Fillable Cash Drawer Count Sheet Template

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to record the cash balance in a cash drawer at the end of a business day or shift. |

| Components | This form typically includes fields for cash denominations, total cash, and discrepancies. |

| Usage Frequency | It is commonly used daily, but some businesses may opt for weekly or monthly counts. |

| Importance | Accurate counts help prevent theft and ensure that financial records are correct. |

| Record Keeping | Businesses are advised to keep these records for a specified period, often for audit purposes. |

| State-Specific Regulations | In some states, specific laws govern the handling of cash and record-keeping practices. |

| Signature Requirement | Many businesses require a manager's or supervisor's signature to validate the count. |

| Discrepancy Reporting | Any discrepancies found during the count should be documented and reported to management. |

| Digital Options | Some businesses utilize digital versions of the Cash Drawer Count Sheet for efficiency and ease of tracking. |

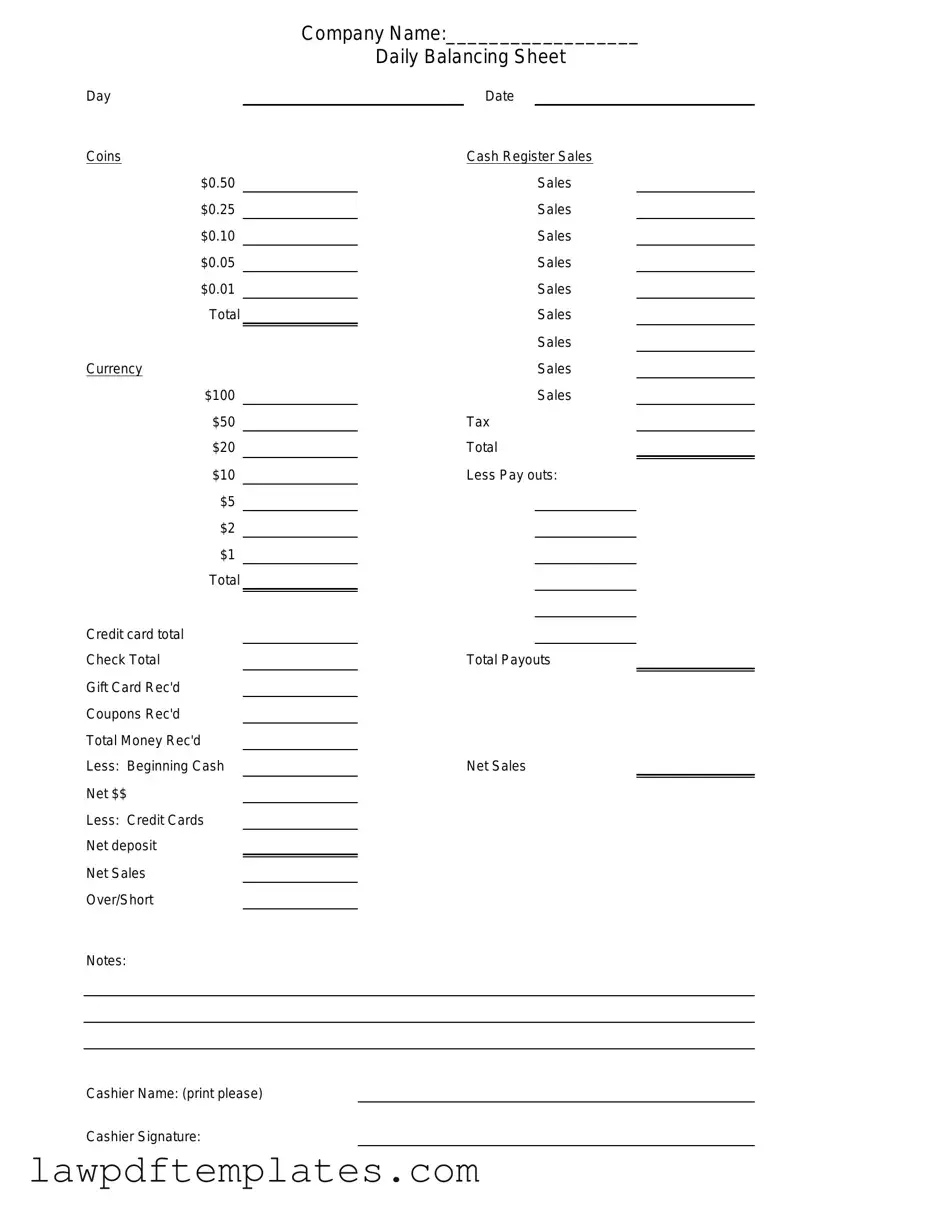

Sample - Cash Drawer Count Sheet Form

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Common mistakes

Filling out a Cash Drawer Count Sheet is an essential task for maintaining accurate financial records. However, many individuals make common mistakes that can lead to discrepancies and complications. One frequent error is failing to record the starting cash balance correctly. This initial amount serves as a reference point for all subsequent calculations. If the starting balance is inaccurate, it can skew the entire count, resulting in confusion and potential financial issues.

Another mistake often encountered is neglecting to document all cash transactions throughout the day. Every sale, return, and cash handling activity should be recorded meticulously. Omitting any transactions can lead to an incomplete picture of the cash flow, making it difficult to reconcile the drawer at the end of the shift. This oversight can also raise questions during audits or financial reviews.

In addition, individuals sometimes miscalculate the total cash at the end of the counting process. Simple arithmetic errors can occur, especially when working quickly or under pressure. It is crucial to double-check calculations to ensure accuracy. A small mistake in totaling can result in significant discrepancies, leading to time-consuming investigations to resolve the issue.

Another common pitfall is not having a clear process for handling discrepancies. If the counted cash does not match the expected total, it is vital to have a systematic approach to investigate the difference. Failing to address discrepancies promptly can lead to unresolved issues and potential trust problems with management or auditors.

Finally, individuals may overlook the importance of signatures on the Cash Drawer Count Sheet. Proper documentation requires that both the person conducting the count and a supervisor or manager sign off on the form. This step not only provides accountability but also ensures that there is a record of who was responsible for the cash count. Skipping this can lead to disputes about responsibility in the event of a cash shortfall.

Common PDF Documents

Employee Status Change Form Template - Notification of a demotion or reduction in status.

The Georgia Tractor Bill of Sale form is crucial for any buyer and seller engaged in a transaction. For those seeking a straightforward solution, the essential Georgia Tractor Bill of Sale documentation is available at essential Georgia Tractor Bill of Sale documentation. This streamlined process aids in ensuring a smooth transfer of ownership while safeguarding the interests of both parties involved.

Broker Price Opinion Sample - Property address and broker information are clearly documented for identification purposes.

Ca Dmv Form 256 - By submitting the DL 44, you are acknowledging your responsibility to follow all driving laws.