Free Deed in Lieu of Foreclosure Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. |

| Governing Law | This process is governed by California Civil Code Sections 2924-2924k. |

| Eligibility | Homeowners facing financial hardship and unable to keep up with mortgage payments may qualify for this option. |

| Benefits | A Deed in Lieu can help preserve the homeowner's credit score compared to a foreclosure. |

| Process | The homeowner must negotiate with the lender and provide necessary documentation to initiate the deed transfer. |

| Potential Risks | Homeowners may still face tax implications or deficiency judgments if the property's value is less than the mortgage balance. |

| Alternatives | Other options include loan modifications, short sales, or traditional foreclosure proceedings. |

Sample - California Deed in Lieu of Foreclosure Form

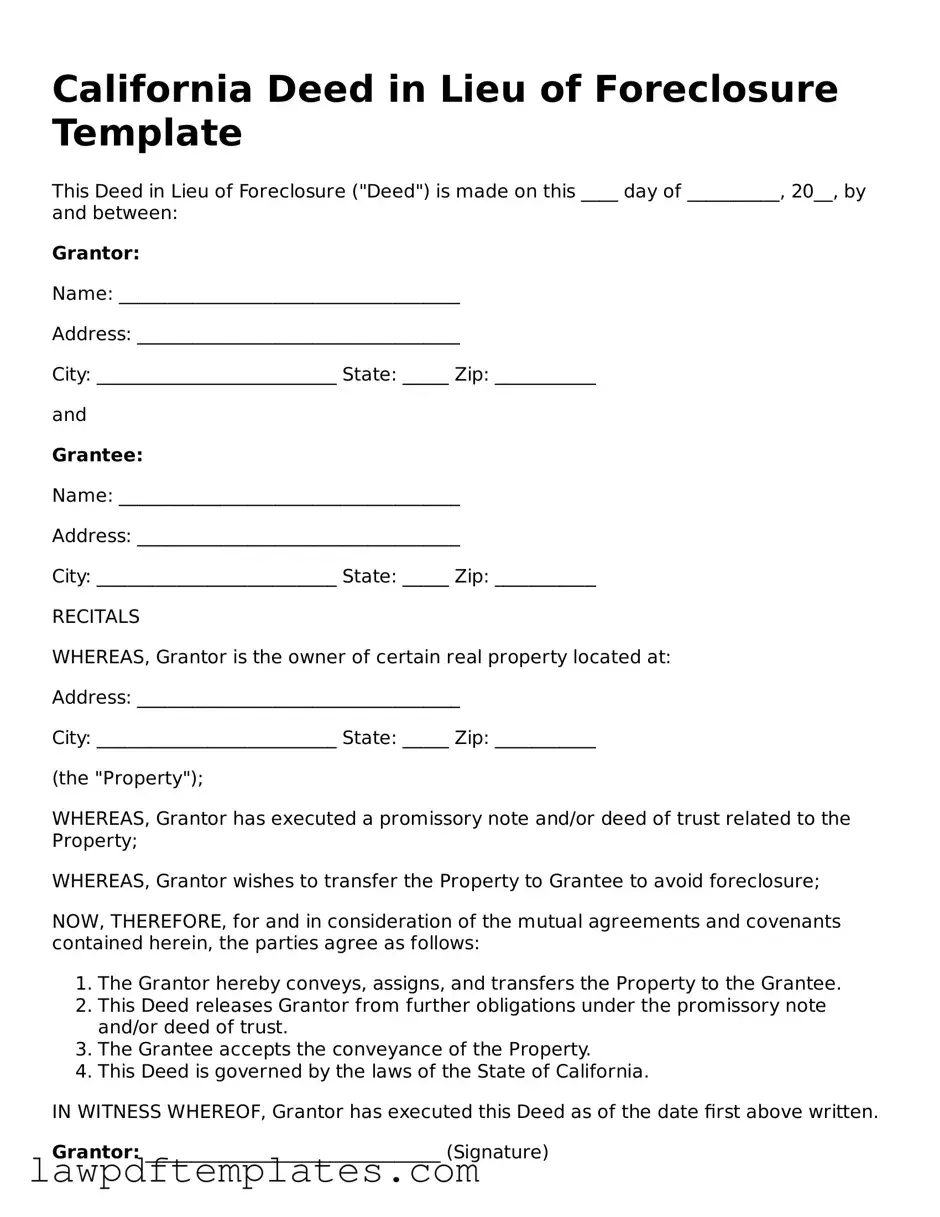

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made on this ____ day of __________, 20__, by and between:

Grantor:

Name: _____________________________________

Address: ___________________________________

City: __________________________ State: _____ Zip: ___________

and

Grantee:

Name: _____________________________________

Address: ___________________________________

City: __________________________ State: _____ Zip: ___________

RECITALS

WHEREAS, Grantor is the owner of certain real property located at:

Address: ___________________________________

City: __________________________ State: _____ Zip: ___________

(the "Property");

WHEREAS, Grantor has executed a promissory note and/or deed of trust related to the Property;

WHEREAS, Grantor wishes to transfer the Property to Grantee to avoid foreclosure;

NOW, THEREFORE, for and in consideration of the mutual agreements and covenants contained herein, the parties agree as follows:

- The Grantor hereby conveys, assigns, and transfers the Property to the Grantee.

- This Deed releases Grantor from further obligations under the promissory note and/or deed of trust.

- The Grantee accepts the conveyance of the Property.

- This Deed is governed by the laws of the State of California.

IN WITNESS WHEREOF, Grantor has executed this Deed as of the date first above written.

Grantor: ________________________________ (Signature)

Date: ______________________________________

Grantee: ________________________________ (Signature)

Date: ______________________________________

ACKNOWLEDGMENT

State of California

County of _______________________________

On this ____ day of __________, 20__, before me, ______________________, a Notary Public in and for said County, personally appeared ______________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same.

