Free Last Will and Testament Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The California Last Will and Testament is governed by the California Probate Code. |

| Age Requirement | To create a valid will in California, the individual must be at least 18 years old. |

| Signature Requirement | The testator must sign the will, or another person may sign on their behalf in their presence. |

| Witnesses | California requires at least two witnesses to sign the will for it to be valid. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the existing one. |

| Holographic Wills | California recognizes holographic wills, which are handwritten and do not require witnesses if signed by the testator. |

Sample - California Last Will and Testament Form

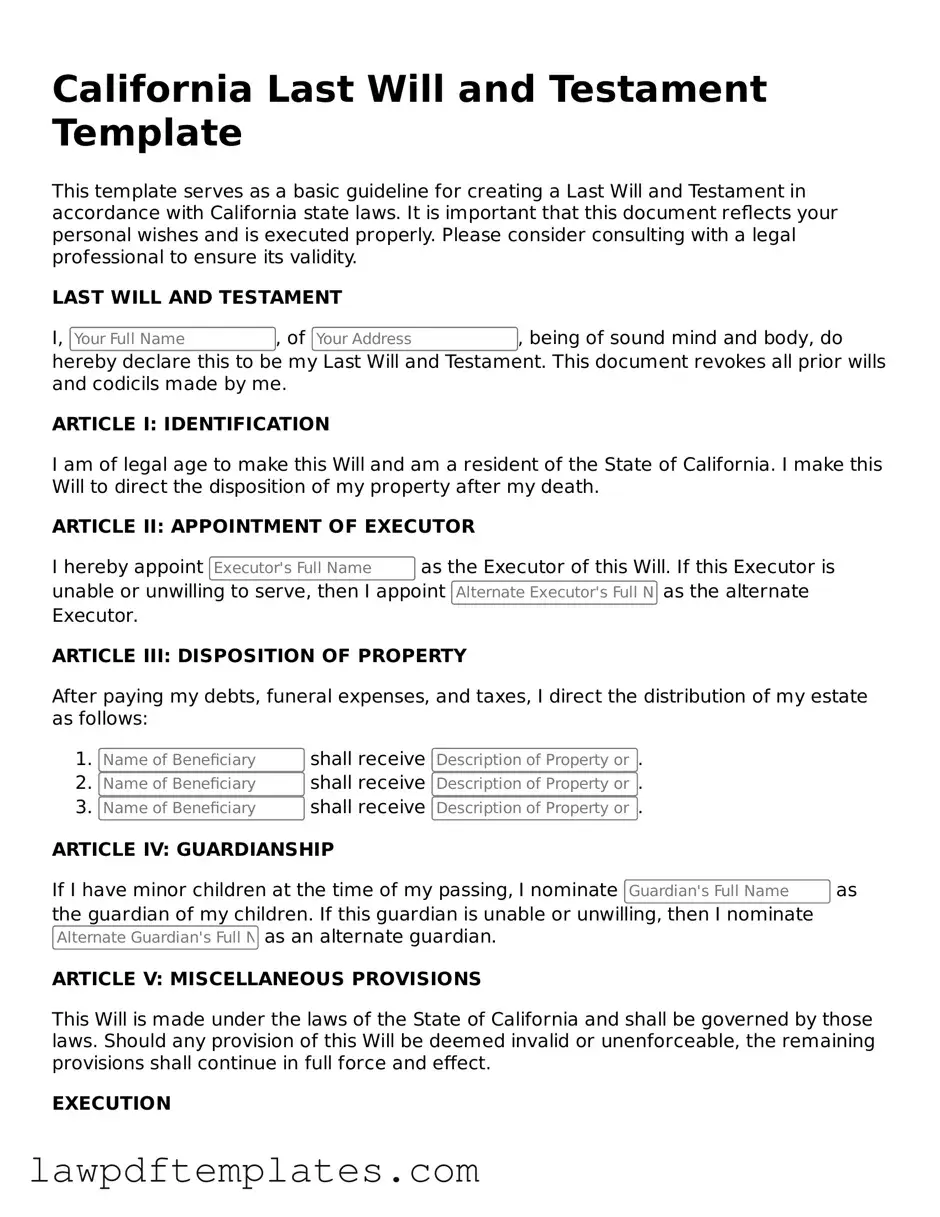

California Last Will and Testament Template

This template serves as a basic guideline for creating a Last Will and Testament in accordance with California state laws. It is important that this document reflects your personal wishes and is executed properly. Please consider consulting with a legal professional to ensure its validity.

