Free ATV Bill of Sale Template for the State of California

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The California ATV Bill of Sale form is used to document the sale and transfer of ownership of an all-terrain vehicle (ATV) in California. |

| Governing Laws | This form is governed by California Vehicle Code Sections 5901-5903, which outline the requirements for vehicle sales and transfers. |

| Required Information | Buyers and sellers must provide specific information, including names, addresses, and vehicle details such as the make, model, and VIN. |

| Signature Requirement | Both the seller and the buyer are required to sign the form to validate the transaction and acknowledge the transfer of ownership. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed Bill of Sale for their records, as it serves as proof of the transaction. |

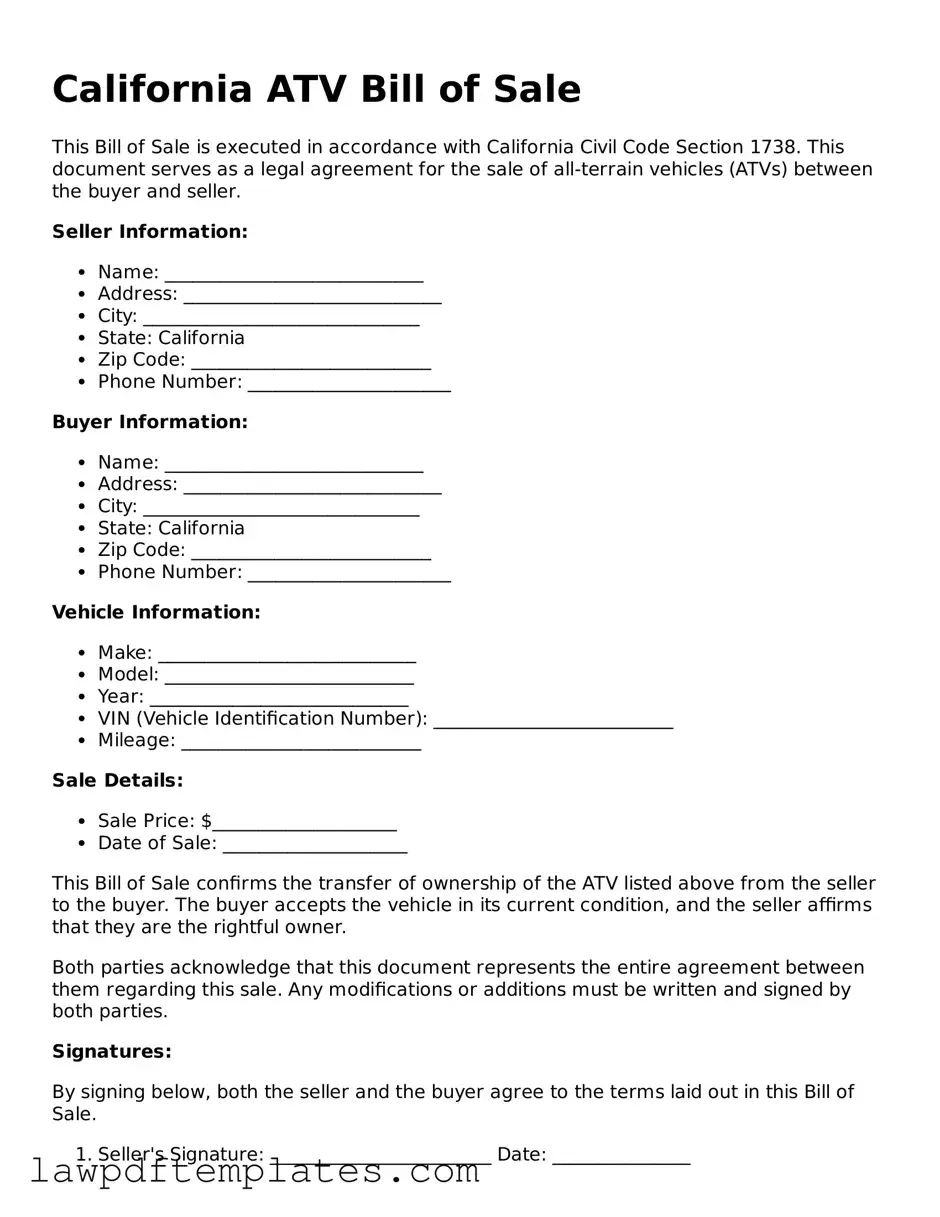

Sample - California ATV Bill of Sale Form

California ATV Bill of Sale

This Bill of Sale is executed in accordance with California Civil Code Section 1738. This document serves as a legal agreement for the sale of all-terrain vehicles (ATVs) between the buyer and seller.

Seller Information:

- Name: ____________________________

- Address: ____________________________

- City: ______________________________

- State: California

- Zip Code: __________________________

- Phone Number: ______________________

Buyer Information:

- Name: ____________________________

- Address: ____________________________

- City: ______________________________

- State: California

- Zip Code: __________________________

- Phone Number: ______________________

Vehicle Information:

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN (Vehicle Identification Number): __________________________

- Mileage: __________________________

Sale Details:

- Sale Price: $____________________

- Date of Sale: ____________________

This Bill of Sale confirms the transfer of ownership of the ATV listed above from the seller to the buyer. The buyer accepts the vehicle in its current condition, and the seller affirms that they are the rightful owner.

Both parties acknowledge that this document represents the entire agreement between them regarding this sale. Any modifications or additions must be written and signed by both parties.

Signatures:

By signing below, both the seller and the buyer agree to the terms laid out in this Bill of Sale.

- Seller's Signature: ________________________ Date: _______________

- Buyer's Signature: ________________________ Date: _______________

Please retain a copy of this Bill of Sale for your records.

Common mistakes

When filling out the California ATV Bill of Sale form, many individuals make common mistakes that can lead to complications later. One frequent error is failing to include all required information. The form asks for specific details such as the buyer's and seller's names, addresses, and the ATV's Vehicle Identification Number (VIN). Omitting any of these details can render the document incomplete.

Another mistake is incorrect VIN entry. The VIN is a unique identifier for the ATV, and even a single incorrect digit can create issues with registration. It is essential to double-check this number against the ATV's title or registration documents.

People often overlook the importance of the sale price. Not listing the sale price or entering an incorrect amount can lead to problems with tax assessments. California requires that the sale price be clearly stated, as this figure is used to determine the tax owed on the transaction.

Additionally, some individuals neglect to sign the form. Both the buyer and the seller must sign the Bill of Sale to validate the transaction. Without signatures, the document may not be recognized as a legal record of the sale.

Another common oversight is failing to date the document. A date is crucial for establishing when the transaction took place. This information is important for both parties, especially in case of future disputes or questions regarding ownership.

People sometimes forget to provide a clear description of the ATV. While the VIN is important, including details such as make, model, and year can help avoid confusion. This description serves as an additional identifier for the vehicle.

Misunderstanding the purpose of the Bill of Sale can lead to errors. Some individuals believe it is merely a receipt, but it serves as a legal document that can protect both parties. Understanding its significance can help ensure all necessary information is accurately provided.

Lastly, individuals may not keep a copy of the completed form. Retaining a copy is essential for both the buyer and seller, as it serves as proof of the transaction. Without a copy, either party may face difficulties if questions arise later.

Discover More ATV Bill of Sale Templates for Specific States

Or Bill of Sale - Contains a description of the ATV being sold, including make and model.

Utilizing a professional motor vehicle bill of sale template can simplify the selling process and ensure all necessary details are accurately captured for both parties involved.

Massachusetts Motorcycle Bill of Sale - Can help prevent misunderstandings after the transaction is complete.