Free Transfer-on-Death Deed Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| What It Is | A California Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by California Probate Code Section 5600-5690. |

| Eligibility | Any individual who owns real property in California can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time before the owner’s death, ensuring flexibility for the property owner. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, allowing for tailored estate planning. |

| Filing Requirements | The deed must be recorded with the county recorder's office where the property is located to be effective. |

Sample - California Transfer-on-Death Deed Form

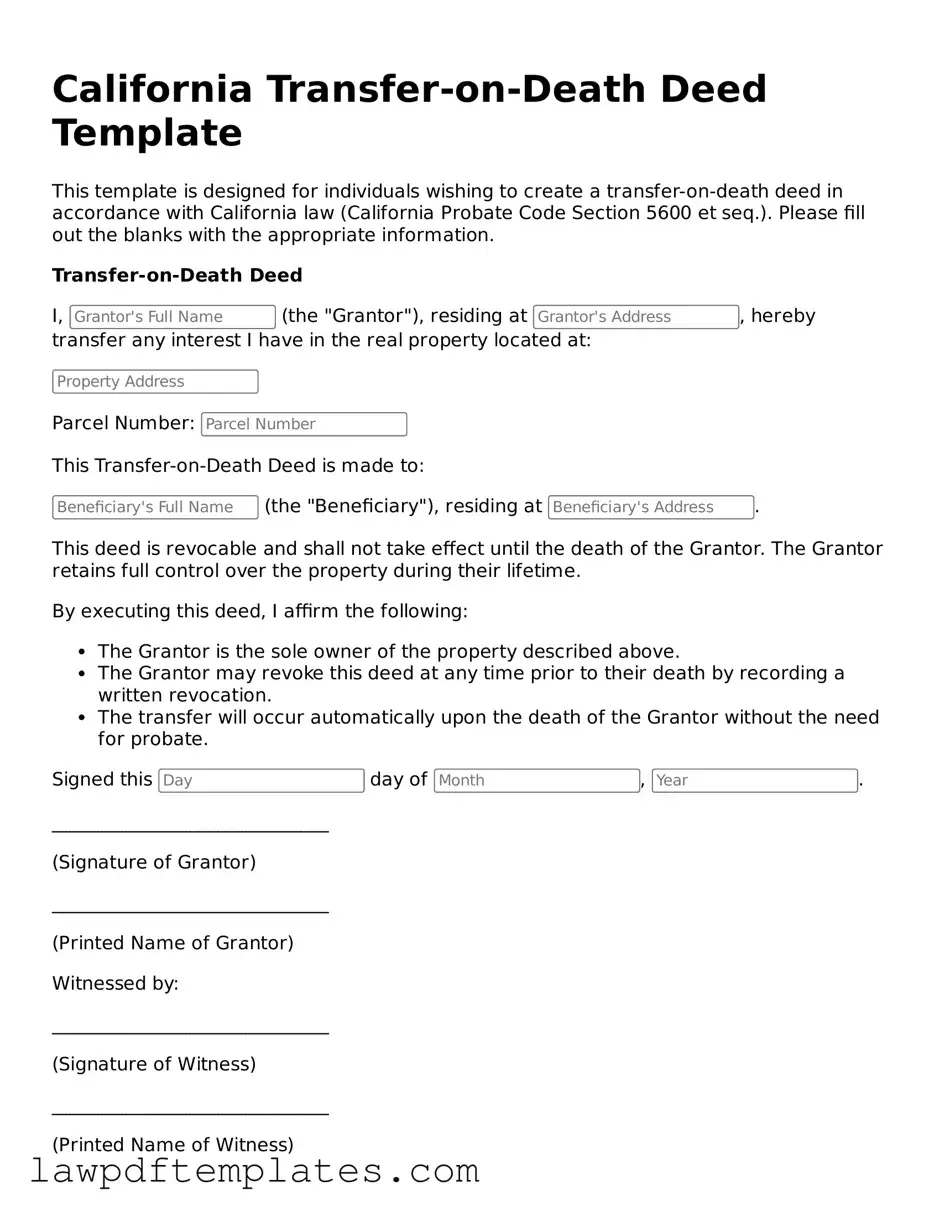

California Transfer-on-Death Deed Template

This template is designed for individuals wishing to create a transfer-on-death deed in accordance with California law (California Probate Code Section 5600 et seq.). Please fill out the blanks with the appropriate information.