LAST WILL AND TESTAMENT

I, , of , being of sound mind and body, do hereby declare this to be my Last Will and Testament. This document revokes all prior wills and codicils made by me.

ARTICLE I: IDENTIFICATION

I am of legal age to make this Will and am a resident of the State of California. I make this Will to direct the disposition of my property after my death.

ARTICLE II: APPOINTMENT OF EXECUTOR

I hereby appoint as the Executor of this Will. If this Executor is unable or unwilling to serve, then I appoint as the alternate Executor.

ARTICLE III: DISPOSITION OF PROPERTY

After paying my debts, funeral expenses, and taxes, I direct the distribution of my estate as follows:

- shall receive .

- shall receive .

- shall receive .

ARTICLE IV: GUARDIANSHIP

If I have minor children at the time of my passing, I nominate as the guardian of my children. If this guardian is unable or unwilling, then I nominate as an alternate guardian.

ARTICLE V: MISCELLANEOUS PROVISIONS

This Will is made under the laws of the State of California and shall be governed by those laws. Should any provision of this Will be deemed invalid or unenforceable, the remaining provisions shall continue in full force and effect.

EXECUTION

In witness whereof, I have hereunto subscribed my name this day of , .

__________________________

Signature of Testator:

Witnesses:

- __________________________

Signature: - __________________________

Signature:

All witnesses must be present during the signing of this Will in order to validate it.

Common mistakes

Filling out a Last Will and Testament form in California can be a straightforward process, but many people make common mistakes that can lead to complications down the road. One frequent error is failing to sign the document properly. In California, the will must be signed by the testator, the person making the will. If this step is overlooked, the will may not be considered valid.

Another mistake involves not having the will witnessed correctly. California law requires that a will be witnessed by at least two individuals who are not beneficiaries. If the witnesses do not meet these criteria, the will could face challenges in probate court. It's crucial to ensure that the witnesses are present at the same time when signing the document.

Many individuals also neglect to date their will. While it might seem minor, the date is essential for determining the most recent version of the will. If multiple wills exist, the one with the latest date typically takes precedence. Without a date, confusion may arise about which will is valid.

Another common oversight is not being specific about assets and beneficiaries. Vague language can lead to misunderstandings among heirs. It’s important to clearly outline who receives what and to provide as much detail as possible. This clarity helps prevent disputes among family members after the testator’s passing.

People sometimes forget to update their will after major life changes, such as marriage, divorce, or the birth of a child. Failing to make these updates can result in unintended beneficiaries or exclusions. Regularly reviewing and revising the will ensures that it accurately reflects current wishes.

Additionally, some individuals mistakenly assume that they can create a will without legal guidance. While it is possible to fill out a form on your own, consulting with a legal professional can help avoid pitfalls and ensure that the will complies with state laws.

Not considering tax implications is another mistake that can have serious consequences. Certain assets may be subject to taxes upon death, and planning for these can help heirs avoid unexpected financial burdens. Understanding the tax landscape can make a significant difference in how an estate is managed.

Lastly, people often overlook the importance of keeping the will in a safe place. After completing the will, it should be stored securely, and loved ones should know where to find it. If a will cannot be located when needed, the individual’s wishes may not be honored, leading to further complications.

Discover More Last Will and Testament Templates for Specific States

Georgia Will Template - Can clarify intentions around joint property owned with spouses or partners.

In addition to its fundamental role in the transfer of ownership, obtaining a Florida Motor Vehicle Bill of Sale form can be streamlined with resources like Fast PDF Templates, which offers easy access to the necessary documentation, ensuring that both buyers and sellers have the appropriate legal backing for their vehicle transactions.

Template for a Will - Establishes how debts and taxes will be paid from your estate.