Fillable California Death of a Joint Tenant Affidavit Template

File Details

| Fact Name | Description |

|---|---|

| Purpose | The California Death of a Joint Tenant Affidavit is used to transfer property ownership when one joint tenant passes away. |

| Governing Law | This form is governed by California Probate Code Section 5600 et seq. |

| Eligibility | Only joint tenants can use this affidavit; it is not applicable for tenants in common. |

| Required Information | The affidavit must include the name of the deceased joint tenant, the date of death, and a description of the property. |

| Signature Requirement | The surviving joint tenant must sign the affidavit to affirm the information is true and correct. |

| Filing Process | Once completed, the affidavit should be filed with the county recorder's office where the property is located. |

| Effect on Title | Filing the affidavit updates the property title to reflect the surviving joint tenant as the sole owner. |

| Potential Tax Implications | Consult a tax professional, as transferring property may have tax consequences for the surviving tenant. |

| Legal Assistance | While the form can be completed without an attorney, seeking legal advice is recommended to ensure compliance with all laws. |

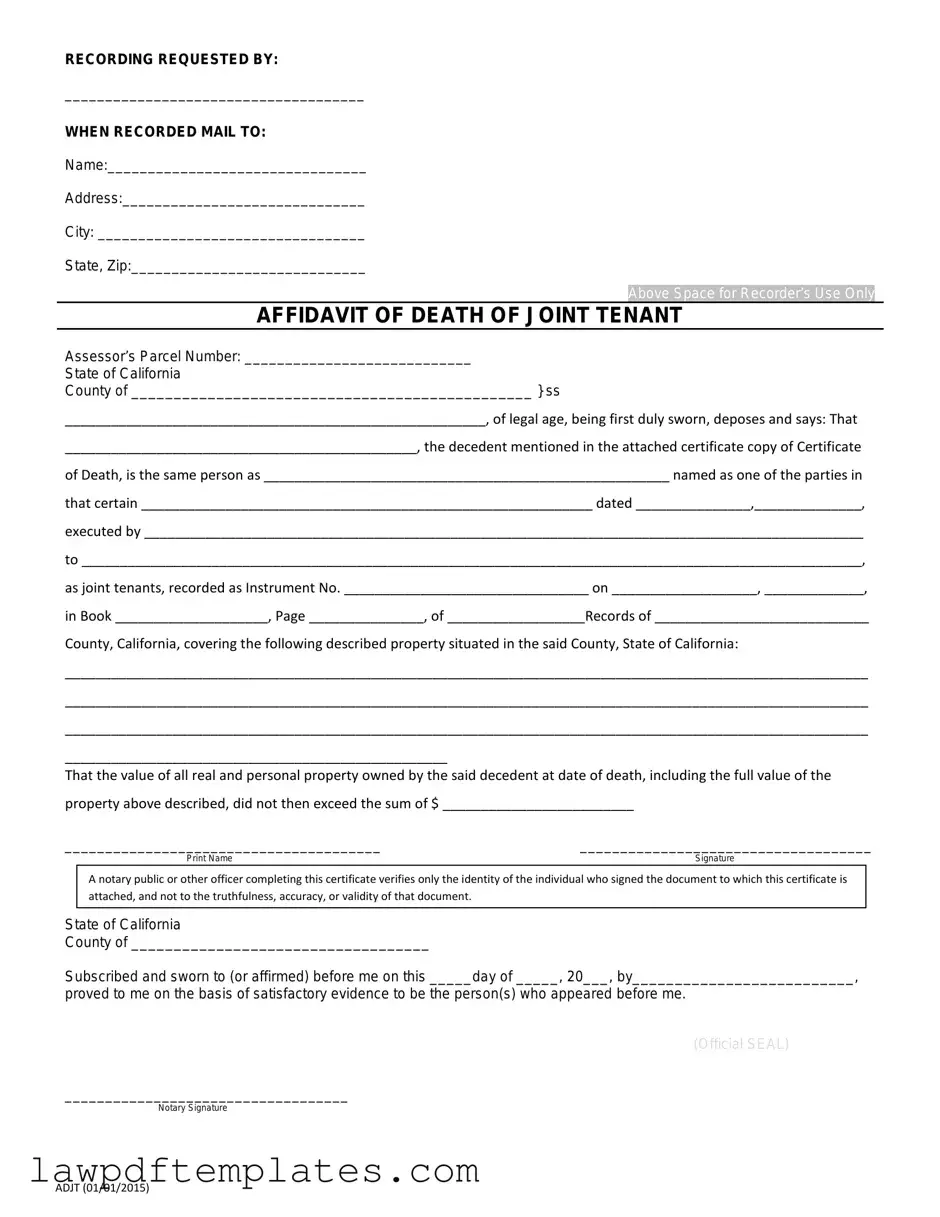

Sample - California Death of a Joint Tenant Affidavit Form

RECORDING REQUESTED BY:

_____________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:______________________________

City: _________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF JOINT TENANT

Assessor’s Parcel Number: ____________________________

State of California

County of _______________________________________________ } ss

_______________________________________________________, of legal age, being first duly sworn, deposes and says: That

______________________________________________, the decedent mentioned in the attached certificate copy of Certificate

of Death, is the same person as _____________________________________________________ named as one of the parties in

that certain ___________________________________________________________ dated _______________,______________,

executed by ______________________________________________________________________________________________

to ______________________________________________________________________________________________________,

as joint tenants, recorded as Instrument No. ________________________________ on ___________________, _____________,

in Book ____________________, Page _______________, of __________________Records of ____________________________

County, California, covering the following described property situated in the said County, State of California:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

__________________________________________________

That the value of all real and personal property owned by the said decedent at date of death, including the full value of the property above described, did not then exceed the sum of $ _________________________

_______________________________________ |

____________________________________ |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

___________________________________

Notary Signature

