Attorney-Approved Deed in Lieu of Foreclosure Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This form helps borrowers avoid the lengthy and costly foreclosure process while allowing lenders to recover their losses more quickly. |

| Eligibility | Homeowners facing financial hardship and unable to make mortgage payments may qualify for this option, subject to lender approval. |

| Governing Laws | Each state has its own laws regarding Deeds in Lieu of Foreclosure. For example, California follows the California Civil Code, while Texas adheres to the Texas Property Code. |

| Advantages | Benefits include a less damaging impact on credit scores compared to foreclosure and the possibility of negotiating a cash incentive from the lender. |

| Disadvantages | Homeowners may still face tax implications and potential deficiency judgments if the property's value is less than the mortgage owed. |

Sample - Deed in Lieu of Foreclosure Form

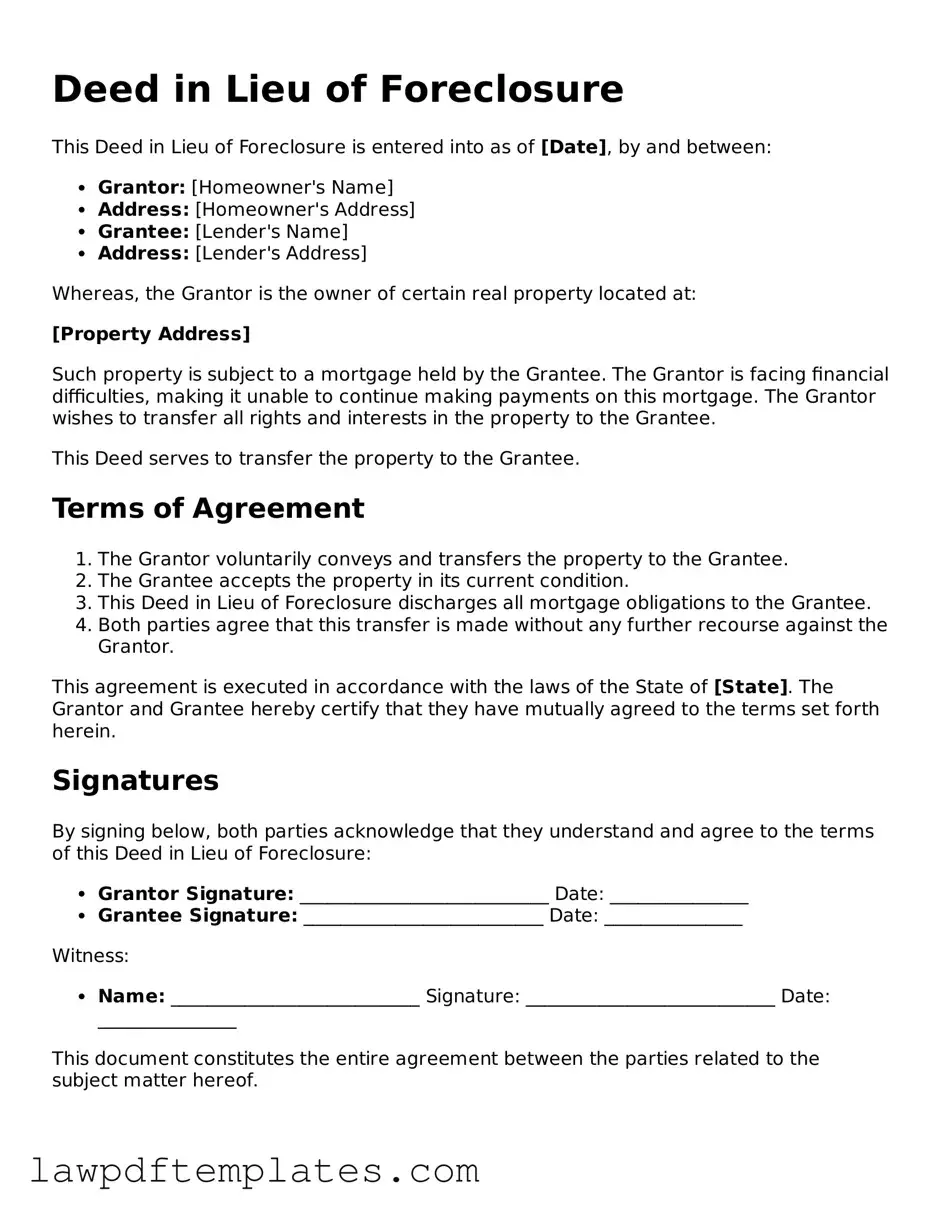

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is entered into as of [Date], by and between:

- Grantor: [Homeowner's Name]

- Address: [Homeowner's Address]

- Grantee: [Lender's Name]

- Address: [Lender's Address]

Whereas, the Grantor is the owner of certain real property located at:

[Property Address]

Such property is subject to a mortgage held by the Grantee. The Grantor is facing financial difficulties, making it unable to continue making payments on this mortgage. The Grantor wishes to transfer all rights and interests in the property to the Grantee.

This Deed serves to transfer the property to the Grantee.

Terms of Agreement

- The Grantor voluntarily conveys and transfers the property to the Grantee.

- The Grantee accepts the property in its current condition.

- This Deed in Lieu of Foreclosure discharges all mortgage obligations to the Grantee.

- Both parties agree that this transfer is made without any further recourse against the Grantor.

This agreement is executed in accordance with the laws of the State of [State]. The Grantor and Grantee hereby certify that they have mutually agreed to the terms set forth herein.

Signatures

By signing below, both parties acknowledge that they understand and agree to the terms of this Deed in Lieu of Foreclosure:

- Grantor Signature: ___________________________ Date: _______________

- Grantee Signature: __________________________ Date: _______________

Witness:

- Name: ___________________________ Signature: ___________________________ Date: _______________

