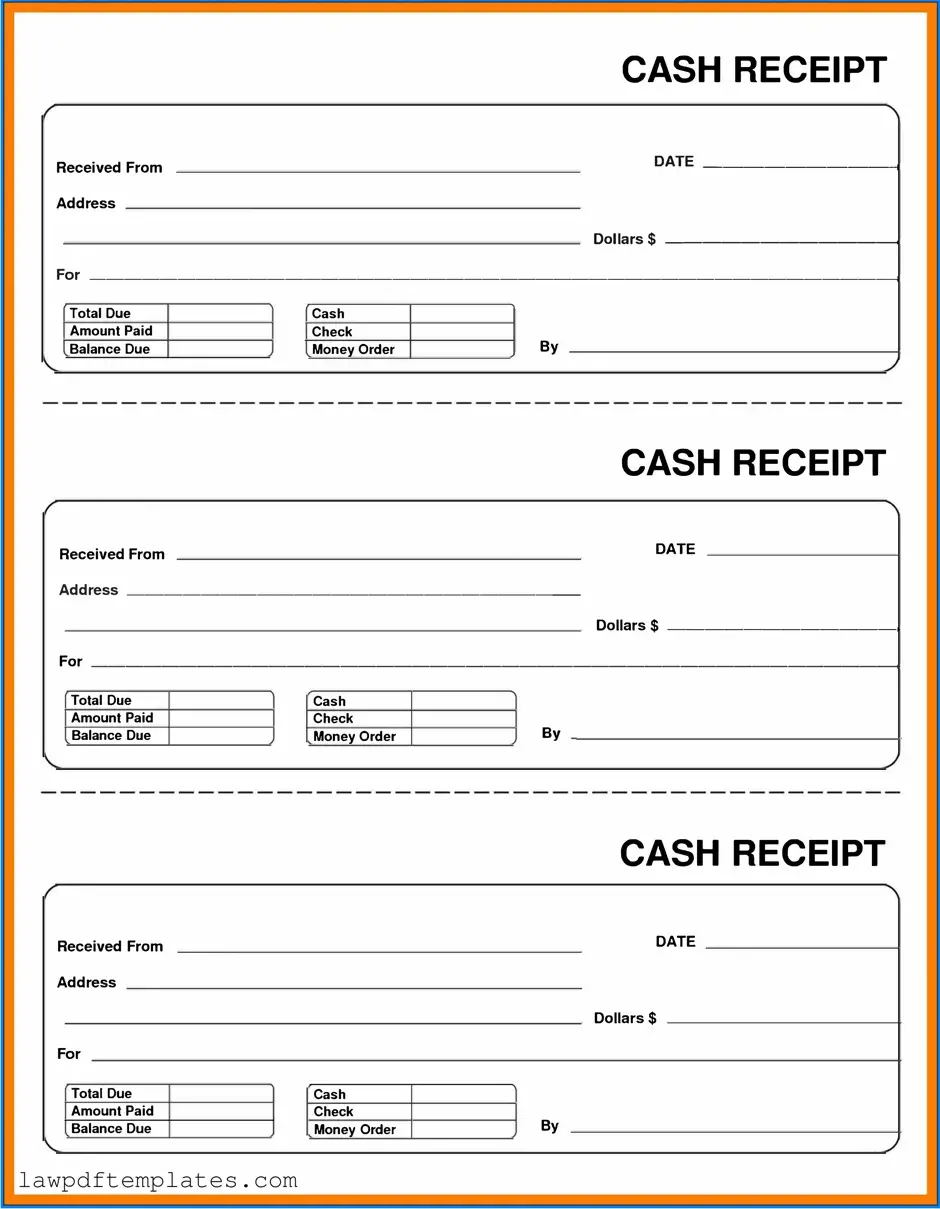

Fillable Cash Receipt Template

File Details

| Fact Name | Description |

|---|---|

| Definition | A Cash Receipt form is a document used to record the receipt of cash payments. |

| Purpose | This form serves as proof of payment for both the payer and the payee. |

| Components | The form typically includes fields for the date, amount received, payer's name, and purpose of the payment. |

| Record Keeping | It is essential for maintaining accurate financial records and can be used for auditing purposes. |

| Legal Requirement | In some states, businesses must issue a cash receipt for any cash transaction exceeding a certain amount, as stipulated by state law. |

| Governing Laws | For example, California law requires receipts for cash transactions over $10 (Cal. Civ. Code § 1747.1). |

| Format | Cash Receipt forms can be printed or generated electronically, depending on the organization's preference. |

| Signature Requirement | Some organizations may require a signature from the payee to validate the transaction. |

| Tax Implications | These forms can be important for tax reporting, as they document income received. |

| Storage | Organizations should retain copies of cash receipts for a specified period, often three to seven years, depending on state regulations. |

Sample - Cash Receipt Form

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Common mistakes

Completing a Cash Receipt form accurately is essential for maintaining proper financial records. However, individuals often make several common mistakes that can lead to complications. One frequent error is failing to include all necessary details, such as the date of the transaction or the amount received. Omitting this information can create confusion and hinder record-keeping efforts.

Another mistake involves incorrect calculations. When individuals do not double-check their math, they may report an inaccurate amount received. This can result in discrepancies in financial records, which may require additional time and effort to resolve.

Some people neglect to provide the payer's information. Without this detail, tracking payments can become challenging. It is crucial to include the name and contact information of the person or entity making the payment to ensure proper attribution.

Additionally, using unclear or ambiguous language can lead to misunderstandings. When descriptions of the transaction are vague, it may be difficult for others to interpret the nature of the payment. Clear and concise descriptions help maintain transparency and clarity in financial documentation.

Lastly, failing to sign or date the form can render it incomplete. A signature serves as an acknowledgment of the transaction, while a date indicates when the payment was made. Both elements are vital for validating the Cash Receipt and ensuring it is legally recognized.

Common PDF Documents

Physical Exam Form for Healthcare Workers - Note any changes to medication as discussed during the visit.

The use of a FedEx Release Form not only facilitates delivery when the recipient is absent but also provides peace of mind, as it allows packages to be left at a designated spot securely. To streamline the process of creating this form, you can find helpful resources at Fast PDF Templates, which can assist in ensuring that all necessary details are accurately filled out and submitted.

Puppy Health Record - Document important dates, such as the first vaccinations and deworming treatments, systematically.