Free Deed Template for the State of Georgia

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Deed form is governed by the Official Code of Georgia Annotated (O.C.G.A.) Title 44, which covers property laws. |

| Types of Deeds | In Georgia, common types of deeds include warranty deeds, quitclaim deeds, and security deeds, each serving different purposes. |

| Signature Requirements | For a deed to be valid in Georgia, it must be signed by the grantor (the person transferring the property) and notarized. |

| Recording | To protect the interests of the parties involved, the deed should be recorded in the county where the property is located. |

| Consideration | While a deed can be executed without monetary consideration, it is common to include a nominal amount to validate the transaction. |

| Legal Description | A complete and accurate legal description of the property must be included in the deed to ensure clarity and prevent disputes. |

Sample - Georgia Deed Form

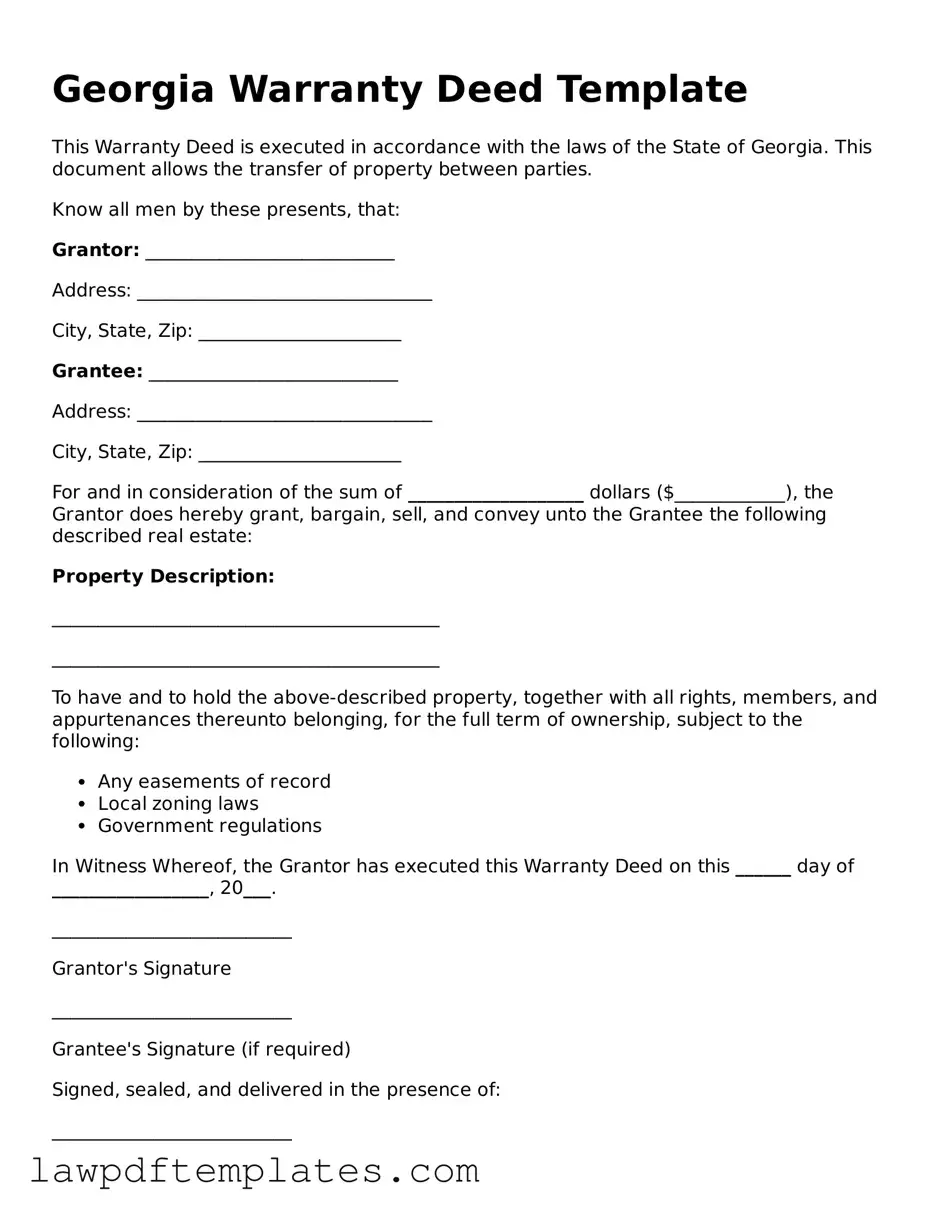

Georgia Warranty Deed Template

This Warranty Deed is executed in accordance with the laws of the State of Georgia. This document allows the transfer of property between parties.

Know all men by these presents, that:

Grantor: ___________________________

Address: ________________________________

City, State, Zip: ______________________

Grantee: ___________________________

Address: ________________________________

City, State, Zip: ______________________

For and in consideration of the sum of ___________________ dollars ($____________), the Grantor does hereby grant, bargain, sell, and convey unto the Grantee the following described real estate:

Property Description:

__________________________________________

__________________________________________

To have and to hold the above-described property, together with all rights, members, and appurtenances thereunto belonging, for the full term of ownership, subject to the following:

- Any easements of record

- Local zoning laws

- Government regulations

In Witness Whereof, the Grantor has executed this Warranty Deed on this ______ day of _________________, 20___.

__________________________

Grantor's Signature

__________________________

Grantee's Signature (if required)

Signed, sealed, and delivered in the presence of:

__________________________

Witness #1

__________________________

Witness #2

State of Georgia, County of ______________________

Before me, a Notary Public in and for said County and State, personally appeared ________________ (Grantor) and ________________ (Grantee), who is known to me and who acknowledged the execution of the above Warranty Deed.

