Free Operating Agreement Template for the State of Florida

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | The Florida Operating Agreement outlines the management structure and operating procedures of a Limited Liability Company (LLC). |

| Governing Law | This agreement is governed by the Florida Statutes, specifically Chapter 605, the Florida Revised Limited Liability Company Act. |

| Purpose | It serves to define the roles and responsibilities of members and managers within the LLC. |

| Flexibility | The agreement allows members to customize the management and operational rules to fit their needs. |

| Member Rights | It outlines the rights and obligations of each member, ensuring clarity in ownership and profit distribution. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which helps prevent conflicts. |

| Amendments | Members can amend the agreement as needed, which allows for adaptability as the business grows. |

| Not Mandatory | While recommended, an operating agreement is not legally required in Florida, but it provides legal protection for members. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or limited to a certain time frame. |

| Tax Implications | It can address how the LLC will be taxed, which is important for financial planning and compliance. |

Sample - Florida Operating Agreement Form

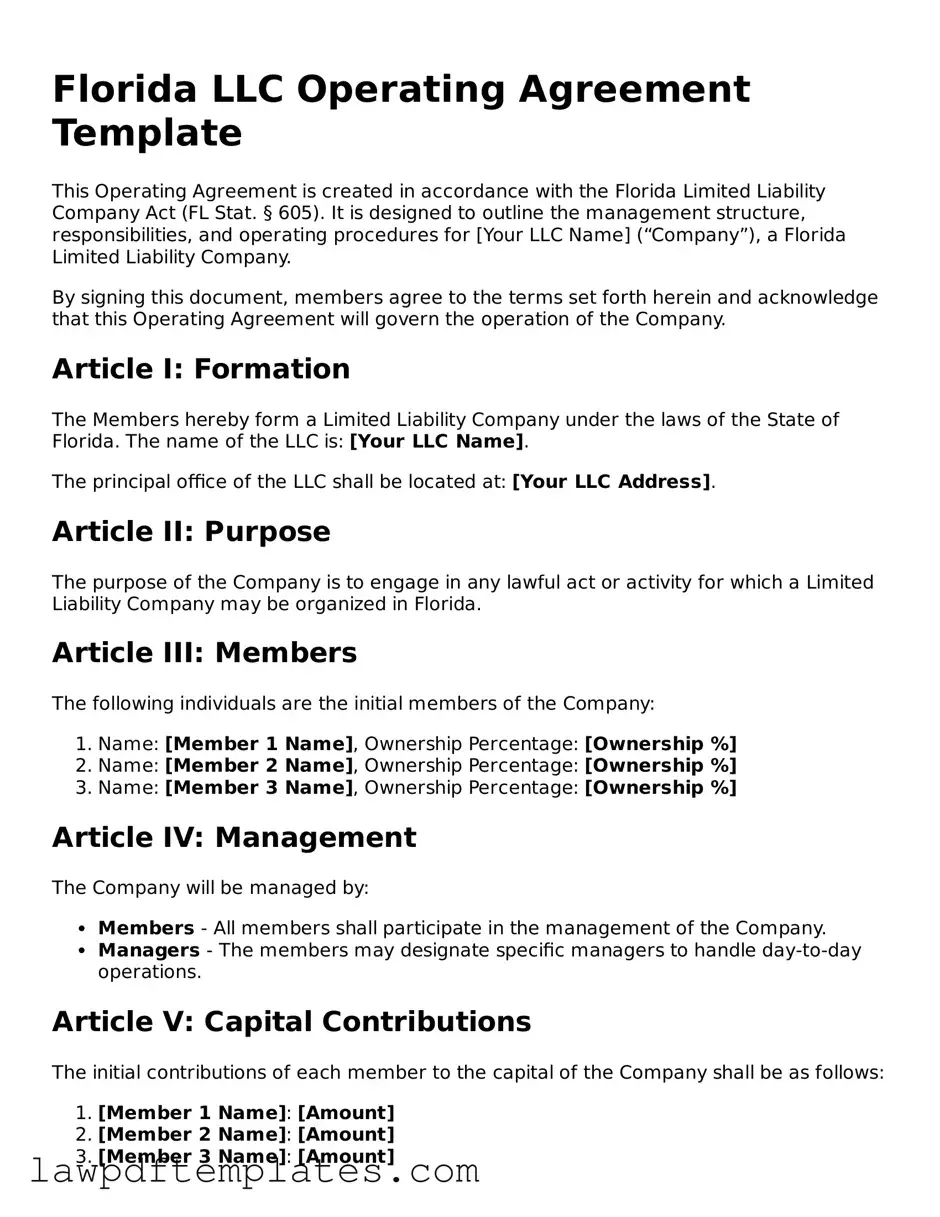

Florida LLC Operating Agreement Template

This Operating Agreement is created in accordance with the Florida Limited Liability Company Act (FL Stat. § 605). It is designed to outline the management structure, responsibilities, and operating procedures for [Your LLC Name] (“Company”), a Florida Limited Liability Company.

By signing this document, members agree to the terms set forth herein and acknowledge that this Operating Agreement will govern the operation of the Company.

Article I: Formation

The Members hereby form a Limited Liability Company under the laws of the State of Florida. The name of the LLC is: [Your LLC Name].

The principal office of the LLC shall be located at: [Your LLC Address].

Article II: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be organized in Florida.

Article III: Members

The following individuals are the initial members of the Company:

- Name: [Member 1 Name], Ownership Percentage: [Ownership %]

- Name: [Member 2 Name], Ownership Percentage: [Ownership %]

- Name: [Member 3 Name], Ownership Percentage: [Ownership %]

Article IV: Management

The Company will be managed by:

- Members - All members shall participate in the management of the Company.

- Managers - The members may designate specific managers to handle day-to-day operations.

Article V: Capital Contributions

The initial contributions of each member to the capital of the Company shall be as follows:

- [Member 1 Name]: [Amount]

- [Member 2 Name]: [Amount]

- [Member 3 Name]: [Amount]

Article VI: Distributions

Distributions of profits and losses will be allocated to members in proportion to their ownership interests.

Article VII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all members.

Article VIII: Miscellaneous

