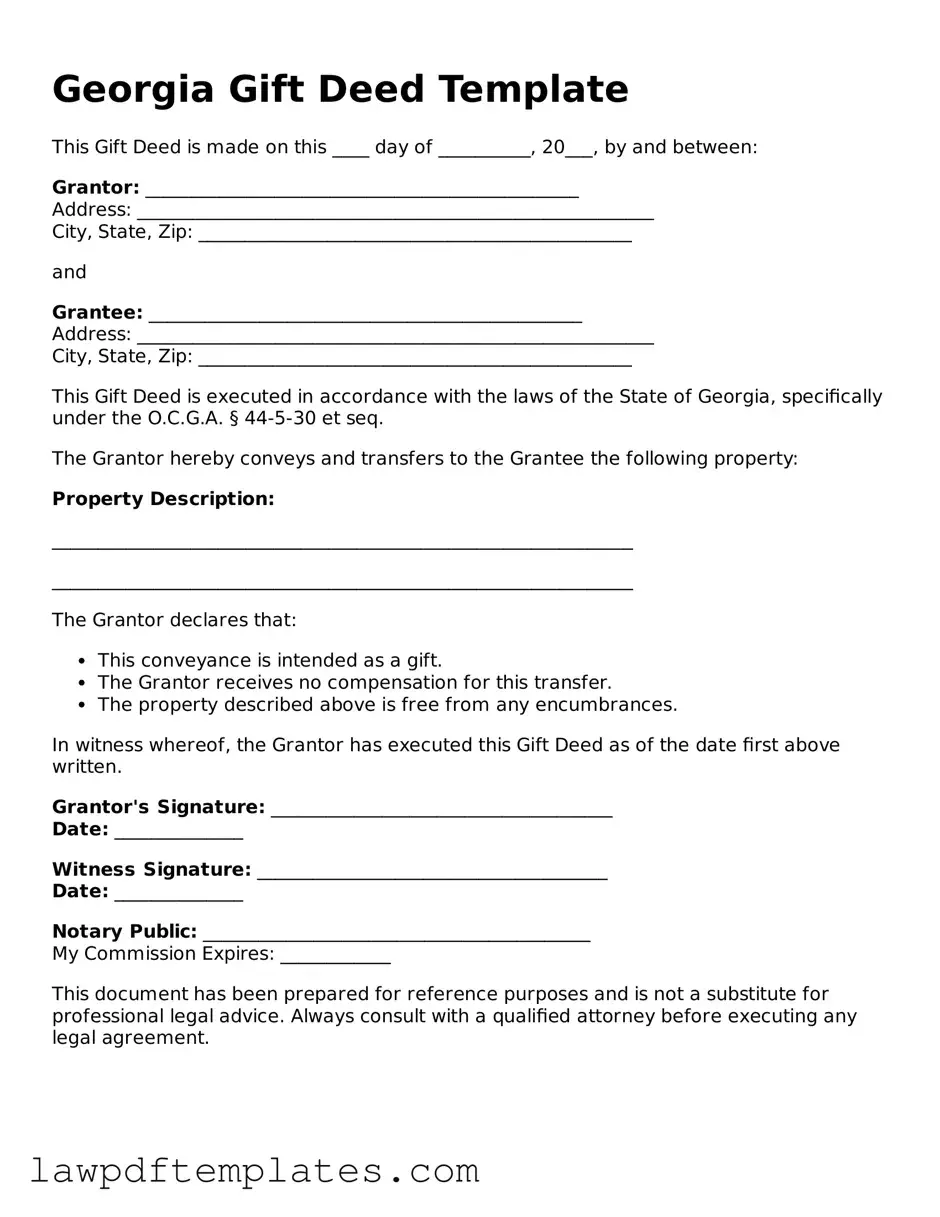

Georgia Gift Deed Template

This Gift Deed is made on this ____ day of __________, 20___, by and between:

Grantor: _______________________________________________

Address: ________________________________________________________

City, State, Zip: _______________________________________________

and

Grantee: _______________________________________________

Address: ________________________________________________________

City, State, Zip: _______________________________________________

This Gift Deed is executed in accordance with the laws of the State of Georgia, specifically under the O.C.G.A. § 44-5-30 et seq.

The Grantor hereby conveys and transfers to the Grantee the following property:

Property Description:

_______________________________________________________________

_______________________________________________________________

The Grantor declares that:

- This conveyance is intended as a gift.

- The Grantor receives no compensation for this transfer.

- The property described above is free from any encumbrances.

In witness whereof, the Grantor has executed this Gift Deed as of the date first above written.

Grantor's Signature: _____________________________________

Date: ______________

Witness Signature: ______________________________________

Date: ______________

Notary Public: __________________________________________

My Commission Expires: ____________

This document has been prepared for reference purposes and is not a substitute for professional legal advice. Always consult with a qualified attorney before executing any legal agreement.

Common mistakes

Filling out the Georgia Gift Deed form can be straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to provide accurate property descriptions. The description should be clear and precise, including details like the property address and parcel number. Without this information, it becomes difficult to identify the property in question, which can create confusion or disputes later.

Another mistake often seen is not including all necessary signatures. Both the donor and the recipient must sign the deed for it to be valid. If one party forgets to sign, the deed may not be enforceable. This oversight can lead to delays or even the need to start the process over again, which can be frustrating for everyone involved.

Additionally, people sometimes overlook the importance of notarization. In Georgia, a Gift Deed must be notarized to be legally binding. Skipping this step can invalidate the deed, leaving the gift unrecognized in the eyes of the law. It’s essential to find a notary public and ensure that the deed is properly signed and stamped.

Lastly, many individuals neglect to record the Gift Deed with the county clerk’s office. Recording the deed is crucial as it provides public notice of the transfer of ownership. Failing to do so can result in complications, especially if the donor or recipient decides to sell the property in the future. Taking the time to ensure all steps are completed correctly can save significant hassle and confusion later on.

Discover More Gift Deed Templates for Specific States

How to Add Name to House Title in California - Helps in minimizing potential tax implications of gifting.

The process of applying for a position at Trader Joe's involves completing the Trader Joe's application form, which is designed to gather vital information regarding your work experience and schedule preferences. For more details and guidance on filling out your application, you can visit the PDF Documents Hub, where you'll find valuable resources to assist you in your journey towards joining this beloved grocery chain.