Fillable Employee Advance Template

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used by employers to provide financial assistance to employees before their regular pay date. |

| Eligibility | Typically, employees must meet certain criteria, such as length of service or financial need, to qualify for an advance. |

| Repayment Terms | Repayment terms are often outlined in the form, detailing how and when the advance will be repaid through payroll deductions. |

| State-Specific Regulations | Different states may have specific laws governing employee advances. For example, California requires clear disclosure of repayment terms under labor laws. |

| Tax Implications | Advances may have tax implications. Generally, they are considered taxable income once received by the employee. |

| Documentation | Employees often need to provide documentation supporting their request for an advance, such as bills or other financial obligations. |

| Employer Discretion | Employers retain the discretion to approve or deny requests based on company policy and the employee's circumstances. |

| Impact on Future Compensation | Receiving an advance may affect an employee's future paychecks, as the amount will be deducted from upcoming wages. |

Sample - Employee Advance Form

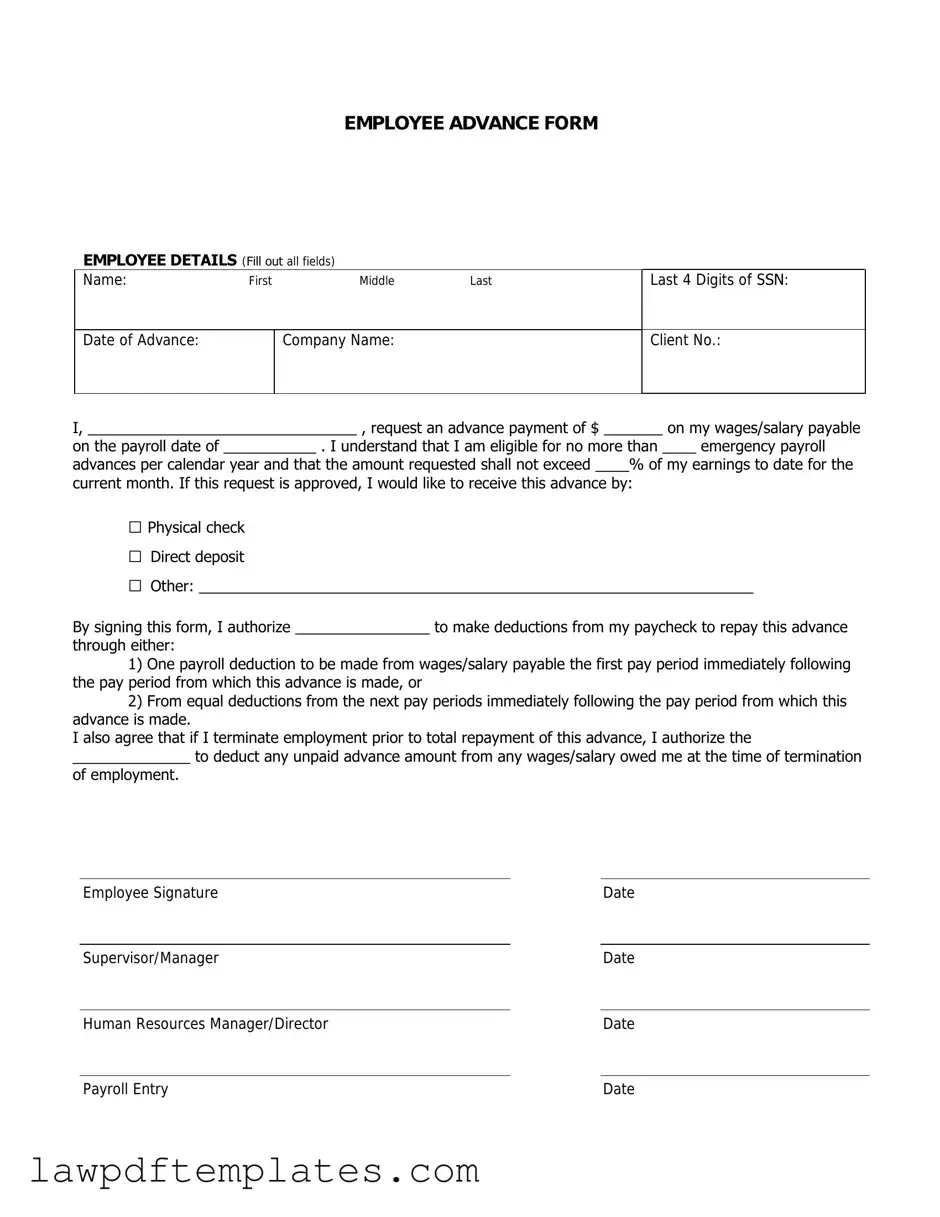

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Common mistakes

Filling out an Employee Advance form can seem straightforward, but many individuals encounter pitfalls that can delay processing or even result in denial of the request. One common mistake is failing to provide all required information. Each section of the form typically serves a specific purpose, and omitting details can lead to confusion or a lack of clarity regarding the request.

Another frequent error is not being specific about the purpose of the advance. When employees simply state "for personal reasons," it does not provide sufficient context for the approver. A clear and detailed explanation helps management understand the necessity of the advance and may increase the likelihood of approval.

Inaccurate calculations can also pose a significant problem. Employees sometimes miscalculate the total amount needed, leading to requests that do not align with their actual needs. Double-checking figures before submission can prevent unnecessary back-and-forth communication with the finance department.

Additionally, neglecting to sign the form is a mistake that can halt the process entirely. A signature indicates that the employee has read and understood the terms of the advance. Without it, the form may be returned for completion, causing delays.

Another issue arises when individuals submit the form without checking the company's policy on advances. Each organization may have different rules regarding eligibility, repayment terms, and maximum amounts. Familiarity with these policies is crucial to ensure compliance and a smoother approval process.

Some employees also fail to provide supporting documentation when required. If the form requests receipts or other proof of expenses, not including these can weaken the request. Providing the necessary documentation can bolster the case for an advance.

Moreover, procrastination can lead to rushed submissions. Waiting until the last minute often results in incomplete forms or overlooked details. It is advisable to fill out the form well in advance of when the funds are needed, allowing time for any corrections or additional information that may be requested.

Finally, poor communication with supervisors or the finance department can create misunderstandings. Employees should ensure they discuss their needs with the appropriate parties before submitting the form. This proactive approach can clarify expectations and improve the chances of a smooth approval process.

Common PDF Documents

Profits or Loss From Business - Schedule C does not apply to partnerships or corporations, which use other forms for reporting income.

For those looking to facilitate the transfer of trailer ownership, utilizing the Trailer Bill of Sale form is crucial, and detailed resources can be found at PDF Documents Hub to help ensure all necessary information is accurately captured.

Ucc-1308 - Signers explicitly state they are not citizens of the US under certain amendments.

Consolation Tournament - Every game is a chance to showcase determination and skill.