Transfer-on-Death Deed

I, (the "Grantor"), residing at , hereby transfer any interest I have in the real property located at:

Parcel Number:

This Transfer-on-Death Deed is made to:

(the "Beneficiary"), residing at .

This deed is revocable and shall not take effect until the death of the Grantor. The Grantor retains full control over the property during their lifetime.

By executing this deed, I affirm the following:

- The Grantor is the sole owner of the property described above.

- The Grantor may revoke this deed at any time prior to their death by recording a written revocation.

- The transfer will occur automatically upon the death of the Grantor without the need for probate.

Signed this day of , .

______________________________

(Signature of Grantor)

______________________________

(Printed Name of Grantor)

Witnessed by:

______________________________

(Signature of Witness)

______________________________

(Printed Name of Witness)

State of California

County of

On this day of , , before me, the undersigned, a , personally appeared , known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________

(Signature of Notary Public)

My commission expires:

Common mistakes

Filling out the California Transfer-on-Death Deed form can be a straightforward process, but there are common mistakes that individuals often make. One frequent error is failing to include the correct legal description of the property. It’s essential to ensure that the property description matches what is recorded with the county. A vague or inaccurate description can lead to complications in transferring ownership.

Another common mistake is neglecting to sign the deed. While it may seem obvious, it’s crucial that all parties involved provide their signatures. Without a signature, the deed is not valid, and this oversight can cause significant delays in the transfer process.

Some individuals mistakenly believe that they can fill out the form without consulting a legal professional. While the form is designed for ease of use, seeking guidance can help avoid pitfalls that may not be immediately apparent. An attorney can provide insights into specific requirements and help ensure that the deed is properly executed.

Additionally, many people overlook the importance of having the deed notarized. In California, notarization is a critical step in making the deed legally binding. Failing to have the deed notarized can lead to challenges in enforcing its terms.

Another mistake is not recording the deed with the county recorder's office. Even if the deed is completed and signed, it must be filed to be effective. Without recording, the transfer may not be recognized, and the property could still be treated as part of the original owner’s estate.

Some individuals also fail to consider the implications of the Transfer-on-Death Deed on their estate planning. This deed may not be the best option for everyone. It’s important to evaluate how it fits into the broader context of an estate plan, including tax implications and potential impacts on other beneficiaries.

Another oversight is not updating the deed when circumstances change. Life events such as marriage, divorce, or the birth of a child can affect how property should be transferred. Failing to update the deed can lead to unintended consequences and disputes among heirs.

Additionally, some people do not clearly identify the beneficiaries. It’s vital to specify who will receive the property upon the owner’s death. Ambiguities in naming beneficiaries can lead to confusion and disputes among family members.

Another frequent error is misunderstanding the nature of the Transfer-on-Death Deed itself. Some individuals think that it functions like a living trust, but it does not provide the same level of control during the owner’s lifetime. This misconception can lead to improper expectations about how the property will be managed.

Finally, many people fail to review the completed deed before submission. Taking the time to double-check all entries can prevent small mistakes from becoming larger issues later on. A careful review ensures that all information is accurate and complete.

Discover More Transfer-on-Death Deed Templates for Specific States

Todi Illinois - Creating this deed can be a proactive step toward managing one's estate and ensuring specific wishes are fulfilled.

For those looking to navigate rental agreements effectively in Georgia, the critical Residential Lease Agreement steps are vital. This process ensures that both landlords and tenants have a clear understanding of their rights and obligations, fostering a smooth rental experience.

California Transfer on Death Deed - Financial institutions may recognize this deed when handling estate matters.

Problems With Transfer on Death Deeds in Indiana - May involve tax implications for the beneficiaries upon transfer.

Transfer on Death Deed Georgia - This approach is beneficial for individuals who wish to maintain control over their property during their lifetime.