This agreement shall be governed by, and construed in accordance with, the laws of the State of Florida.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of [Date].

_____________________________

[Member 1 Signature]

[Member 1 Printed Name]

_____________________________

[Member 2 Signature]

[Member 2 Printed Name]

_____________________________

[Member 3 Signature]

[Member 3 Printed Name]

Common mistakes

When completing the Florida Operating Agreement form, individuals often encounter several common pitfalls that can lead to complications down the line. One frequent mistake is the failure to clearly define the roles and responsibilities of each member. Without explicit definitions, misunderstandings can arise, potentially causing disputes among members. It is essential to outline who is responsible for specific tasks and decision-making processes.

Another common error is neglecting to specify the ownership percentages of each member. This oversight can create confusion regarding profit sharing and voting rights. Each member's contribution to the business should be clearly articulated in the agreement to avoid future disagreements. Proper documentation of ownership percentages ensures that all members are on the same page regarding their stakes in the business.

Additionally, many people overlook the importance of including provisions for resolving disputes. Without a clear dispute resolution process, conflicts may escalate, resulting in costly legal battles. Including a method for mediation or arbitration can provide a structured way to address issues that may arise, fostering a more collaborative environment among members.

Another mistake involves failing to update the Operating Agreement as changes occur within the business. Life events such as the addition of new members, changes in ownership, or shifts in business direction necessitate revisions to the agreement. Keeping the document current is crucial for reflecting the true state of the business and protecting the interests of all members.

Lastly, individuals often neglect to seek legal advice when drafting their Operating Agreement. While it may seem straightforward, the nuances of business law can be complex. Consulting with a legal professional can help ensure that the agreement complies with state laws and adequately protects the rights of all members. Taking this step can prevent costly mistakes and provide peace of mind.

Discover More Operating Agreement Templates for Specific States

How to Set Up an Operating Agreement for Llc - It can define the term of existence for the LLC.

For those looking to create a reliable and legally sound documentation for the exchange of a vehicle, the Fast PDF Templates offers convenient templates that simplify the process, ensuring all necessary information is captured effectively.

Llc Operating Agreement Massachusetts - The Operating Agreement serves as a reference for legal and financial matters.

California Operating Agreement - It can cover the allocation of voting power in relation to investment contributions.

Operating Agreement Llc Nc Template - This agreement may include provisions for dissolution of the LLC.