WITNESS my hand and official seal.

Signature: _____________________________

My Commission Expires: _____________

Common mistakes

When filling out the California Deed in Lieu of Foreclosure form, many people make simple yet significant mistakes that can complicate the process. One common error is failing to provide complete and accurate information. This includes not listing all parties involved in the transaction or omitting necessary details about the property. Incomplete forms can lead to delays or even rejection of the deed, which can prolong the homeowner's financial distress.

Another frequent mistake is not understanding the implications of signing the deed. Some individuals may not realize that by signing this document, they are effectively transferring ownership of their property back to the lender. This can have serious consequences, including potential tax implications or impacts on credit scores. Without fully grasping these effects, homeowners might inadvertently make a decision that could worsen their financial situation.

Additionally, many people overlook the need for proper signatures. The Deed in Lieu of Foreclosure requires the signatures of all parties involved, including spouses or co-owners. If anyone fails to sign, the deed may be considered invalid. This oversight can lead to unnecessary complications down the line, especially if the lender attempts to enforce the deed without proper documentation.

Lastly, some individuals neglect to seek legal advice before submitting the form. While it may seem straightforward, the legal ramifications can be complex. Consulting with a lawyer can provide clarity on the process and help ensure that all necessary steps are taken. Without this guidance, homeowners risk making decisions that could have long-lasting effects on their financial health.

Discover More Deed in Lieu of Foreclosure Templates for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Some lenders may require that the borrower be in default before considering a Deed in Lieu of Foreclosure.

Deed in Lieu of Foreclosure Form - It provides a potentially quicker resolution than traditional foreclosure.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - The Deed in Lieu process may also offer the opportunity to settle other financial obligations tied to the property.

For those looking to understand the intricacies of managing parental responsibilities, the important Power of Attorney for a Child document can provide necessary guidance in ensuring your child's welfare is prioritized during your absence.

Georgia Foreclosure Laws - This process may also facilitate a faster resolution compared to traditional foreclosure proceedings, benefiting all parties involved.