Attorney-Approved Employee Loan Agreement Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a document outlining the terms under which an employer provides a loan to an employee. |

| Purpose | This agreement serves to clarify the repayment terms, interest rates, and any other conditions related to the loan. |

| Repayment Terms | Typically, the agreement specifies the repayment schedule, including the frequency and amount of payments. |

| Interest Rate | The document may include the interest rate applicable to the loan, which can vary based on the employer's policy. |

| Governing Law | The agreement is governed by the laws of the state where the employer is located. For example, in California, the relevant laws include the California Civil Code. |

| Default Terms | In the event of default, the agreement outlines the consequences, which may include immediate repayment or other actions. |

| Confidentiality | Often, the agreement includes a confidentiality clause to protect the privacy of both the employer and employee. |

| Signatures | Both the employer and employee must sign the agreement to indicate their acceptance of the terms outlined. |

Sample - Employee Loan Agreement Form

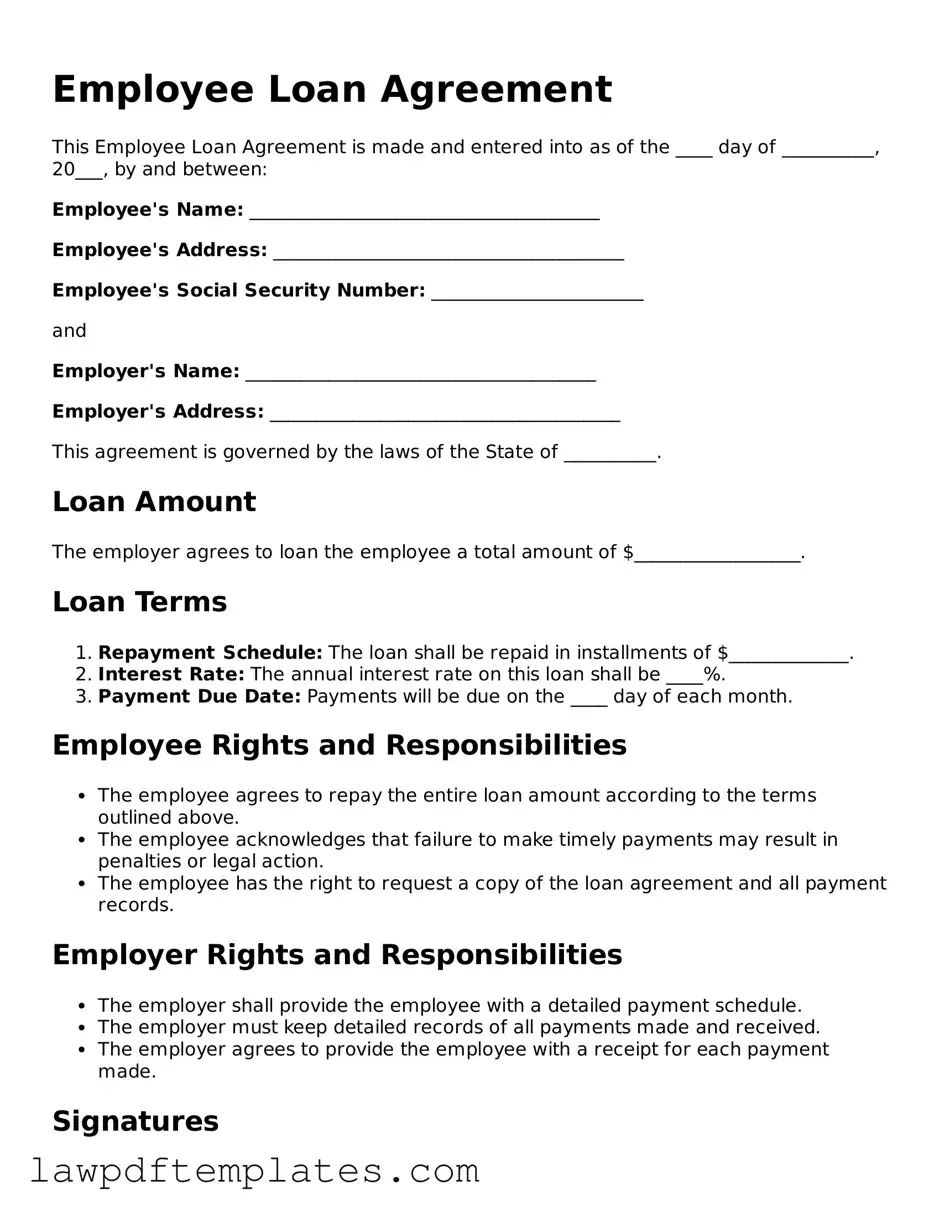

Employee Loan Agreement

This Employee Loan Agreement is made and entered into as of the ____ day of __________, 20___, by and between:

Employee's Name: ______________________________________

Employee's Address: ______________________________________

Employee's Social Security Number: _______________________

and

Employer's Name: ______________________________________

Employer's Address: ______________________________________

This agreement is governed by the laws of the State of __________.

Loan Amount

The employer agrees to loan the employee a total amount of $__________________.

Loan Terms

- Repayment Schedule: The loan shall be repaid in installments of $_____________.

- Interest Rate: The annual interest rate on this loan shall be ____%.

- Payment Due Date: Payments will be due on the ____ day of each month.

Employee Rights and Responsibilities

- The employee agrees to repay the entire loan amount according to the terms outlined above.

- The employee acknowledges that failure to make timely payments may result in penalties or legal action.

- The employee has the right to request a copy of the loan agreement and all payment records.

Employer Rights and Responsibilities

- The employer shall provide the employee with a detailed payment schedule.

- The employer must keep detailed records of all payments made and received.

- The employer agrees to provide the employee with a receipt for each payment made.

Signatures

By signing below, both parties agree to the terms of this Employee Loan Agreement.

Employee Signature: ___________________________ Date: _______________

Employer Signature: ___________________________ Date: _______________

This agreement is binding upon both parties and may only be amended in writing, signed by both parties.

Common mistakes

Filling out an Employee Loan Agreement form requires careful attention to detail. One common mistake is failing to provide accurate personal information. Employees often overlook the need to double-check their names, addresses, and contact information. Inaccuracies can lead to complications in communication and may delay the loan approval process.

Another frequent error involves the loan amount. Employees sometimes request a sum that exceeds the company's policy limits or their own financial needs. This can result in the rejection of the loan application or unnecessary complications in repayment terms. It is essential to understand the company's lending policies and to request a reasonable amount based on personal circumstances.

In addition, many individuals neglect to read the repayment terms thoroughly. They may misunderstand the interest rates, repayment schedule, or consequences of late payments. This oversight can lead to financial strain and unexpected penalties. A clear understanding of these terms is crucial for maintaining a good relationship with the employer and ensuring financial stability.

Lastly, employees often forget to include necessary documentation. Supporting documents, such as proof of income or identification, may be required to process the loan. Missing these documents can delay the approval process or even result in a denial. It is advisable to compile all required paperwork before submitting the agreement to streamline the process.