Free Real Estate Purchase Agreement Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by California state law, specifically the California Civil Code. |

| Standardization | This form is standardized by the California Association of Realtors (CAR) to ensure consistency across transactions. |

| Offer and Acceptance | The agreement outlines the terms of the offer made by the buyer and the acceptance by the seller. |

| Contingencies | It includes various contingencies, such as financing, inspections, and appraisals, which protect both parties. |

| Earnest Money | The form specifies the amount of earnest money deposit required to demonstrate the buyer's commitment. |

| Closing Timeline | It establishes a timeline for closing the transaction, typically within 30 to 60 days after acceptance. |

| Disclosure Requirements | The agreement mandates disclosures from the seller regarding the property's condition and any known issues. |

| Legal Binding | Once signed by both parties, the agreement becomes a legally binding contract enforceable in a court of law. |

Sample - California Real Estate Purchase Agreement Form

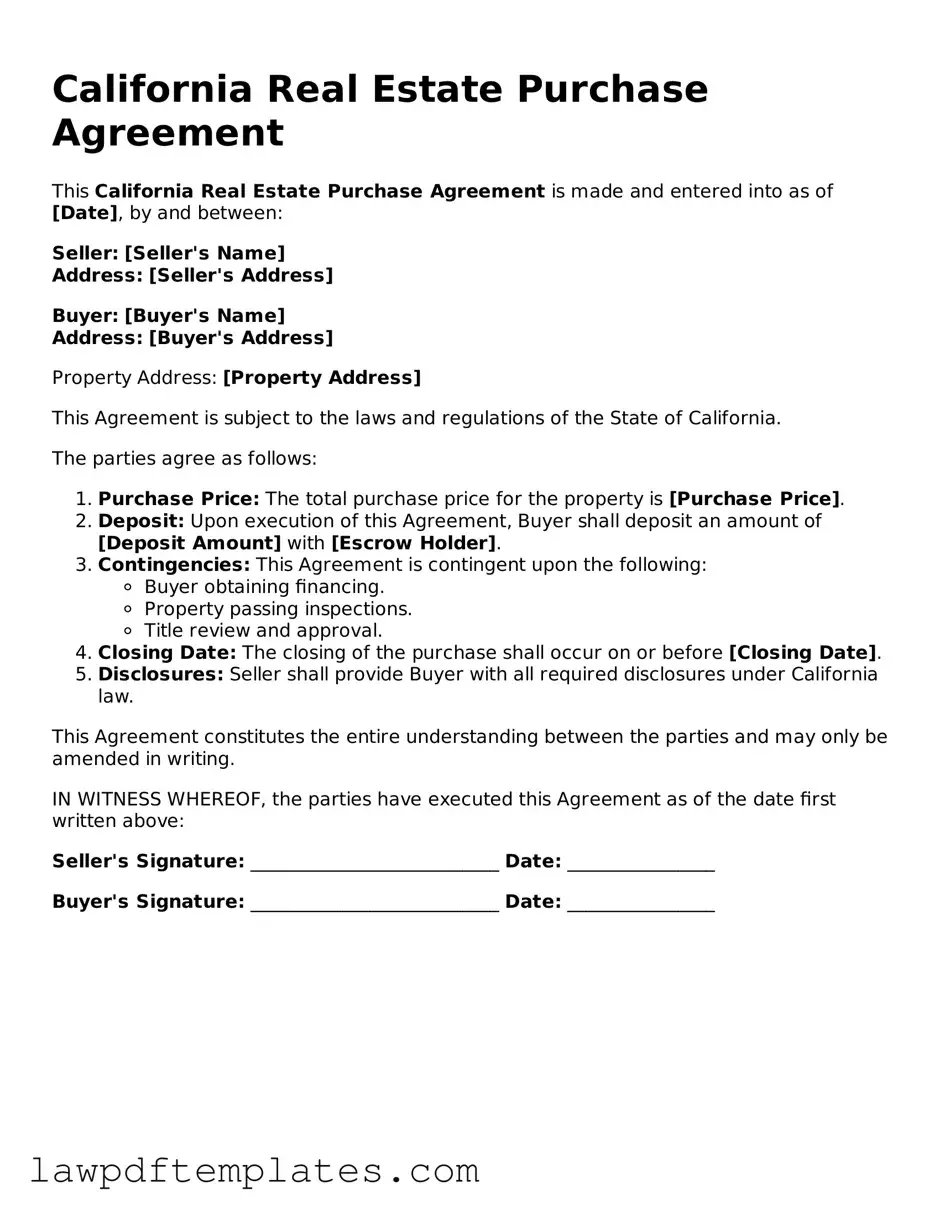

California Real Estate Purchase Agreement

This California Real Estate Purchase Agreement is made and entered into as of [Date], by and between:

Seller: [Seller's Name]

Address: [Seller's Address]

Buyer: [Buyer's Name]

Address: [Buyer's Address]

Property Address: [Property Address]

This Agreement is subject to the laws and regulations of the State of California.

The parties agree as follows:

- Purchase Price: The total purchase price for the property is [Purchase Price].

- Deposit: Upon execution of this Agreement, Buyer shall deposit an amount of [Deposit Amount] with [Escrow Holder].

- Contingencies: This Agreement is contingent upon the following:

- Buyer obtaining financing.

- Property passing inspections.

- Title review and approval.

- Closing Date: The closing of the purchase shall occur on or before [Closing Date].

- Disclosures: Seller shall provide Buyer with all required disclosures under California law.

This Agreement constitutes the entire understanding between the parties and may only be amended in writing.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above:

Seller's Signature: ___________________________ Date: ________________

Buyer's Signature: ___________________________ Date: ________________

Common mistakes

Filling out the California Real Estate Purchase Agreement can be a complex task. Many individuals make common mistakes that can lead to confusion or delays in the transaction. Understanding these pitfalls can help ensure a smoother process.

