Free Bill of Sale Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The California Bill of Sale form is used to document the sale of personal property between a buyer and a seller. |

| Governing Law | The form is governed by California Civil Code Sections 1738-1740. |

| Property Types | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | Notarization is not required for a Bill of Sale in California, but it can add an extra layer of security. |

| Seller's Information | The seller must provide their name, address, and signature on the form. |

| Buyer's Information | The buyer's name and address must also be included to establish ownership. |

| Date of Sale | The date when the transaction occurs should be clearly stated on the form. |

| Consideration | The form should specify the amount paid for the property, known as consideration. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records after the transaction is completed. |

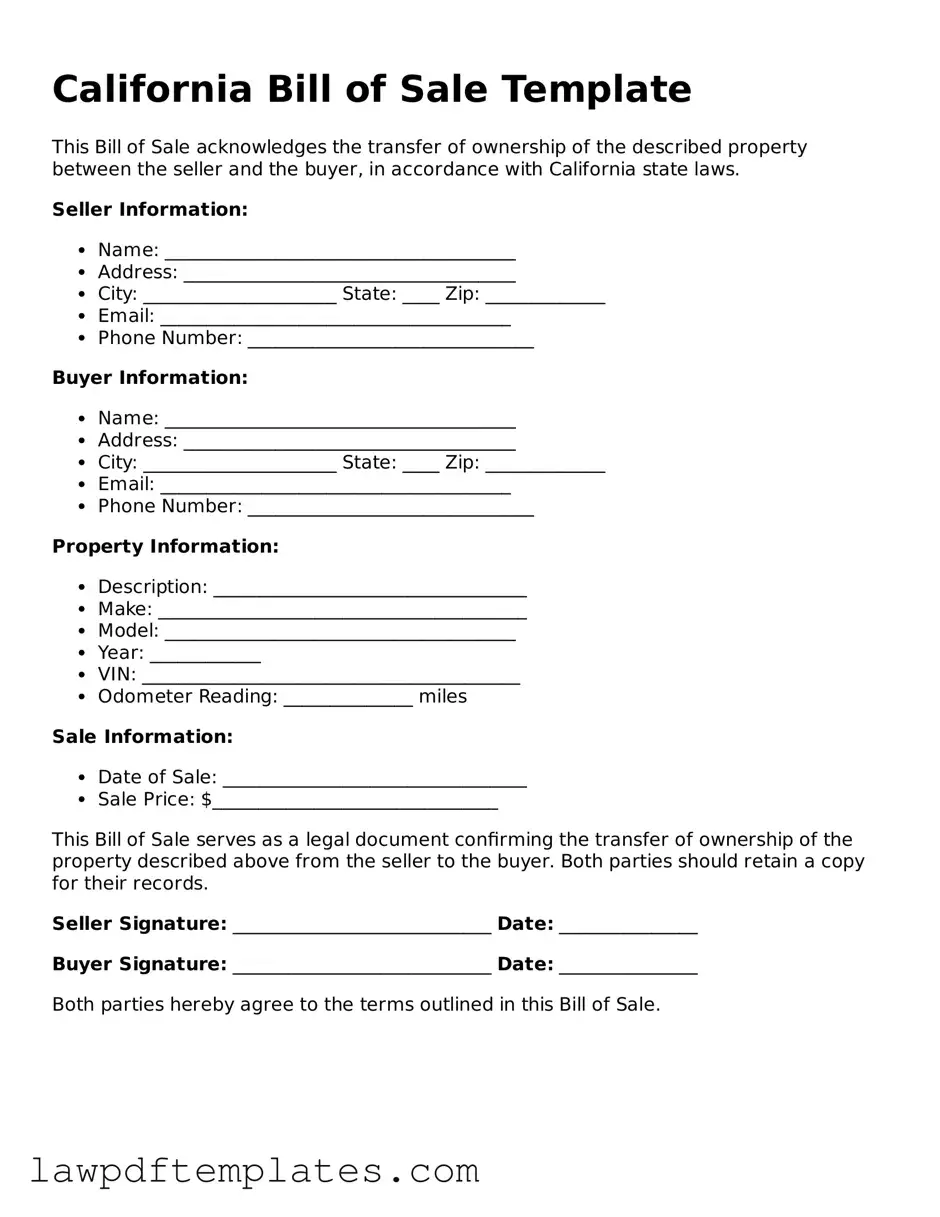

Sample - California Bill of Sale Form

California Bill of Sale Template

This Bill of Sale acknowledges the transfer of ownership of the described property between the seller and the buyer, in accordance with California state laws.

Seller Information:

- Name: ______________________________________

- Address: ____________________________________

- City: _____________________ State: ____ Zip: _____________

- Email: ______________________________________

- Phone Number: _______________________________

Buyer Information:

- Name: ______________________________________

- Address: ____________________________________

- City: _____________________ State: ____ Zip: _____________

- Email: ______________________________________

- Phone Number: _______________________________

Property Information:

- Description: __________________________________

- Make: ________________________________________

- Model: ______________________________________

- Year: ____________

- VIN: _________________________________________

- Odometer Reading: ______________ miles

Sale Information:

- Date of Sale: _________________________________

- Sale Price: $_______________________________

This Bill of Sale serves as a legal document confirming the transfer of ownership of the property described above from the seller to the buyer. Both parties should retain a copy for their records.

Seller Signature: ____________________________ Date: _______________

Buyer Signature: ____________________________ Date: _______________

Both parties hereby agree to the terms outlined in this Bill of Sale.

Common mistakes

When completing the California Bill of Sale form, individuals often overlook critical details that can lead to complications later. One common mistake is failing to include the correct date of the transaction. This date is essential for establishing the timeline of ownership transfer and can affect liability and tax implications.