ADJT (01/01/2015)

Common mistakes

Filling out the California Death of a Joint Tenant Affidavit form can be a straightforward process, but mistakes can lead to delays or complications. One common error is not providing accurate information about the deceased joint tenant. It is essential to ensure that the name matches exactly as it appears on legal documents. Any discrepancies can raise questions and potentially cause issues in the transfer of property.

Another frequent mistake involves the failure to include the date of death. This date is crucial for establishing the timeline of ownership transfer. Omitting this information can result in the affidavit being rejected or returned for correction, which can slow down the process significantly.

Many individuals forget to sign the affidavit. Without a signature, the document is not valid. It's important to check that all required parties have signed where necessary. Additionally, some people neglect to have the affidavit notarized. In California, notarization is often required to ensure the document is legally binding.

Inaccurate descriptions of the property can also be a significant pitfall. The affidavit should clearly identify the property involved, including the address and any relevant legal descriptions. Vague or incomplete descriptions can lead to confusion and may require additional documentation to clarify ownership.

Another mistake is failing to provide supporting documentation. Along with the affidavit, individuals should include a copy of the deceased joint tenant's death certificate. This document serves as proof of death and is often necessary for processing the affidavit correctly.

People sometimes overlook the importance of checking for additional requirements specific to their county. Different counties may have unique rules or forms that need to accompany the affidavit. Being unaware of these requirements can lead to unnecessary delays.

Additionally, some individuals may not understand the implications of the affidavit. This form is not just a formality; it officially transfers ownership of the property. Failing to grasp this can lead to misunderstandings about property rights and responsibilities.

Lastly, procrastination can be a significant barrier. Waiting too long to submit the affidavit can lead to complications, especially if there are other heirs or if the property is subject to additional claims. Timely submission is crucial to ensure a smooth transition of ownership.

Common PDF Documents

Broward Animal Control - Provides a historical record of vaccinations for future pet care.

Chicago Title Lien Waiver - Understanding and using this waiver is a key aspect of construction project management.

For those looking to navigate the complexities of property transactions, the Texas Real Estate Sales Contract form serves as an essential tool, and additional resources can be found at texasformspdf.com/fillable-texas-real-estate-sales-contract-online/ to assist in the completion of this important document.

How to Fill Out Edd Disability Form - Submission of the DE 2501 is not a guarantee of benefits; EDD reviews each claim individually.