Given under my hand and official seal, this ____ day of ________________, 20___.

__________________________

Notary Public

My commission expires: ________________

Common mistakes

Filling out a Georgia Deed form can seem straightforward, but many people encounter common pitfalls that can lead to complications later on. One frequent mistake is failing to provide accurate property descriptions. The deed must include a detailed description of the property being transferred, including its boundaries. Omitting this information or using vague language can create confusion and may even result in legal disputes in the future.

Another common error is neglecting to include the names of all parties involved. It is essential to list the full legal names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). If any names are misspelled or omitted, it could invalidate the deed or complicate the transfer process.

People also often overlook the requirement for notarization. In Georgia, a deed must be signed in the presence of a notary public to be legally binding. Failing to have the deed notarized can render it unenforceable, meaning the transfer of property may not be recognized by the state.

Additionally, individuals sometimes forget to include the date of the transaction. While it may seem minor, the date is crucial for establishing the timeline of ownership and can affect the rights of the parties involved. Without a date, there may be ambiguity about when the transfer took place, which could lead to disputes.

Lastly, people frequently miscalculate the transfer tax. In Georgia, a transfer tax is imposed on property transactions, and it is the responsibility of the grantor to pay this tax. Failing to accurately calculate and pay the required transfer tax can result in penalties or delays in the property transfer process.

Discover More Deed Templates for Specific States

How Do I Get My Deed to My House - Virtual conveyancing may include electronic deeds, which are becoming more common.

The Free And Invoice PDF form is a document used to create and send invoices in a standardized format. This form simplifies the billing process for businesses, making it easier to communicate payment details and request funds. By using this form, businesses can maintain professionalism and efficiency in their invoicing procedures. For more resources, you can check out Fast PDF Templates.

Grant Deed California - It's critical to ensure all relevant parties sign the Deed for it to be valid.

Release of Dower Rights Ohio Form - Can be contingent on payment of the purchase price.

How to Get House Deed - Careful attention to details on a deed can help avoid future disputes.