Free Transfer-on-Death Deed Template for the State of Florida

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, specifically Section 732.401, enacted in 2015. |

| Eligibility | Any individual who owns real property in Florida can create a TOD Deed, provided they are of sound mind and legal age. |

| Beneficiary Designation | Property owners can name one or more beneficiaries to receive the property after their death. |

| Revocation | A TOD Deed can be revoked at any time before the property owner's death by filing a new deed or a written revocation. |

| No Immediate Transfer | Ownership of the property does not transfer to the beneficiary until the owner's death, allowing the owner to retain full control during their lifetime. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes, as the transfer occurs only upon death. |

| Recording Requirement | To be effective, a TOD Deed must be recorded in the county where the property is located before the owner's death. |

| Limitations | Not all types of property can be transferred via a TOD Deed; for example, it cannot be used for properties held in a trust. |

| Legal Assistance | While individuals can create a TOD Deed without legal help, consulting an attorney is advisable to ensure it meets all legal requirements. |

Sample - Florida Transfer-on-Death Deed Form

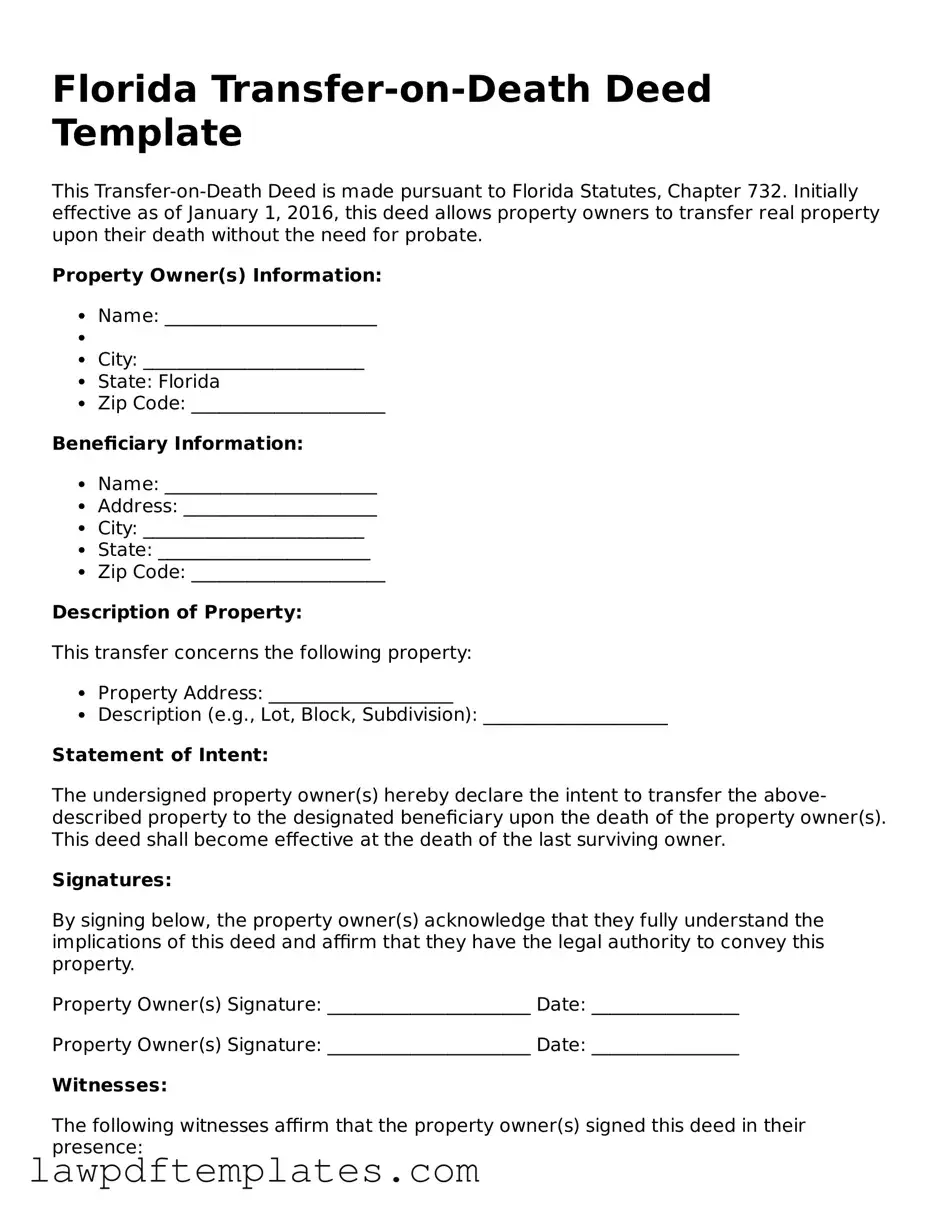

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to Florida Statutes, Chapter 732. Initially effective as of January 1, 2016, this deed allows property owners to transfer real property upon their death without the need for probate.

Property Owner(s) Information:

- Name: _______________________

- City: ________________________

- State: Florida

- Zip Code: _____________________

Beneficiary Information:

- Name: _______________________

- Address: _____________________

- City: ________________________

- State: _______________________

- Zip Code: _____________________

Description of Property:

This transfer concerns the following property:

- Property Address: ____________________

- Description (e.g., Lot, Block, Subdivision): ____________________

Statement of Intent:

The undersigned property owner(s) hereby declare the intent to transfer the above-described property to the designated beneficiary upon the death of the property owner(s). This deed shall become effective at the death of the last surviving owner.

Signatures:

By signing below, the property owner(s) acknowledge that they fully understand the implications of this deed and affirm that they have the legal authority to convey this property.

Property Owner(s) Signature: ______________________ Date: ________________

Property Owner(s) Signature: ______________________ Date: ________________

Witnesses:

The following witnesses affirm that the property owner(s) signed this deed in their presence:

Witness Signature: ______________________ Date: ________________

Witness Signature: ______________________ Date: ________________

Notarization:

State of Florida

County of _______________

On this _____ day of __________, 20___, before me, personally appeared the property owner(s), known to me to be the person(s) whose name(s) are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

