Free Promissory Note Template for the State of California

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | The California Civil Code governs promissory notes in California. |

| Parties Involved | Typically, there are two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, as agreed upon by both parties. |

| Payment Terms | Payment terms, including the due date and payment frequency, must be clearly stated. |

| Security | A promissory note can be secured or unsecured. Secured notes may involve collateral. |

| Default Conditions | Conditions under which a borrower is considered in default should be outlined in the note. |

| Amendments | Any changes to the terms of the note must be documented and agreed upon by both parties. |

| Signatures | Both parties must sign the note for it to be legally binding. |

| State-Specific Considerations | California does not require notarization, but it is recommended for added legal protection. |

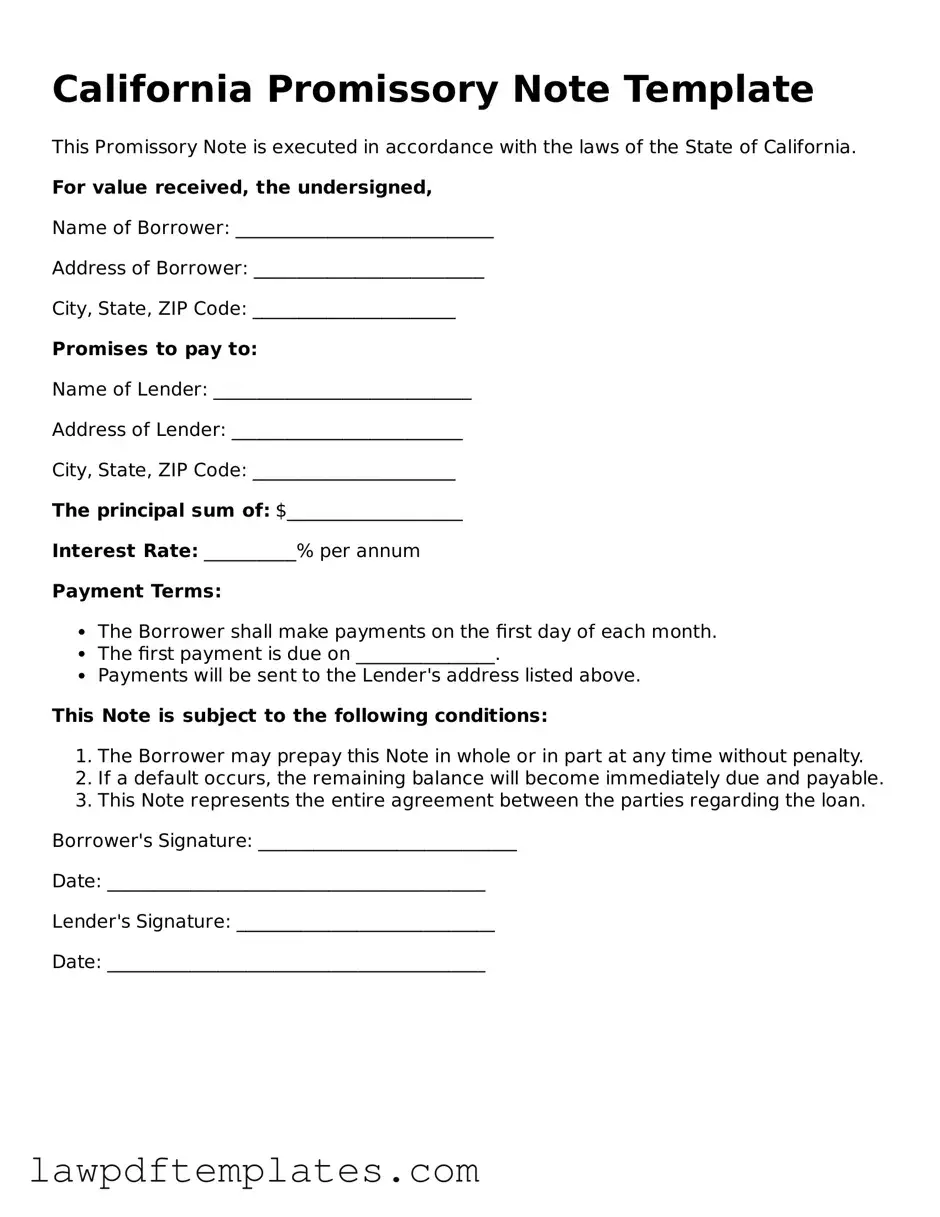

Sample - California Promissory Note Form

California Promissory Note Template

This Promissory Note is executed in accordance with the laws of the State of California.

For value received, the undersigned,

Name of Borrower: ____________________________

Address of Borrower: _________________________

City, State, ZIP Code: ______________________

Promises to pay to:

Name of Lender: ____________________________

Address of Lender: _________________________

City, State, ZIP Code: ______________________

The principal sum of: $___________________

Interest Rate: __________% per annum

Payment Terms:

- The Borrower shall make payments on the first day of each month.

- The first payment is due on _______________.

- Payments will be sent to the Lender's address listed above.

This Note is subject to the following conditions:

- The Borrower may prepay this Note in whole or in part at any time without penalty.

- If a default occurs, the remaining balance will become immediately due and payable.

- This Note represents the entire agreement between the parties regarding the loan.

Borrower's Signature: ____________________________

Date: _________________________________________

Lender's Signature: ____________________________

Date: _________________________________________

Common mistakes

When filling out the California Promissory Note form, individuals often make several common mistakes that can lead to complications down the line. One of the primary errors is failing to include all necessary details about the loan. This includes the amount borrowed, interest rate, and repayment terms. If these elements are missing or unclear, it can create confusion and disputes between the borrower and lender.

Another frequent mistake is neglecting to specify the payment schedule. Whether the borrower is expected to make monthly, quarterly, or annual payments should be clearly outlined. Without this information, both parties may have different expectations regarding when payments are due, potentially leading to missed payments and financial strain.

People also often overlook the importance of signatures. A promissory note is not legally binding unless it is signed by both the borrower and the lender. Failing to secure both signatures can render the document unenforceable in court. Additionally, forgetting to date the signatures can create ambiguity about when the agreement was made, which may complicate matters if disputes arise.

Another mistake involves using vague language. Terms and conditions should be explicit. For example, if the note includes a clause about late fees, the amount and conditions should be clearly stated. Ambiguity can lead to misunderstandings and disputes, which can be avoided with precise language.

Lastly, individuals sometimes ignore the legal implications of the document. A promissory note is a legal obligation, and both parties should fully understand their rights and responsibilities. Failing to consult with a legal expert can result in overlooking important provisions or protections that could be beneficial. Taking the time to ensure that the document is complete and accurate can save both parties from future legal headaches.

Discover More Promissory Note Templates for Specific States

Loan Note Template - A well-crafted promissory note minimizes the risk of disputes over repayment expectations.

Promissory Note Template Georgia - A promissory note can also specify payment methods, like check or electronic transfer.

For anyone looking to ensure a smooth transaction, a complete guide to the Tractor Bill of Sale is invaluable. This document facilitates the formal transfer of ownership, safeguarding both the seller's and buyer's interests by documenting all necessary transaction details.

Promissory Note Template Massachusetts - It's important to keep a copy of the promissory note for your records.

Promissory Note Ohio - The note can facilitate easier financial planning for the borrower.