Free Articles of Incorporation Template for the State of California

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The California Articles of Incorporation form is used to create a corporation in California. |

| Governing Law | This form is governed by the California Corporations Code, specifically Sections 200-213. |

| Filing Requirement | To officially form a corporation, the completed Articles of Incorporation must be filed with the California Secretary of State. |

| Information Needed | Key information includes the corporation's name, purpose, agent for service of process, and the number of shares authorized. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which can vary based on the type of corporation. |

| Online Filing | Corporations can file their Articles of Incorporation online through the California Secretary of State's website for convenience. |

| Processing Time | Typically, processing takes about 2-4 weeks, but expedited services are available for an additional fee. |

| Amendments | If changes are needed after filing, amendments can be made by submitting a separate form to the Secretary of State. |

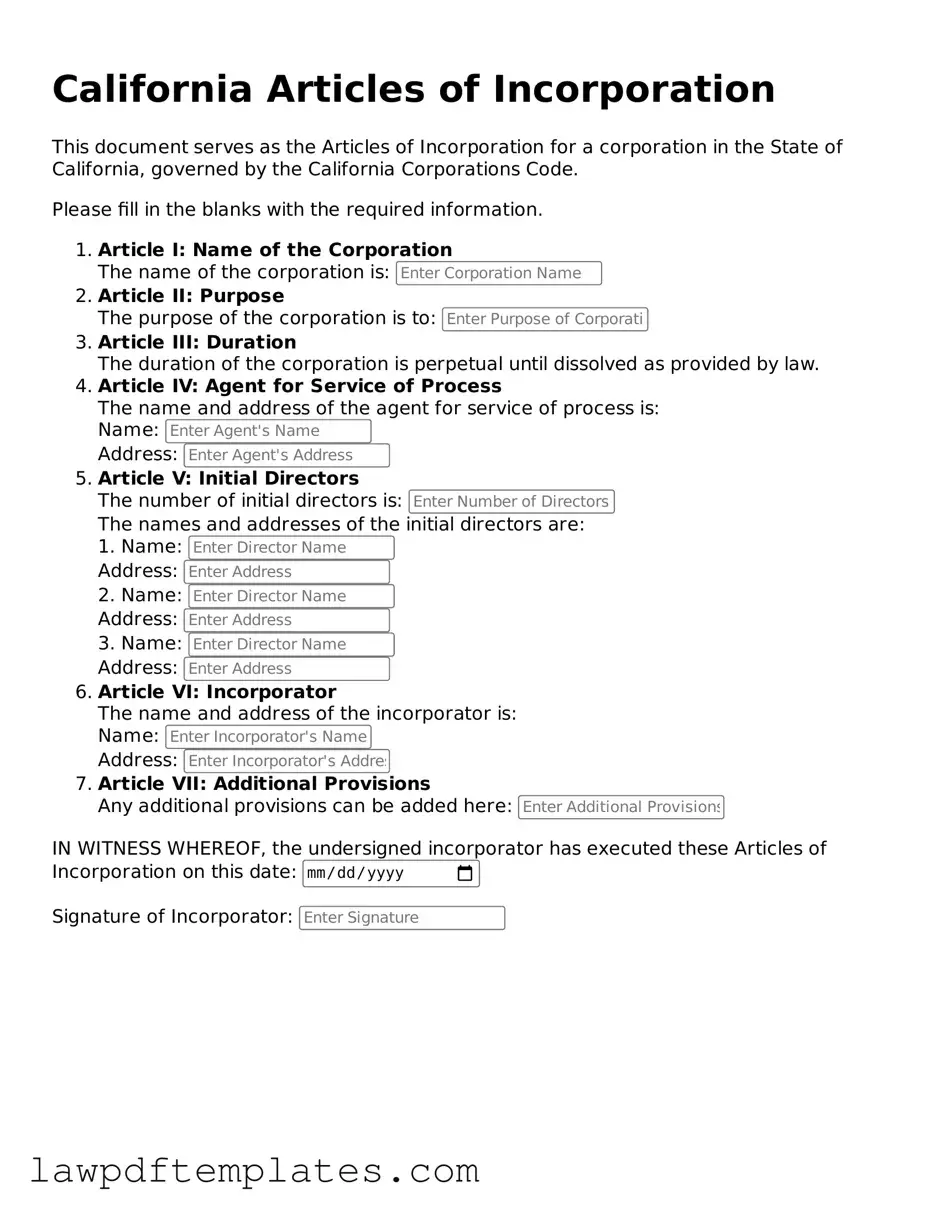

Sample - California Articles of Incorporation Form

California Articles of Incorporation

This document serves as the Articles of Incorporation for a corporation in the State of California, governed by the California Corporations Code.

Please fill in the blanks with the required information.

- Article I: Name of the Corporation

The name of the corporation is: - Article II: Purpose

The purpose of the corporation is to: - Article III: Duration

The duration of the corporation is perpetual until dissolved as provided by law. - Article IV: Agent for Service of Process

The name and address of the agent for service of process is:

Name:

Address: - Article V: Initial Directors

The number of initial directors is:

The names and addresses of the initial directors are:

1. Name:

Address:

2. Name:

Address:

3. Name:

Address: - Article VI: Incorporator

The name and address of the incorporator is:

Name:

Address: - Article VII: Additional Provisions

Any additional provisions can be added here:

IN WITNESS WHEREOF, the undersigned incorporator has executed these Articles of Incorporation on this date:

Signature of Incorporator:

Common mistakes

Filing the California Articles of Incorporation is a crucial step for anyone looking to establish a corporation in the state. However, many individuals make common mistakes that can lead to delays or complications. Understanding these pitfalls can save time and ensure a smoother process.