One frequent mistake is leaving the property description incomplete. It's crucial to provide a detailed description, including the address and any specific features of the property. Vague descriptions can lead to misunderstandings and disputes later on.

Another common error involves not including all necessary parties in the agreement. If multiple buyers or sellers are involved, all names must be accurately listed. Omitting a party can create legal complications down the line.

Many people also overlook the importance of dates. Failing to specify important dates, such as the closing date or the date of acceptance, can create uncertainty. Clear timelines help all parties stay on track.

Another mistake is neglecting to address contingencies. Buyers often assume that certain conditions will be understood. However, explicitly stating contingencies, such as financing or inspection requirements, protects both parties and clarifies expectations.

Some individuals mistakenly leave out earnest money details. This deposit shows the buyer's commitment and can be a crucial part of the agreement. Clearly stating the amount and conditions for its return is essential.

In addition, failing to check for disclosures is a common oversight. Sellers must provide specific disclosures about the property. Ensuring these are included protects the seller and informs the buyer of any potential issues.

Buyers sometimes forget to outline inclusions and exclusions. It's important to specify what items are included in the sale, such as appliances or fixtures. This clarity prevents disputes after the sale.

Another mistake is not understanding financing terms. Buyers should clearly state how they plan to finance the purchase. This information is vital for both parties to ensure a smooth transaction.

Lastly, many individuals fail to review the agreement thoroughly before signing. Taking the time to read through the entire document can prevent costly mistakes and misunderstandings. Seeking professional guidance can also be beneficial.

Discover More Real Estate Purchase Agreement Templates for Specific States

Free Nc Real Estate Purchase Agreement - A legal document outlining the terms of buying a property.

The Ohio Residential Lease Agreement is a crucial legal document that not only outlines the terms and conditions between a landlord and a tenant for renting residential property in Ohio but also serves to protect the interests of both parties. To ensure clarity and avoid any ambiguities, it is essential to utilize the Residential Lease Agreement form, which defines the rights and responsibilities that each party must adhere to throughout the rental period.

Free Florida Real Estate Forms - It serves to formalize the intent of both parties to proceed with the purchase and sale.