Free Promissory Note Template for the State of Florida

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specified amount of money to a designated party at a specified time. |

| Governing Laws | The Florida Promissory Note is governed by the Florida Uniform Commercial Code (UCC), specifically Chapter 673. |

| Types | Promissory Notes can be secured or unsecured, depending on whether collateral is provided to back the loan. |

| Interest Rates | Florida law allows for the inclusion of interest rates, which can be fixed or variable, as agreed upon by the parties involved. |

Sample - Florida Promissory Note Form

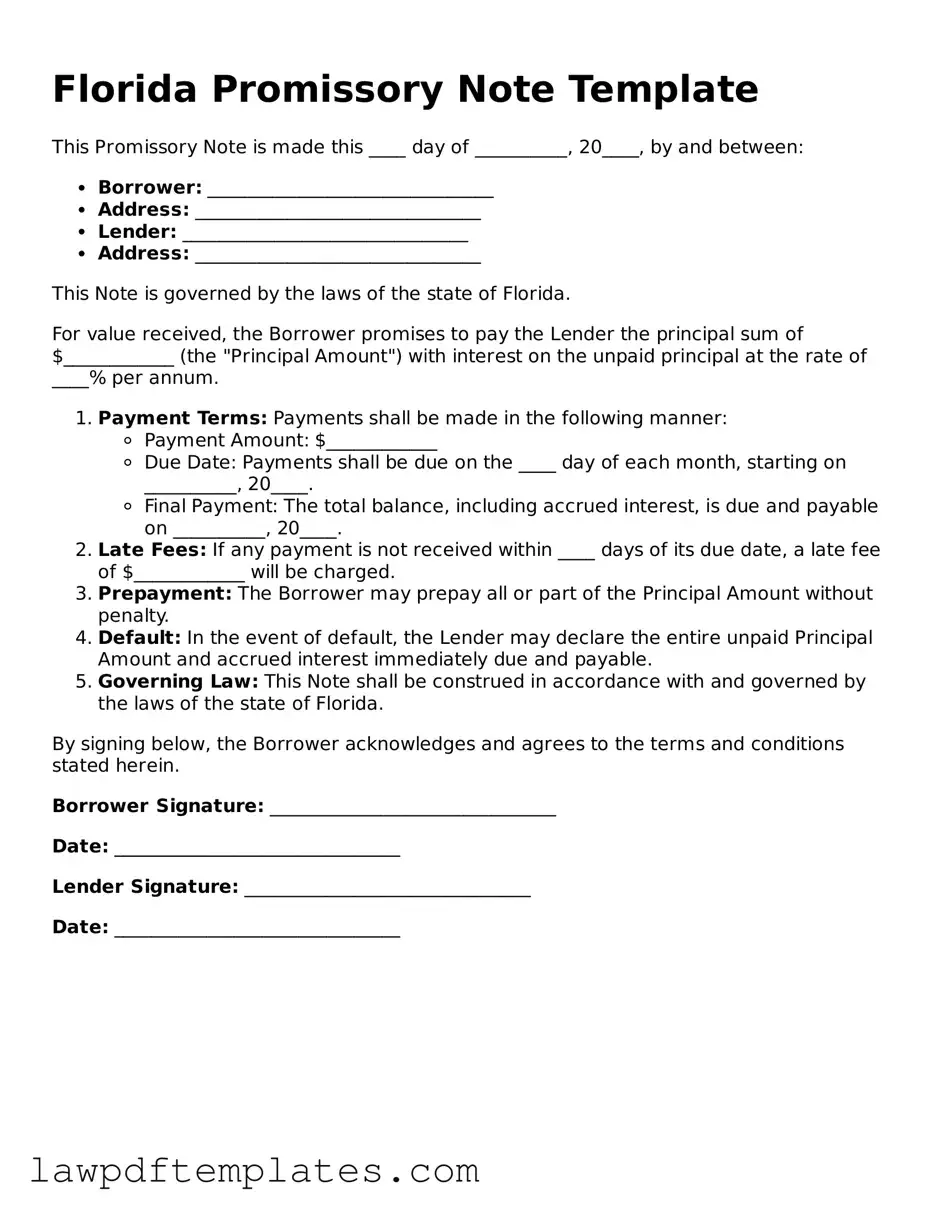

Florida Promissory Note Template

This Promissory Note is made this ____ day of __________, 20____, by and between:

- Borrower: _______________________________

- Address: _______________________________

- Lender: _______________________________

- Address: _______________________________

This Note is governed by the laws of the state of Florida.

For value received, the Borrower promises to pay the Lender the principal sum of $____________ (the "Principal Amount") with interest on the unpaid principal at the rate of ____% per annum.

- Payment Terms: Payments shall be made in the following manner:

- Payment Amount: $____________

- Due Date: Payments shall be due on the ____ day of each month, starting on __________, 20____.

- Final Payment: The total balance, including accrued interest, is due and payable on __________, 20____.

- Late Fees: If any payment is not received within ____ days of its due date, a late fee of $____________ will be charged.

- Prepayment: The Borrower may prepay all or part of the Principal Amount without penalty.

- Default: In the event of default, the Lender may declare the entire unpaid Principal Amount and accrued interest immediately due and payable.

- Governing Law: This Note shall be construed in accordance with and governed by the laws of the state of Florida.

By signing below, the Borrower acknowledges and agrees to the terms and conditions stated herein.

Borrower Signature: _______________________________

Date: _______________________________

Lender Signature: _______________________________

Date: _______________________________

Common mistakes

Filling out the Florida Promissory Note form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to include all necessary parties. It is essential to list both the borrower and the lender clearly. Omitting one party can render the note unenforceable.

Another common mistake is not specifying the loan amount. The total amount borrowed must be stated clearly. If this information is left blank or incorrectly filled out, it can lead to disputes later on.

Many individuals also overlook the importance of the interest rate. Not specifying whether the loan is interest-bearing or not can create confusion. If there is an interest rate, it should be clearly stated to avoid misunderstandings.

People often forget to include the payment schedule. This section should detail how and when payments will be made. Without this information, it can be challenging to enforce repayment terms.

Another mistake is not including a due date for the final payment. This date is crucial for both parties. If it is missing, it can lead to uncertainty about when the loan will be fully repaid.

Signatures are vital, yet many fail to sign the document. Both the borrower and lender must sign the Promissory Note for it to be valid. Additionally, not having witnesses or notarization, when required, can also invalidate the document.

Some people neglect to read the entire document before signing. It is crucial to understand all terms and conditions outlined in the note. Failing to do so can lead to unintentional agreements to unfavorable terms.

Another mistake is using outdated or incorrect forms. Always ensure you are using the latest version of the Florida Promissory Note form. Using an old version can lead to compliance issues.

Lastly, individuals sometimes fail to keep copies of the signed note. It is important to retain a copy for personal records. This can be essential if disputes arise in the future.

Discover More Promissory Note Templates for Specific States

Simple Promissory Note - A promissory note can contribute to a business’s financial planning and cash flow management.

When engaging in a transaction, it is important to have a properly completed Bill of Sale, which you can easily acquire from resources like PDF Documents Hub, ensuring all necessary information is accurately documented for both parties involved.

Illinois Promissory Note - Having a promissory note can help prevent misunderstandings about the debt situation.