Free Deed in Lieu of Foreclosure Template for the State of Georgia

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Georgia Deed in Lieu of Foreclosure form allows a borrower to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by the laws of the State of Georgia, specifically O.C.G.A. § 44-14-162. |

| Eligibility | Homeowners facing financial difficulties or potential foreclosure can use this form if the lender agrees. |

| Benefits | A deed in lieu can help borrowers avoid the lengthy foreclosure process and may have less impact on their credit score. |

| Consent Required | The lender must agree to accept the deed in lieu. This is not a unilateral decision by the borrower. |

| Documentation | Borrowers must provide necessary documentation, including proof of financial hardship and property information. |

| Legal Advice | It is advisable for borrowers to seek legal counsel before signing a deed in lieu of foreclosure to understand their rights. |

Sample - Georgia Deed in Lieu of Foreclosure Form

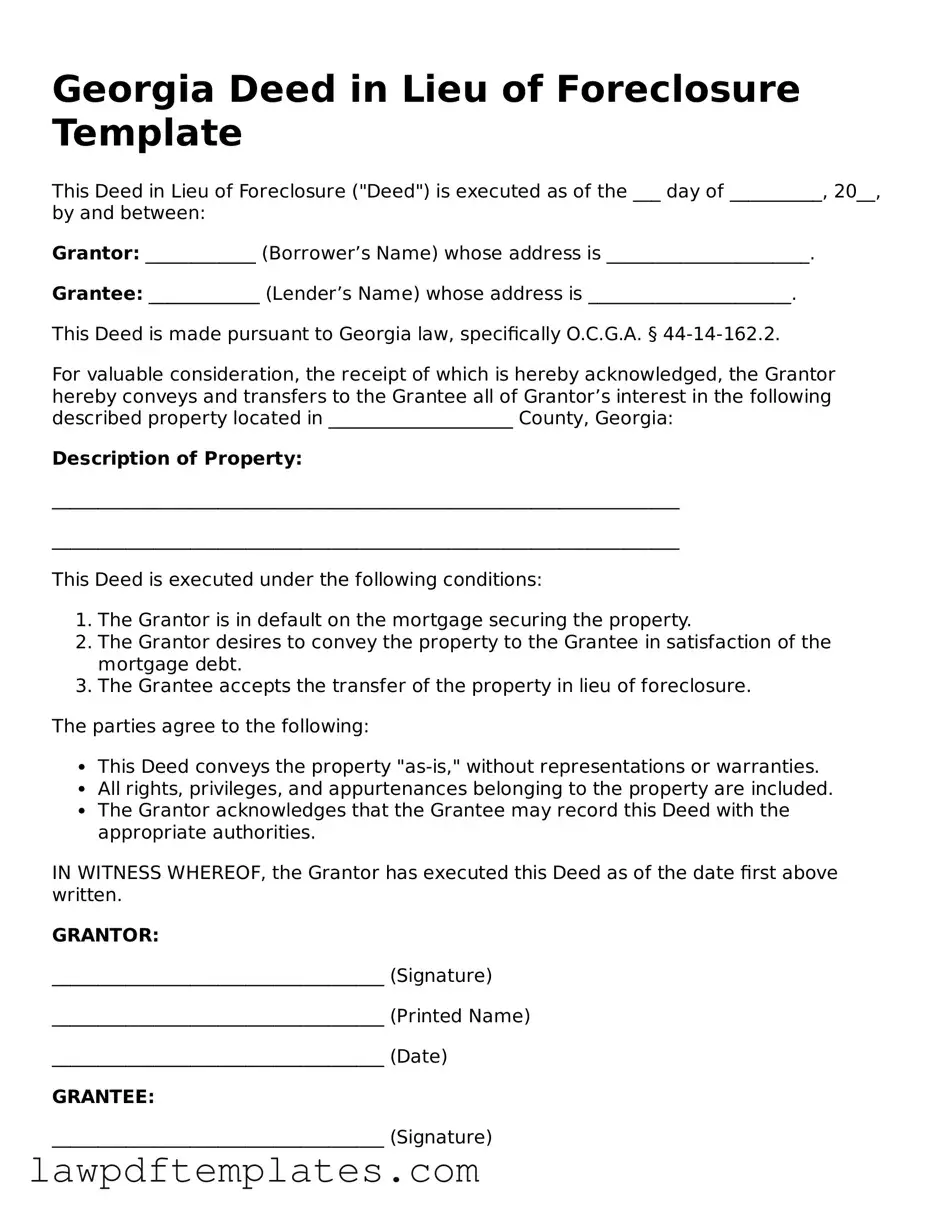

Georgia Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is executed as of the ___ day of __________, 20__, by and between:

Grantor: ____________ (Borrower’s Name) whose address is ______________________.

Grantee: ____________ (Lender’s Name) whose address is ______________________.

This Deed is made pursuant to Georgia law, specifically O.C.G.A. § 44-14-162.2.

For valuable consideration, the receipt of which is hereby acknowledged, the Grantor hereby conveys and transfers to the Grantee all of Grantor’s interest in the following described property located in ____________________ County, Georgia:

Description of Property:

____________________________________________________________________

____________________________________________________________________

This Deed is executed under the following conditions:

- The Grantor is in default on the mortgage securing the property.

- The Grantor desires to convey the property to the Grantee in satisfaction of the mortgage debt.

- The Grantee accepts the transfer of the property in lieu of foreclosure.

The parties agree to the following:

- This Deed conveys the property "as-is," without representations or warranties.

- All rights, privileges, and appurtenances belonging to the property are included.

- The Grantor acknowledges that the Grantee may record this Deed with the appropriate authorities.

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the date first above written.

GRANTOR:

____________________________________ (Signature)

____________________________________ (Printed Name)

____________________________________ (Date)

GRANTEE:

____________________________________ (Signature)

____________________________________ (Printed Name)

____________________________________ (Date)

Notary Public