This document constitutes the entire agreement between the parties related to the subject matter hereof.

Common mistakes

Filling out a Deed in Lieu of Foreclosure form can be a complex process, and many individuals make mistakes that can lead to complications down the line. One common error is failing to understand the implications of the deed. A Deed in Lieu of Foreclosure transfers ownership of the property back to the lender, which means the homeowner relinquishes all rights to the property. Not fully grasping this can lead to regret and confusion later.

Another frequent mistake involves incorrect or incomplete information. Homeowners often overlook details such as the legal description of the property or their own personal information. This can result in delays or even rejection of the deed. Ensuring that all sections are filled out accurately is crucial for a smooth process.

Additionally, some individuals neglect to consult with a legal or financial advisor before signing the deed. This oversight can lead to unforeseen consequences, such as tax implications or impacts on credit scores. Seeking professional advice can provide clarity and help homeowners make informed decisions.

Moreover, many people fail to communicate with their lender throughout the process. Keeping the lines of communication open is essential. Lenders may have specific requirements or forms that need to be submitted along with the Deed in Lieu of Foreclosure. Not following these guidelines can result in complications or a denial of the deed.

Lastly, homeowners often underestimate the importance of obtaining a release of liability. Without this document, the lender may still pursue the homeowner for any remaining debt after the property is transferred. It is vital to ensure that all debts related to the property are settled and that the homeowner is fully released from any further obligations.

Consider Popular Types of Deed in Lieu of Foreclosure Documents

Lady Bird Title - The Lady Bird Deed encourages thoughtful planning, allowing for tailored asset distribution aligned with the owner’s wishes.

A Virginia Motor Vehicle Bill of Sale form is a legal document that records the sale and transfer of a vehicle from one party to another. This form serves as proof of ownership and includes important details about the vehicle and the transaction. To ensure a smooth transfer, take the time to fill out the form accurately by clicking the button below. For more information, visit PDF Documents Hub.