Another frequent error involves neglecting to provide accurate vehicle or item identification. For vehicles, this means not including the Vehicle Identification Number (VIN). For other items, a detailed description is crucial. Without this information, proving ownership can become problematic.

People also often forget to include the purchase price. This figure is not just a formality; it serves as a record of the transaction value, which can impact taxes and future resale. Omitting this detail can lead to misunderstandings or disputes later on.

Many individuals do not sign the form. A signature is a vital part of validating the document. Both the seller and buyer should sign, as their consent is necessary for the transaction to be legally recognized.

Another mistake is not providing the correct names and addresses of both parties. This information ensures that all parties can be contacted if any issues arise. Errors in names or addresses can lead to confusion and potential legal challenges.

Some people fail to check the form for completeness before submission. Leaving sections blank can invalidate the document. Each part of the Bill of Sale must be filled out accurately to ensure it serves its intended purpose.

Additionally, individuals sometimes do not keep a copy of the completed Bill of Sale. Retaining a copy is important for personal records and can serve as proof of the transaction if disputes arise in the future.

In some cases, people may not understand the implications of the Bill of Sale. It is not merely a receipt; it is a legal document that can impact ownership rights and responsibilities. Failing to grasp this can lead to unintended consequences.

Another error involves using outdated forms. Legal documents can change over time, and using an old version of the Bill of Sale may lead to issues. Always ensure that you have the most current form.

Lastly, individuals sometimes rush through the process. Taking the time to review each detail can prevent costly mistakes. A thorough approach ensures that the Bill of Sale is complete and accurate, protecting both parties involved.

Discover More Bill of Sale Templates for Specific States

Bill of Sale Template Nc - The form can clarify that the seller is the rightful owner of the item sold.

For those looking to draft a reliable document for their transaction, utilizing resources like PDF Documents Hub can simplify the process of creating a General Bill of Sale form that ensures all necessary details are included and legally binding.

How to Transfer Title After Death - This document can include specific clauses based on local laws or regulations.