Free Quitclaim Deed Template for the State of Florida

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that allows a property owner to transfer their interest in a property to another party without guaranteeing the title. |

| Usage | Commonly used in situations like transferring property between family members, clearing up title issues, or in divorce settlements. |

| Governing Law | In Florida, quitclaim deeds are governed by the Florida Statutes, specifically Chapter 689, which outlines the laws related to property conveyances. |

| Requirements | The deed must be signed by the grantor (the person transferring the property) and should be notarized to be legally valid. |

| Recording | To ensure public notice of the property transfer, the quitclaim deed should be recorded with the local county clerk's office. |

| Limitations | Unlike warranty deeds, quitclaim deeds do not provide any warranty or guarantee regarding the property title, which means the grantee assumes all risks. |

Sample - Florida Quitclaim Deed Form

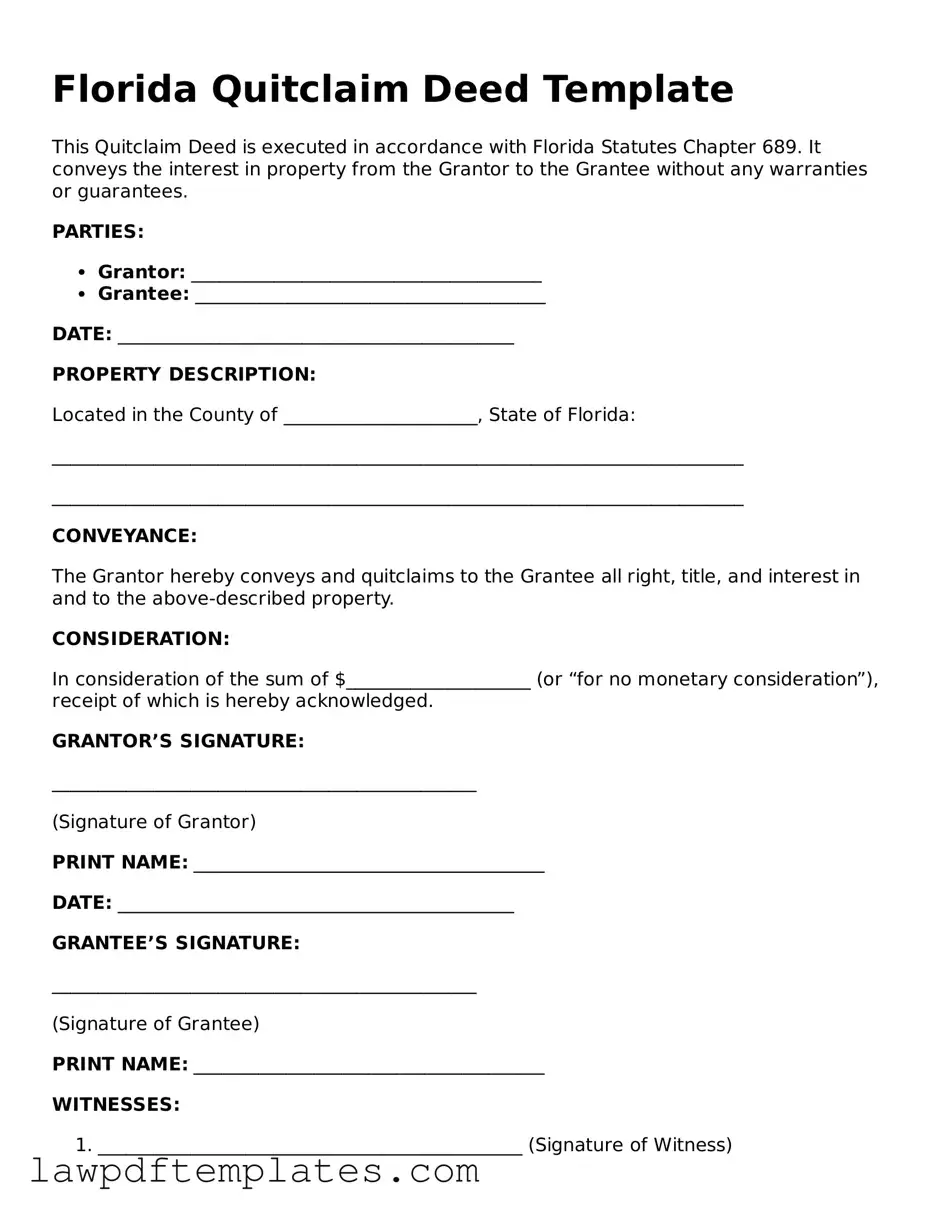

Florida Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with Florida Statutes Chapter 689. It conveys the interest in property from the Grantor to the Grantee without any warranties or guarantees.

PARTIES:

- Grantor: ______________________________________

- Grantee: ______________________________________

DATE: ___________________________________________

PROPERTY DESCRIPTION:

Located in the County of _____________________, State of Florida:

___________________________________________________________________________

___________________________________________________________________________

CONVEYANCE:

The Grantor hereby conveys and quitclaims to the Grantee all right, title, and interest in and to the above-described property.

CONSIDERATION:

In consideration of the sum of $____________________ (or “for no monetary consideration”), receipt of which is hereby acknowledged.

GRANTOR’S SIGNATURE:

______________________________________________

(Signature of Grantor)

PRINT NAME: ______________________________________

DATE: ___________________________________________

GRANTEE’S SIGNATURE:

______________________________________________

(Signature of Grantee)

PRINT NAME: ______________________________________

WITNESSES:

- ______________________________________________ (Signature of Witness)

- ______________________________________________ (Signature of Witness)

NOTARY PUBLIC:

State of Florida, County of ______________________.

Sworn to (or affirmed) and subscribed before me this ______ day of ______________, 20__.

