Free Durable Power of Attorney Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to designate another person to make financial and legal decisions on their behalf, even if they become incapacitated. |

| Governing Laws | The California Durable Power of Attorney is governed by the California Probate Code, specifically Sections 4000 to 4545. |

| Durability | This type of power of attorney remains effective even if the principal becomes mentally incompetent, unlike a regular power of attorney. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent to do so. |

| Notarization | While notarization is not strictly required, it is highly recommended to ensure the document is recognized and accepted by financial institutions and other entities. |

Sample - California Durable Power of Attorney Form

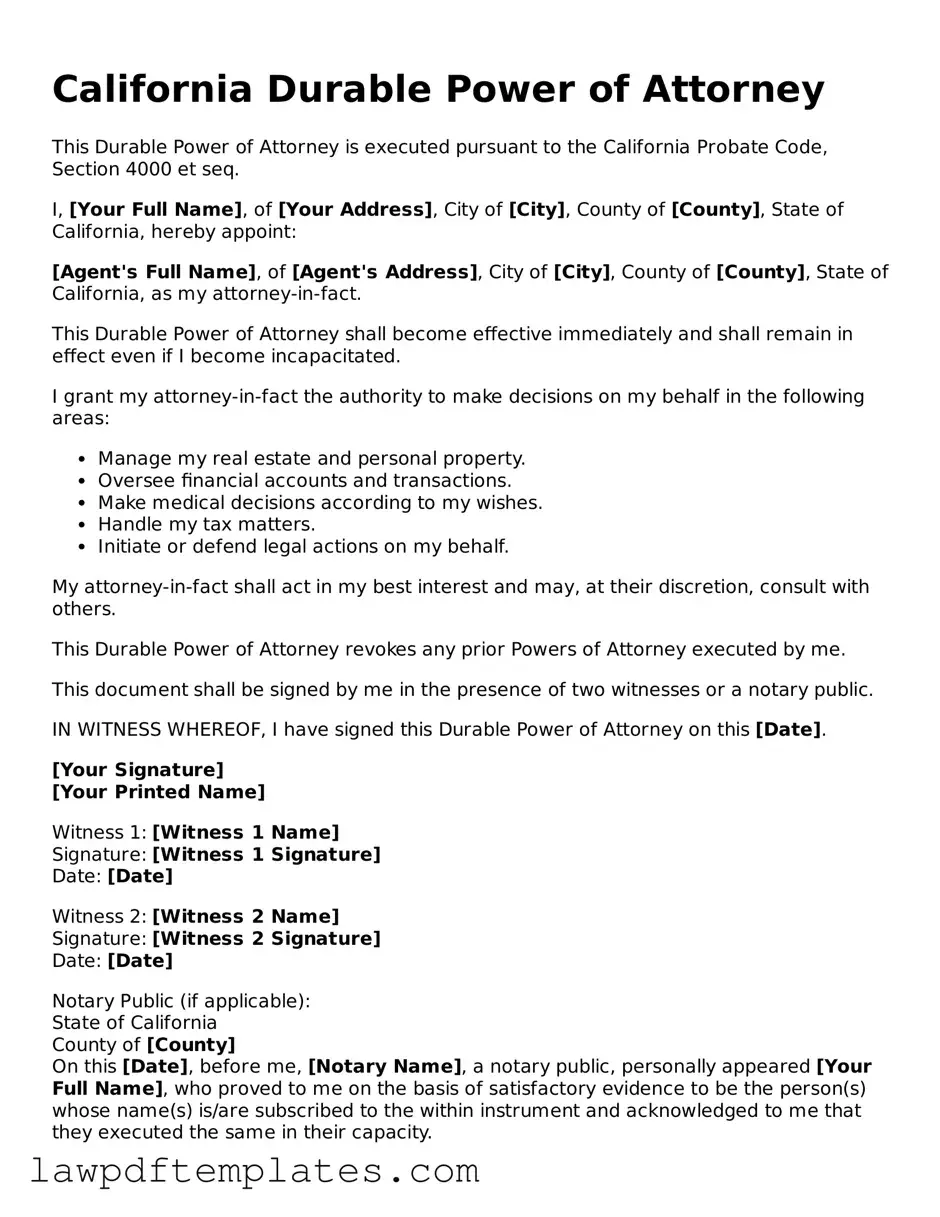

California Durable Power of Attorney

This Durable Power of Attorney is executed pursuant to the California Probate Code, Section 4000 et seq.

