Free Deed in Lieu of Foreclosure Template for the State of Florida

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Benefits | This process can help homeowners avoid the lengthy and costly foreclosure process, and it may also have a less negative impact on their credit score compared to a foreclosure. |

| Governing Law | In Florida, the deed in lieu of foreclosure is governed by the Florida Statutes, particularly Chapter 697, which addresses the transfer of property interests. |

| Requirements | Homeowners must typically be in default on their mortgage and must obtain the lender's agreement to accept the deed in lieu of foreclosure. |

Sample - Florida Deed in Lieu of Foreclosure Form

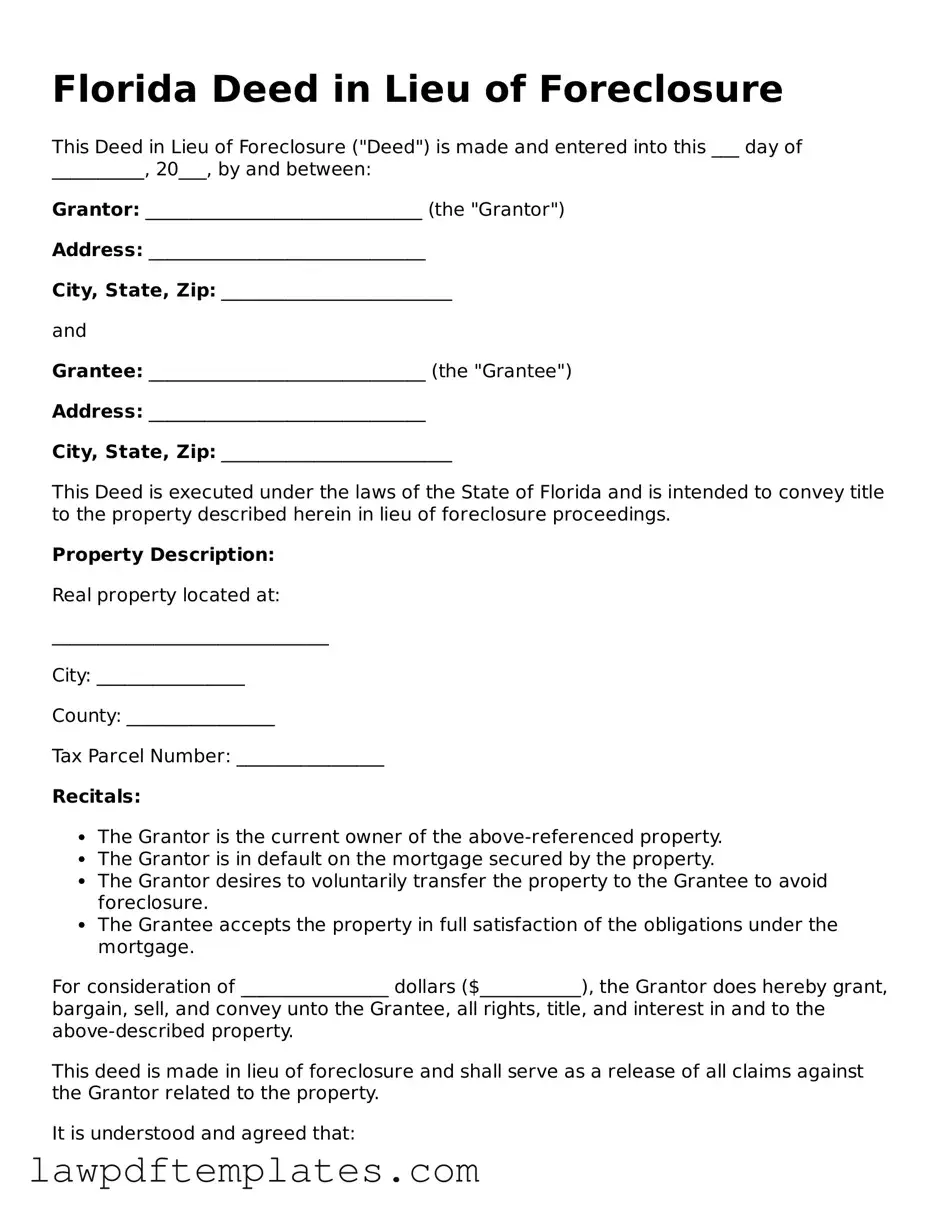

Florida Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure ("Deed") is made and entered into this ___ day of __________, 20___, by and between:

Grantor: ______________________________ (the "Grantor")

Address: ______________________________

City, State, Zip: _________________________

and

Grantee: ______________________________ (the "Grantee")

Address: ______________________________

City, State, Zip: _________________________

This Deed is executed under the laws of the State of Florida and is intended to convey title to the property described herein in lieu of foreclosure proceedings.