One of the most frequent errors is failing to choose a unique name for the corporation. The name must not only comply with California's naming rules but also be distinguishable from existing entities. Before submitting the form, it’s wise to conduct a thorough search to confirm that your desired name isn’t already in use.

Another common mistake is incomplete or inaccurate information. The Articles of Incorporation require specific details, such as the corporation’s purpose and the names and addresses of the initial directors. Omitting any of this information can result in rejection of the application. Double-checking all entries for accuracy is essential.

Many applicants also overlook the importance of the registered agent. A registered agent is required to receive legal documents on behalf of the corporation. Failing to designate a registered agent or providing incorrect information about them can lead to serious legal consequences. It's important to choose someone who is reliable and available during business hours.

Additionally, some individuals forget to include the correct filing fee. Each corporation type has its own fee structure, and submitting the wrong amount can delay the processing of your application. Always verify the current fees on the California Secretary of State's website before filing.

Another mistake is not understanding the corporation's purpose. While California allows for a general purpose statement, being vague can lead to questions or complications later. Clearly defining the business activities can help avoid issues down the road.

Lastly, many people fail to keep copies of their submission. After filing the Articles of Incorporation, it’s crucial to retain a copy for your records. This documentation can be vital for future reference, especially when applying for licenses or permits. It’s a simple step that can prevent headaches in the future.

By avoiding these common mistakes, individuals can navigate the incorporation process more smoothly. Taking the time to understand the requirements and double-checking all information can lead to a successful start for your new business venture.

Discover More Articles of Incorporation Templates for Specific States

Llc Articles of Organization Nj - Provides proof of a corporate entity's existence.

The IRS Form 2553 is a crucial document used by eligible small business corporations to elect S corporation status for tax purposes. By filing this form, businesses can potentially enjoy tax benefits, such as avoiding double taxation on corporate income. Understanding the form and its requirements is essential for any small business looking to optimize its tax strategy. For additional resources, you can explore templates like those available at Fast PDF Templates.

Incorporate Nc - Corporations can own property and enter contracts separate from owners.