Free Loan Agreement Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | The California Loan Agreement form outlines the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of California. |

| Parties Involved | The form identifies both the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The total amount of money being borrowed is clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and payment amounts, are included. |

| Default Conditions | The form outlines the conditions under which the borrower may be considered in default. |

| Governing Language | The document is typically written in plain language to ensure clarity for all parties involved. |

| Signatures Required | Both parties must sign the agreement for it to be legally binding. |

| Amendment Clause | The form may include a clause detailing how changes to the agreement can be made. |

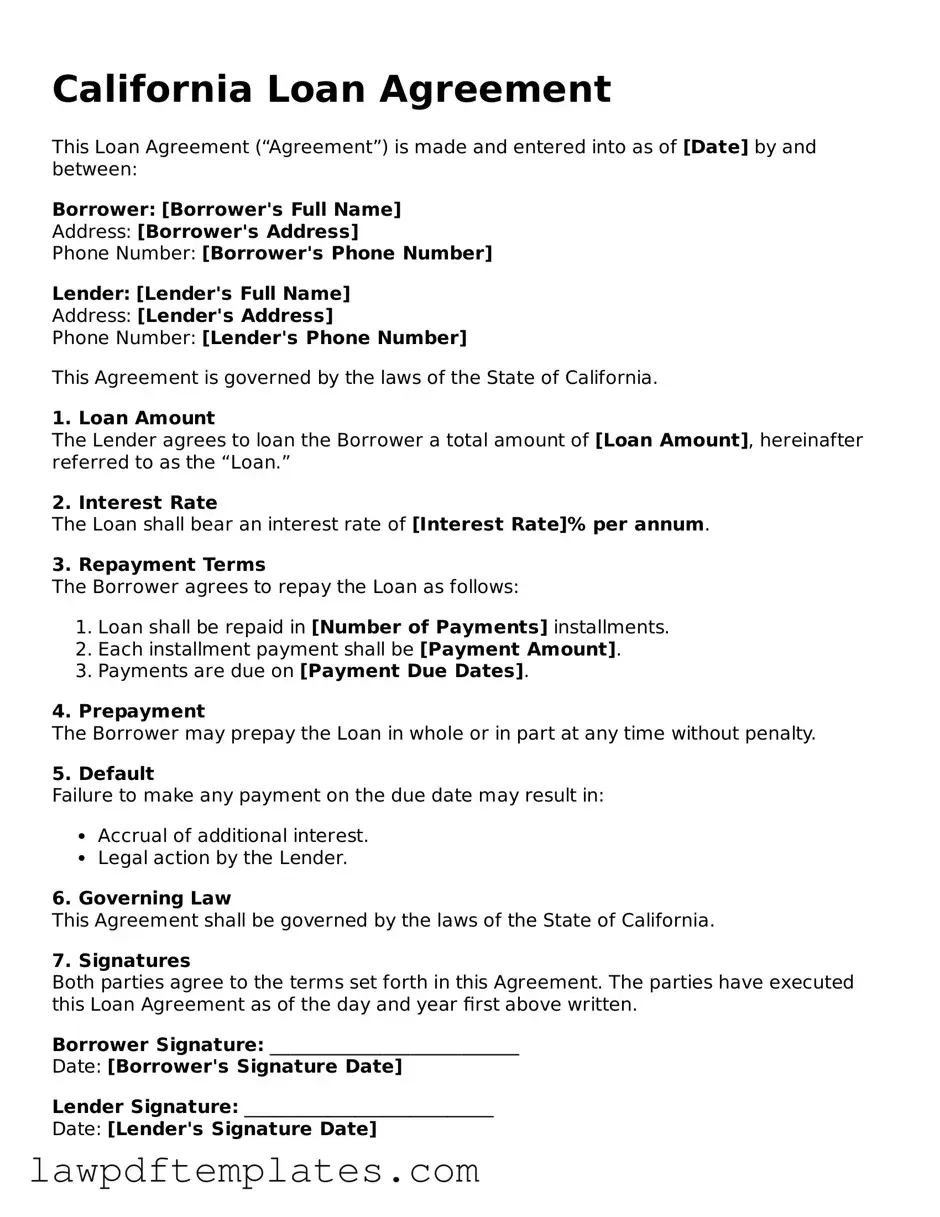

Sample - California Loan Agreement Form

California Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into as of [Date] by and between:

Borrower: [Borrower's Full Name]

Address: [Borrower's Address]

Phone Number: [Borrower's Phone Number]

Lender: [Lender's Full Name]

Address: [Lender's Address]

Phone Number: [Lender's Phone Number]

This Agreement is governed by the laws of the State of California.

1. Loan Amount

The Lender agrees to loan the Borrower a total amount of [Loan Amount], hereinafter referred to as the “Loan.”

2. Interest Rate

The Loan shall bear an interest rate of [Interest Rate]% per annum.

3. Repayment Terms

The Borrower agrees to repay the Loan as follows:

- Loan shall be repaid in [Number of Payments] installments.

- Each installment payment shall be [Payment Amount].

- Payments are due on [Payment Due Dates].

4. Prepayment

The Borrower may prepay the Loan in whole or in part at any time without penalty.

5. Default

Failure to make any payment on the due date may result in:

- Accrual of additional interest.

- Legal action by the Lender.

6. Governing Law

This Agreement shall be governed by the laws of the State of California.

7. Signatures

Both parties agree to the terms set forth in this Agreement. The parties have executed this Loan Agreement as of the day and year first above written.

Borrower Signature: ___________________________

Date: [Borrower's Signature Date]

Lender Signature: ___________________________

Date: [Lender's Signature Date]

Common mistakes

Filling out a California Loan Agreement form can be a straightforward task, but many people make common mistakes that can lead to complications down the line. One frequent error is not providing complete information. When sections are left blank, it raises questions and can delay the loan process. Always ensure that every part of the form is filled out accurately.

Another mistake is using incorrect names. It's essential to use the legal names of all parties involved. Nicknames or abbreviations can cause confusion and may render the agreement unenforceable. Double-check the spelling of names to avoid this issue.

Many individuals also forget to include the loan amount. This seems simple, but if the amount is missing or incorrect, it can lead to disputes later. Clearly state the total loan amount to ensure everyone is on the same page.

Some people neglect to read the terms and conditions. Skimming through this section can result in misunderstandings about repayment schedules or interest rates. Take the time to read and understand these terms before signing.

Signing the form without a witness is another common oversight. In California, having a witness can add an extra layer of validity to the agreement. Ensure that a neutral party is present during the signing process.

Additionally, failing to date the agreement can create confusion about when the loan terms begin. Always include the date next to your signature to clarify when the agreement takes effect.

People often overlook the need for clear communication about payment methods. Specifying how payments will be made—whether by check, bank transfer, or another method—can prevent misunderstandings later.

Another mistake is not keeping a copy of the signed agreement. After everything is finalized, it’s crucial to have a record of the agreement for future reference. Make sure to store it in a safe place.

Some individuals also forget to discuss what happens in case of default. Not addressing this in the agreement can lead to complications if payments are missed. Clearly outline the consequences of default to avoid surprises.

Lastly, many people fail to seek legal advice when needed. While it may seem unnecessary, consulting a legal expert can help clarify complex terms and ensure that the agreement is fair and valid. Don’t hesitate to ask for help if something seems unclear.

Discover More Loan Agreement Templates for Specific States

Florida Promissory Note Template - Interest rates can be fixed or variable, depending on the terms specified in the agreement.

A Virginia Motor Vehicle Bill of Sale form is a legal document that records the sale and transfer of a vehicle from one party to another. This form serves as proof of ownership and includes important details about the vehicle and the transaction. To ensure a smooth transfer, take the time to fill out the form accurately by clicking the button below or visiting PDF Documents Hub for more resources.

Illinois Promissory Note - Document the contact information for both the borrower and the lender easily.