Free Real Estate Purchase Agreement Template for the State of Florida

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Florida Real Estate Purchase Agreement is a legal document used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of Florida, specifically under Chapter 475 of the Florida Statutes, which covers real estate transactions. |

| Essential Elements | Key components include the purchase price, property description, closing date, and contingencies such as financing or inspection clauses. |

| Binding Nature | Once signed by both parties, the agreement becomes legally binding, meaning both the buyer and seller are obligated to adhere to its terms. |

| Standardization | The form is often standardized, which helps streamline the process and ensures that essential information is included in every transaction. |

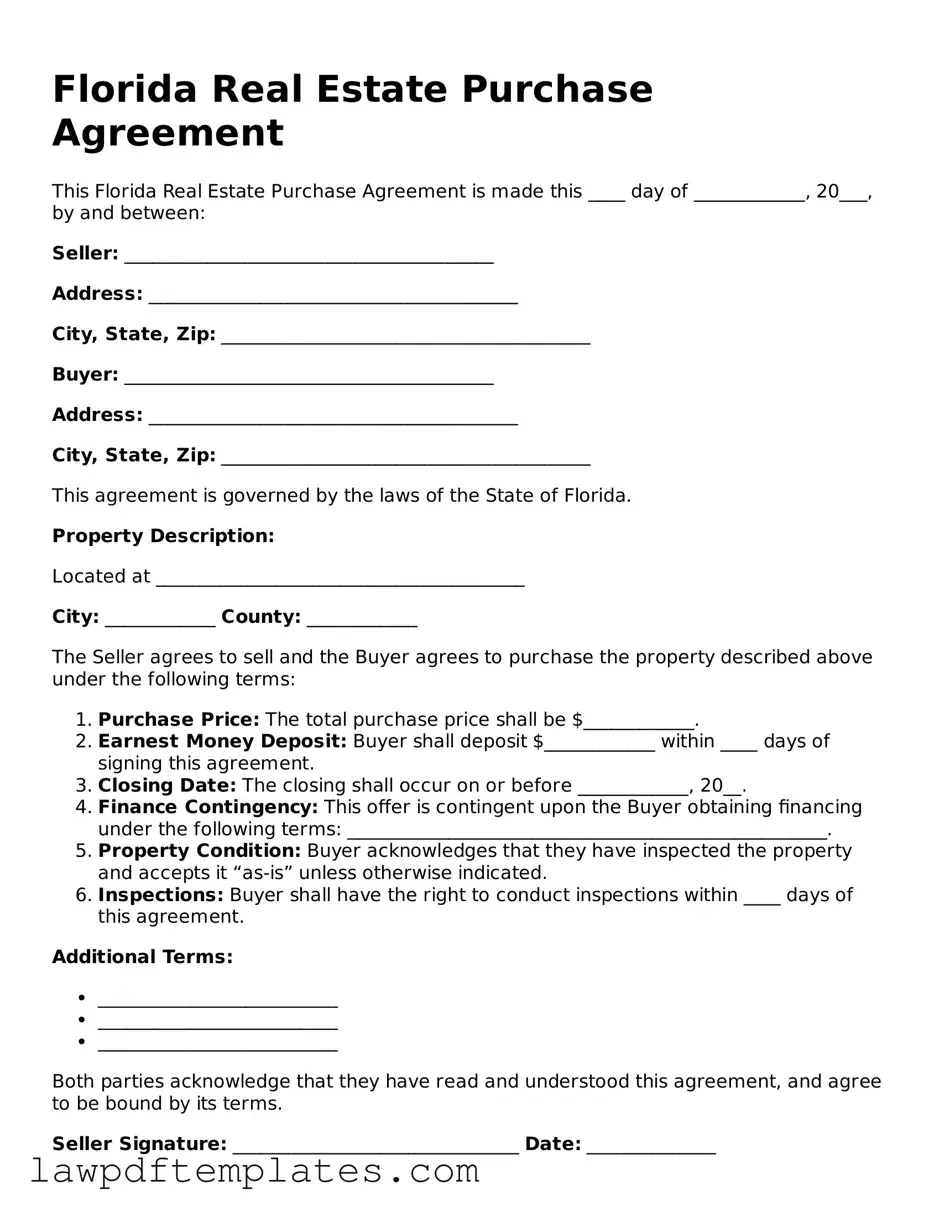

Sample - Florida Real Estate Purchase Agreement Form

Florida Real Estate Purchase Agreement

This Florida Real Estate Purchase Agreement is made this ____ day of ____________, 20___, by and between:

Seller: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________________

Buyer: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________________

This agreement is governed by the laws of the State of Florida.

Property Description:

Located at ________________________________________

City: ____________ County: ____________

The Seller agrees to sell and the Buyer agrees to purchase the property described above under the following terms:

- Purchase Price: The total purchase price shall be $____________.

- Earnest Money Deposit: Buyer shall deposit $____________ within ____ days of signing this agreement.

- Closing Date: The closing shall occur on or before ____________, 20__.

- Finance Contingency: This offer is contingent upon the Buyer obtaining financing under the following terms: ____________________________________________________.

- Property Condition: Buyer acknowledges that they have inspected the property and accepts it “as-is” unless otherwise indicated.

- Inspections: Buyer shall have the right to conduct inspections within ____ days of this agreement.

Additional Terms:

- __________________________

- __________________________

- __________________________

Both parties acknowledge that they have read and understood this agreement, and agree to be bound by its terms.

Seller Signature: _______________________________ Date: ______________

Buyer Signature: _______________________________ Date: ______________

Common mistakes

Filling out the Florida Real Estate Purchase Agreement form can be a straightforward process, but several common mistakes can lead to complications. One frequent error is failing to provide accurate property descriptions. Buyers and sellers must ensure that the property is clearly identified, including the address and any specific legal descriptions. Omitting this information can lead to disputes later on.

Another mistake often made is neglecting to include all necessary terms and conditions. This includes the purchase price, closing date, and any contingencies that may apply, such as financing or inspections. Without these details, the agreement may lack clarity, which can create confusion and potential legal issues down the line.

Many individuals also overlook the importance of signatures. Both the buyer and seller must sign the agreement for it to be legally binding. In some cases, parties may forget to sign or may not provide the date of their signatures. This oversight can render the agreement unenforceable.

Additionally, buyers and sellers sometimes fail to understand the implications of contingencies. For instance, if a buyer includes a financing contingency, they must ensure that they can secure a mortgage within the specified timeframe. Not doing so could result in the loss of the deposit or other penalties.

Lastly, misunderstandings regarding earnest money deposits can occur. Buyers often miscalculate the amount they should provide or fail to specify how the deposit will be handled if the deal falls through. This can lead to disputes regarding the return of funds or the enforcement of the agreement.

Discover More Real Estate Purchase Agreement Templates for Specific States

Purchase Contract for Home - It specifies the legal description of the property being sold, ensuring clarity on what is included in the sale.

For those looking to ensure a smooth transaction when buying or selling an RV, the Texas RV Bill of Sale is indispensable. This legal document not only serves as proof of purchase but also captures vital details about the vehicle, the seller, and the buyer. To make the process even easier, you can find the necessary form through PDF Documents Hub.

Nj Real Estate Contract Pdf - It identifies the legal descriptions of the property being sold.

Free Nc Real Estate Purchase Agreement - Lists any existing liens or claims against the property.

Midland Title Toledo - A legal document outlining the terms of a real estate purchase.