Free Gift Deed Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without compensation. |

| Governing Law | The California Civil Code, specifically Sections 11911-11914, governs the use and execution of Gift Deeds. |

| Parties Involved | The form involves a donor (the person giving the gift) and a donee (the person receiving the gift). |

| Consideration | Unlike other deeds, a Gift Deed does not require monetary consideration to be valid. |

| Recording | To ensure legal recognition, the Gift Deed should be recorded with the county recorder's office where the property is located. |

| Tax Implications | Gift Deeds may have gift tax implications under federal law, which should be considered by the donor. |

| Revocation | A Gift Deed is generally irrevocable once executed and delivered, unless specific conditions allow for revocation. |

| Witness Requirement | The document must be signed by the donor in the presence of a notary public to be valid. |

| Legal Advice | It is advisable for both parties to seek legal advice before executing a Gift Deed to understand their rights and obligations. |

Sample - California Gift Deed Form

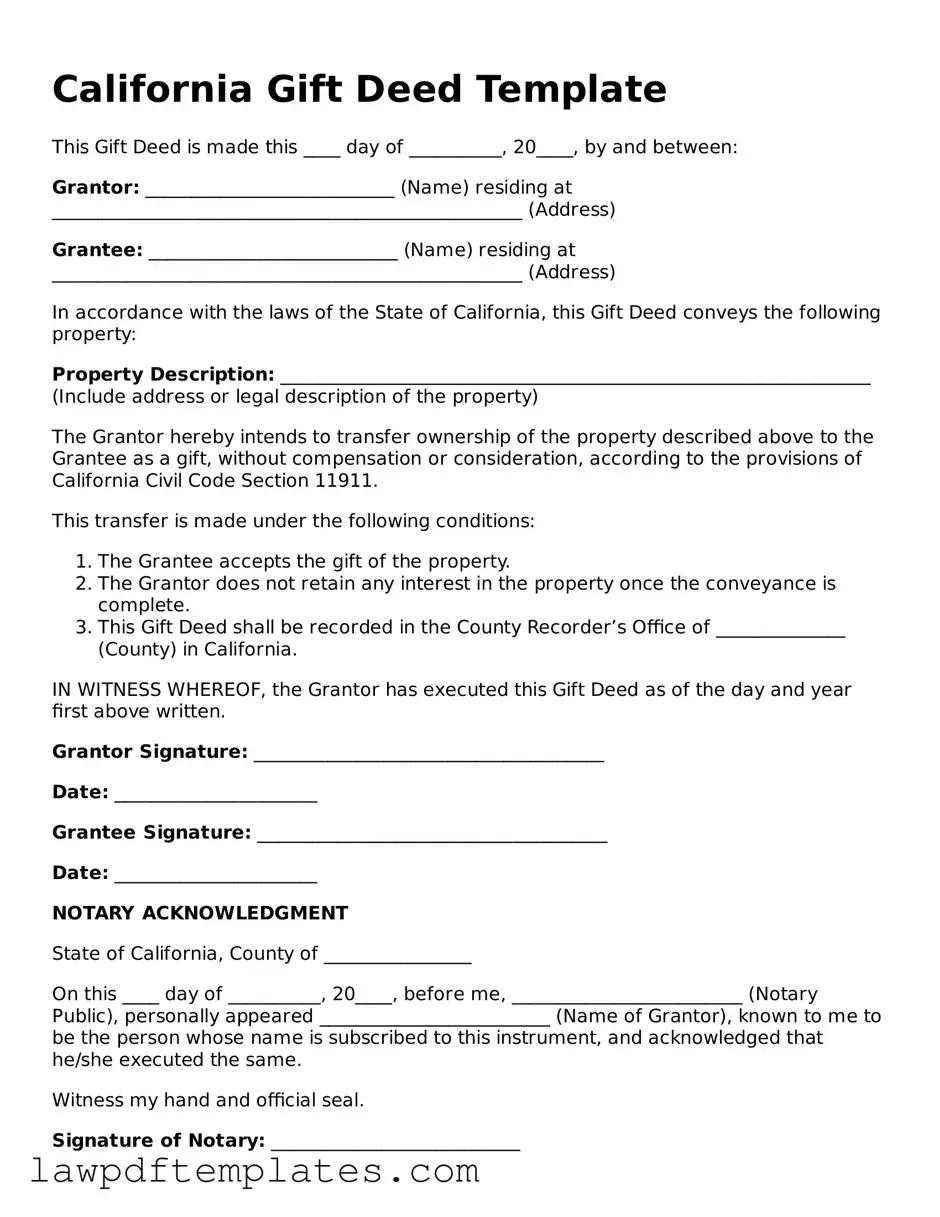

California Gift Deed Template

This Gift Deed is made this ____ day of __________, 20____, by and between:

Grantor: ___________________________ (Name) residing at ___________________________________________________ (Address)

Grantee: ___________________________ (Name) residing at ___________________________________________________ (Address)

In accordance with the laws of the State of California, this Gift Deed conveys the following property:

Property Description: ________________________________________________________________ (Include address or legal description of the property)

The Grantor hereby intends to transfer ownership of the property described above to the Grantee as a gift, without compensation or consideration, according to the provisions of California Civil Code Section 11911.

This transfer is made under the following conditions:

- The Grantee accepts the gift of the property.

- The Grantor does not retain any interest in the property once the conveyance is complete.

- This Gift Deed shall be recorded in the County Recorder’s Office of ______________ (County) in California.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed as of the day and year first above written.

Grantor Signature: ______________________________________

Date: ______________________

Grantee Signature: ______________________________________

Date: ______________________

NOTARY ACKNOWLEDGMENT

State of California, County of ________________

On this ____ day of __________, 20____, before me, _________________________ (Notary Public), personally appeared _________________________ (Name of Grantor), known to me to be the person whose name is subscribed to this instrument, and acknowledged that he/she executed the same.

Witness my hand and official seal.

Signature of Notary: ___________________________

My Commission Expires: ____________________

Common mistakes

Filling out a California Gift Deed form is an important step in transferring property without monetary exchange. However, many individuals make mistakes that can complicate the process or even invalidate the deed. One common error is failing to include all required information. Every section of the form must be completed accurately. Omitting details such as the legal description of the property can lead to confusion and potential disputes in the future.

Another frequent mistake is not having the deed properly notarized. In California, a Gift Deed must be signed in front of a notary public to be legally binding. Skipping this step can render the deed ineffective, causing delays and requiring additional steps to correct the oversight. It is essential to ensure that the notary's signature and seal are present before submitting the form.

People often overlook the importance of specifying the relationship between the giver and the recipient. This detail, while it may seem minor, provides context for the transaction and can be crucial for tax purposes. Not indicating the relationship may lead to questions from tax authorities later on, potentially complicating the situation.

Another common pitfall is misunderstanding the implications of a Gift Deed. Some individuals mistakenly believe that a Gift Deed is the same as a sale. In reality, a Gift Deed transfers ownership without any financial compensation, which can have significant tax implications for both the giver and the recipient. Understanding these implications is vital to avoid unexpected tax liabilities.

Additionally, individuals sometimes fail to check for existing liens or encumbrances on the property before completing the deed. If the property has outstanding debts or claims against it, the recipient may inherit these issues. Conducting a thorough title search can prevent future complications and ensure a smooth transfer of ownership.

Another mistake involves not recording the Gift Deed with the county recorder's office. While completing the form is an essential step, recording it ensures that the transfer is officially recognized. Failing to record the deed can lead to challenges in proving ownership, especially if disputes arise later.

Some individuals also neglect to consider the potential impact on estate planning. Transferring property through a Gift Deed can affect the giver's estate and may have unintended consequences for heirs. It is wise to consult with a legal or financial advisor to understand how this decision fits into the broader context of estate planning.

Lastly, many people underestimate the importance of consulting legal professionals. While the Gift Deed form may seem straightforward, nuances in individual situations can complicate matters. Seeking guidance from a knowledgeable attorney can help ensure that all aspects of the transfer are handled correctly, safeguarding the interests of both parties involved.

Discover More Gift Deed Templates for Specific States

How to Transfer Deed of House - The timeframe for the transfer of ownership is immediate upon signing and recording the Gift Deed.

Completing the Trader Joe's application form is crucial for those looking to join the team at this beloved grocery store chain, gathering vital details about applicants such as their experience and schedule. For further information and guidance on the application process, visit PDF Documents Hub and take the first step towards your new career.