State of Georgia

County of _______________

Subscribed and sworn before me this ___ day of ____________, 20__.

____________________________________ (Notary Signature)

____________________________________ (Printed Name)

My Commission Expires: ________________

Common mistakes

When filling out the Georgia Deed in Lieu of Foreclosure form, many individuals make critical mistakes that can complicate the process. One common error is failing to provide accurate property information. It’s essential to include the correct legal description of the property. If the details are incorrect, it could lead to delays or even a rejection of the deed.

Another frequent mistake is not obtaining the necessary signatures. All parties involved must sign the document for it to be valid. This includes the borrower and, in some cases, the lender. Skipping this step can render the deed ineffective, leaving the borrower in a difficult situation.

People often overlook the importance of understanding their rights and obligations. The deed in lieu of foreclosure can have significant consequences. Without proper knowledge, a borrower might unknowingly forfeit certain rights or miss out on potential benefits. It’s wise to consult with a legal expert before proceeding.

Additionally, some individuals fail to provide supporting documentation. This may include proof of hardship or other relevant financial information. Such documents can strengthen the case for a deed in lieu and help facilitate a smoother process.

Not considering tax implications is another mistake that can have lasting effects. A deed in lieu of foreclosure may trigger tax consequences, and it’s crucial to understand these before signing. Consulting a tax professional can provide clarity and help avoid unexpected liabilities.

Lastly, many people rush through the process without reviewing the entire form thoroughly. Each section of the deed is important, and overlooking details can lead to complications later. Taking the time to carefully read and understand every part of the document can save a lot of trouble down the line.

Discover More Deed in Lieu of Foreclosure Templates for Specific States

Deed in Lieu of Foreclosure Form - This option may help the homeowner protect their credit rating.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Documentation of any agreements made regarding the Deed in Lieu should be retained for future reference.

For those looking to securely document their motorcycle transactions, the Texas Motorcycle Bill of Sale form can be accessed through PDF Documents Hub, ensuring that all necessary details are properly recorded for both the seller and buyer.

Deed in Lieu Vs Foreclosure - This document helps homeowners exit a mortgage obligation when they are unable to continue making payments.