______________________________________________

(Notary Public Signature)

My Commission Expires: _____________________

Common mistakes

When completing a Florida Quitclaim Deed form, individuals often make several common mistakes that can lead to complications in the property transfer process. One of the most frequent errors is failing to include all necessary parties involved in the transaction. A Quitclaim Deed requires the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Omitting one of these parties can render the deed invalid, causing delays or disputes later on.

Another mistake occurs when individuals neglect to provide a proper legal description of the property being transferred. Instead of a vague address, the deed must include a detailed description that accurately defines the boundaries and characteristics of the property. This description is crucial for establishing clear ownership and preventing future legal issues. If the legal description is incorrect or incomplete, it can lead to confusion or disputes regarding the property lines.

People also often overlook the need for signatures and notarization. A Quitclaim Deed must be signed by the grantor in the presence of a notary public. Failing to have the deed properly notarized can result in the deed being deemed invalid. It is essential to ensure that all signatures are present and that the notary's acknowledgment is correctly completed to avoid any potential legal challenges.

Lastly, many individuals do not consider the implications of the deed on their taxes. While a Quitclaim Deed itself does not typically trigger a tax event, it is important to understand how the transfer may affect property taxes or capital gains taxes in the future. Consulting with a tax professional can provide clarity on these matters, ensuring that all parties are aware of their financial responsibilities after the transfer is complete.

Discover More Quitclaim Deed Templates for Specific States

Free Quitclaim Deed Form California - This type of deed aids in the settlement of debts or obligations.

In order to complete the transfer of ownership smoothly, having the right documentation is essential, and the Illinois Bill of Sale is particularly important in this process. For those looking to simplify their transactions, resources such as Fast PDF Templates can provide ready-to-use forms that ensure clarity and protect both parties involved.

Where Can I Get a Quitclaim Deed Form - This form allows property owners to convey their rights to a buyer or relative quickly.

How to Gift Land to Family Member - A Quitclaim Deed is not a warranty deed; it does not promise clear title.