Property Description:

Real property located at:

______________________________

City: ________________

County: ________________

Tax Parcel Number: ________________

Recitals:

- The Grantor is the current owner of the above-referenced property.

- The Grantor is in default on the mortgage secured by the property.

- The Grantor desires to voluntarily transfer the property to the Grantee to avoid foreclosure.

- The Grantee accepts the property in full satisfaction of the obligations under the mortgage.

For consideration of ________________ dollars ($___________), the Grantor does hereby grant, bargain, sell, and convey unto the Grantee, all rights, title, and interest in and to the above-described property.

This deed is made in lieu of foreclosure and shall serve as a release of all claims against the Grantor related to the property.

It is understood and agreed that:

- The Grantee assumes all risks and liabilities associated with the property from the date of execution.

- The Grantor disclaims all warranties, express or implied, regarding the condition of the property.

- This Deed will be recorded in the public records of the county where the property is located.

Signatures:

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the day and year first above written.

Grantor:

______________________________ (Signature)

______________________________ (Printed Name)

Date: ___________________

Grantee:

______________________________ (Signature)

______________________________ (Printed Name)

Date: ___________________

Witnesses:

______________________________ (Witness 1 Signature)

______________________________ (Printed Name)

______________________________ (Witness 2 Signature)

______________________________ (Printed Name)

STATE OF FLORIDA

COUNTY OF ________________

The foregoing instrument was acknowledged before me this ___ day of __________, 20___, by ______________________________ (name of Grantor), who is personally known to me or has produced __________________ (type of identification) as identification.

______________________________ (Notary Public Signature)

______________________________ (Printed Name)

My Commission Expires: _________________

Common mistakes

Filling out the Florida Deed in Lieu of Foreclosure form can be a critical step for homeowners facing financial difficulties. However, several common mistakes can hinder the process and create further complications. Awareness of these pitfalls can help ensure that the form is completed correctly and efficiently.

One major mistake is failing to provide accurate property information. The form requires specific details about the property, including the legal description and the address. Omitting or incorrectly entering this information can lead to delays or even rejection of the deed. It is essential to double-check that all property details are correct and match official records.

Another frequent error involves not fully understanding the implications of signing the deed. Some individuals may not realize that by executing this document, they are voluntarily transferring ownership of their property to the lender. It’s crucial to grasp the potential consequences, including how this decision may affect one’s credit score and future housing options.

Additionally, neglecting to obtain the necessary signatures can be a significant oversight. The deed must be signed by all parties listed on the title, including spouses or co-owners. If any required signatures are missing, the document may be deemed invalid, leading to further complications in the foreclosure process.

Lastly, many people overlook the importance of consulting with a legal professional before submitting the deed. While it may seem like a straightforward process, having an expert review the form can help identify any errors or omissions. This step can provide peace of mind and ensure that all legal requirements are met, ultimately facilitating a smoother transition for the homeowner.

Discover More Deed in Lieu of Foreclosure Templates for Specific States

Deed in Lieu Vs Foreclosure - It is essential for a borrower to understand the implications on their credit score before proceeding with a Deed in Lieu of Foreclosure.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - It’s crucial for borrowers to fully understand the implications of giving up their home through this deed.

For those looking to manage their RV transactions efficiently, utilizing resources such as the PDF Documents Hub can be invaluable. This platform offers easy access to the necessary forms, making the process of completing a Texas RV Bill of Sale seamless and straightforward.

California Pre-foreclosure Property Transfer - It provides a clear process for the lender to take control of the property.

Georgia Foreclosure Laws - A Deed in Lieu of Foreclosure may result in a waiver of any remaining loan balance by the lender, easing the borrower’s financial burden.