I, [Your Full Name], of [Your Address], City of [City], County of [County], State of California, hereby appoint:

[Agent's Full Name], of [Agent's Address], City of [City], County of [County], State of California, as my attorney-in-fact.

This Durable Power of Attorney shall become effective immediately and shall remain in effect even if I become incapacitated.

I grant my attorney-in-fact the authority to make decisions on my behalf in the following areas:

- Manage my real estate and personal property.

- Oversee financial accounts and transactions.

- Make medical decisions according to my wishes.

- Handle my tax matters.

- Initiate or defend legal actions on my behalf.

My attorney-in-fact shall act in my best interest and may, at their discretion, consult with others.

This Durable Power of Attorney revokes any prior Powers of Attorney executed by me.

This document shall be signed by me in the presence of two witnesses or a notary public.

IN WITNESS WHEREOF, I have signed this Durable Power of Attorney on this [Date].

[Your Signature]

[Your Printed Name]

Witness 1: [Witness 1 Name]

Signature: [Witness 1 Signature]

Date: [Date]

Witness 2: [Witness 2 Name]

Signature: [Witness 2 Signature]

Date: [Date]

Notary Public (if applicable):

State of California

County of [County]

On this [Date], before me, [Notary Name], a notary public, personally appeared [Your Full Name], who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that they executed the same in their capacity.

Signature: ______________________

(Notary Public)

Common mistakes

Filling out a California Durable Power of Attorney (DPOA) form can be a straightforward process, but many people encounter pitfalls along the way. One common mistake is failing to clearly define the powers granted to the agent. Without specific instructions, there can be confusion about what decisions the agent can make on behalf of the principal. It’s essential to be explicit about financial matters, health care decisions, and other important areas.

Another frequent error is not signing the form in front of a notary public or witnesses, as required by California law. A signature that is not properly notarized can render the document invalid. This step is crucial for ensuring that the DPOA holds up under scrutiny and is recognized by banks and healthcare providers.

People often overlook the importance of selecting the right agent. Choosing someone who is not trustworthy or lacks the ability to handle financial matters can lead to complications. It’s advisable to choose an individual who understands the responsibilities and is willing to act in the principal's best interests.

Additionally, failing to communicate with the chosen agent about their role can create misunderstandings. The principal should discuss their wishes and any specific instructions. This conversation helps ensure that the agent knows what to do when the time comes.

Another mistake is neglecting to update the DPOA when life circumstances change. Major life events such as marriage, divorce, or the death of a previously appointed agent can affect the validity of the document. Regularly reviewing and updating the DPOA is a good practice to ensure it reflects current wishes.

Many people also forget to consider alternate agents. If the primary agent is unable or unwilling to serve, having a backup ensures that there is always someone designated to act on behalf of the principal. This precaution can prevent delays and complications in critical situations.

Some individuals mistakenly believe that a DPOA is only necessary for the elderly or those with health issues. In reality, anyone can benefit from having a DPOA in place, regardless of age or health status. Life is unpredictable, and having a plan can provide peace of mind.

Finally, neglecting to keep the DPOA in a safe yet accessible location can be problematic. It’s important for both the principal and the agent to know where the document is stored. Making copies and sharing them with relevant parties can also facilitate smoother transactions when the DPOA needs to be used.

Discover More Durable Power of Attorney Templates for Specific States

Power of Attorney New Jersey - This legal tool is essential for anyone who wants to plan for unforeseen medical or personal circumstances.

Durable Power of Attorney Form Massachusetts - You might want to involve legal advice, especially for complex situations.

The Free And Invoice PDF form is a document used to create and send invoices in a standardized format. This form simplifies the billing process for businesses, making it easier to communicate payment details and request funds. By using this form, businesses can maintain professionalism and efficiency in their invoicing procedures. For those looking for options to enhance their invoicing, Fast PDF Templates offers a variety of choices to suit different needs.

Types of Power of Attorney Ohio - A Durable Power of Attorney allows someone to manage your financial matters if you become unable to do so yourself.