Free Loan Agreement Template for the State of Florida

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Loan Agreement is governed by Florida state law. |

| Parties Involved | The agreement typically involves a lender and a borrower. |

| Loan Amount | The specific amount of money being borrowed must be clearly stated. |

| Interest Rate | The agreement should specify the interest rate applicable to the loan. |

| Repayment Terms | Details about how and when the loan will be repaid are essential. |

| Default Conditions | The agreement outlines what constitutes a default and the consequences. |

| Collateral | If applicable, the form should identify any collateral securing the loan. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

Sample - Florida Loan Agreement Form

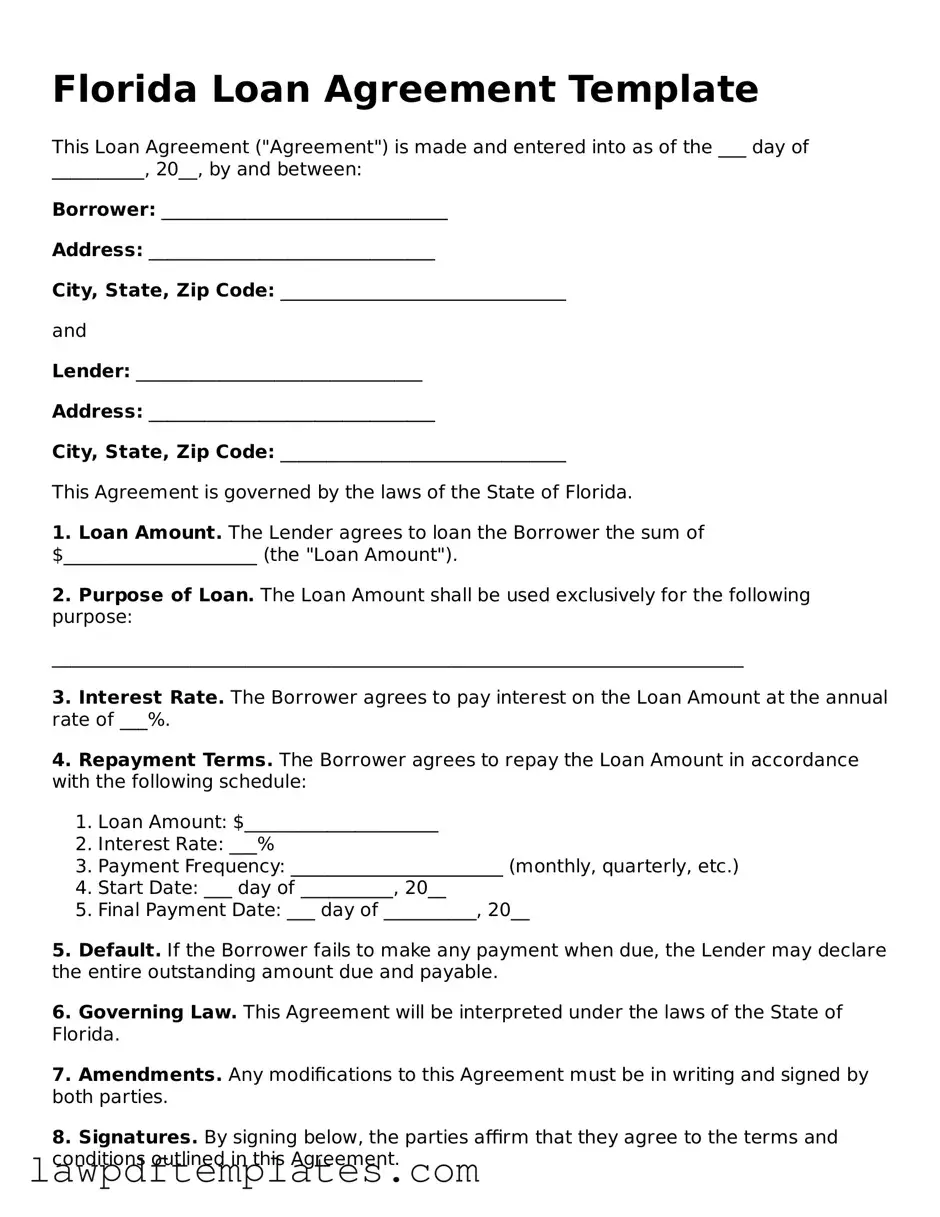

Florida Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of the ___ day of __________, 20__, by and between:

Borrower: _______________________________

Address: _______________________________

City, State, Zip Code: _______________________________

and

Lender: _______________________________

Address: _______________________________

City, State, Zip Code: _______________________________

This Agreement is governed by the laws of the State of Florida.

1. Loan Amount. The Lender agrees to loan the Borrower the sum of $_____________________ (the "Loan Amount").

2. Purpose of Loan. The Loan Amount shall be used exclusively for the following purpose:

___________________________________________________________________________

3. Interest Rate. The Borrower agrees to pay interest on the Loan Amount at the annual rate of ___%.

4. Repayment Terms. The Borrower agrees to repay the Loan Amount in accordance with the following schedule:

- Loan Amount: $_____________________

- Interest Rate: ___%

- Payment Frequency: _______________________ (monthly, quarterly, etc.)

- Start Date: ___ day of __________, 20__

- Final Payment Date: ___ day of __________, 20__

5. Default. If the Borrower fails to make any payment when due, the Lender may declare the entire outstanding amount due and payable.

6. Governing Law. This Agreement will be interpreted under the laws of the State of Florida.

7. Amendments. Any modifications to this Agreement must be in writing and signed by both parties.

8. Signatures. By signing below, the parties affirm that they agree to the terms and conditions outlined in this Agreement.

Borrower's Signature: _______________________________

Date: _______________________________

Lender's Signature: _______________________________

Date: _______________________________

Common mistakes

Filling out the Florida Loan Agreement form can be straightforward, but many people make common mistakes that can lead to issues down the line. One frequent error is not providing complete personal information. It’s essential to include your full name, address, and contact details. Omitting any of this information can delay the processing of your loan.

Another mistake is failing to read the terms and conditions carefully. Many people skim through the document, missing important clauses that could affect their loan. Understanding the interest rate, repayment schedule, and any fees associated with the loan is crucial. Always take the time to read everything thoroughly.

Additionally, some individuals neglect to double-check their calculations. Errors in the loan amount or interest rate can lead to significant problems later. It’s wise to verify all figures before submitting the form. A simple mistake can result in misunderstandings about how much you owe.

Using the wrong loan type is another common pitfall. There are different types of loans available, and choosing the incorrect one can complicate matters. Make sure to select the loan that best fits your financial situation and needs.

People often forget to sign the form. A signature is necessary to validate the agreement. Without it, the document is incomplete and may not be considered legally binding. Always ensure that you have signed and dated the form before submission.

Another mistake is not providing required documentation. Lenders often request additional information, such as proof of income or identification. Failing to include these documents can slow down the approval process. It’s best to gather all necessary paperwork beforehand.

Many applicants also overlook the importance of including a co-signer when required. If your credit score is low or you have limited income, a co-signer can improve your chances of approval. Not including one when needed can result in denial of the loan.

Lastly, people sometimes submit the form without a clear understanding of their credit situation. Knowing your credit score and history can help you negotiate better terms. If you’re unaware of your credit status, you might miss out on favorable loan conditions.

Discover More Loan Agreement Templates for Specific States

Illinois Promissory Note - Both parties can sign the agreement to formalize the loan transaction.

For further assistance with the process, you can find helpful resources to guide you through the USCIS I-864 form at PDF Documents Hub, which provides important information to ensure you meet all necessary requirements.

Promissory Note California - The form may also outline assignment of rights.