Notary Public Signature: ______________________

My Commission Expires: ______________________

Common mistakes

Filling out the Florida Transfer-on-Death Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One prevalent error is failing to properly identify the property. It is essential to provide a complete legal description of the property, not just the address. Omitting details can create confusion and may render the deed ineffective.

Another mistake often seen is neglecting to include the full names of the beneficiaries. Using nicknames or initials instead of full legal names can cause issues during the transfer process. The deed should clearly state the beneficiaries to avoid disputes or delays in the future.

People frequently overlook the requirement for signatures. Both the grantor and two witnesses must sign the deed for it to be valid. Failing to have the necessary signatures can invalidate the document, leading to unwanted complications after the grantor’s passing.

Additionally, many individuals do not consider the implications of the deed being recorded. After completing the form, it is crucial to file it with the appropriate county clerk’s office. If the deed is not recorded, the transfer may not be recognized, and the property could end up in probate.

Another common error is not updating the deed after life changes. Events such as marriage, divorce, or the death of a beneficiary can impact the validity of the deed. It is vital to review and, if necessary, revise the deed to reflect current circumstances.

Some people fail to understand the implications of joint ownership. When multiple beneficiaries are named, it is essential to clarify how ownership will be divided. Not addressing this can lead to misunderstandings and disputes among heirs.

Moreover, individuals sometimes forget to seek legal advice. While the form may seem simple, the consequences of mistakes can be significant. Consulting with a legal expert can provide clarity and ensure that the deed is filled out correctly.

Lastly, many individuals underestimate the importance of understanding state laws. Florida has specific regulations regarding Transfer-on-Death Deeds. Ignoring these laws can result in a deed that does not comply with state requirements, ultimately jeopardizing the intended transfer of property.

Discover More Transfer-on-Death Deed Templates for Specific States

Transfer on Death Deed Georgia - This form may be useful for anyone wanting to leave their home or other real estate to family or friends without probate delays.

For those looking to navigate the Texas real estate market effectively, using the Texas Real Estate Purchase Agreement form is crucial. This form not only clarifies the responsibilities of both the buyer and seller but also sets the stage for a successful transaction. To conveniently access this essential document, you can visit PDF Documents Hub and ensure you have everything in order for your property sale.

Transfer on Death Affidavit - It is important to comply with state laws when executing this deed.

How to File a Transfer on Death Deed - Setting up this deed is a straightforward process that can save hassle later.