Attorney-Approved Business Purchase and Sale Agreement Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document outlining the terms for buying or selling a business. |

| Parties Involved | The agreement typically involves a seller and a buyer, who are both identified in the document. |

| Purchase Price | The total amount to be paid for the business is specified, including any terms related to payment. |

| Assets Included | The agreement lists all assets being sold, which may include inventory, equipment, and intellectual property. |

| Liabilities | Details regarding any liabilities that the buyer will assume or that the seller will retain are included. |

| Governing Law | The agreement specifies which state's laws will govern the contract, which can vary based on the location of the business. |

| Due Diligence | Buyers are often given a period to conduct due diligence to verify the business's financial and operational status. |

| Confidentiality | Many agreements include confidentiality clauses to protect sensitive information shared during the transaction. |

| Closing Process | The agreement outlines the steps and timeline for finalizing the sale, including the transfer of ownership. |

Sample - Business Purchase and Sale Agreement Form

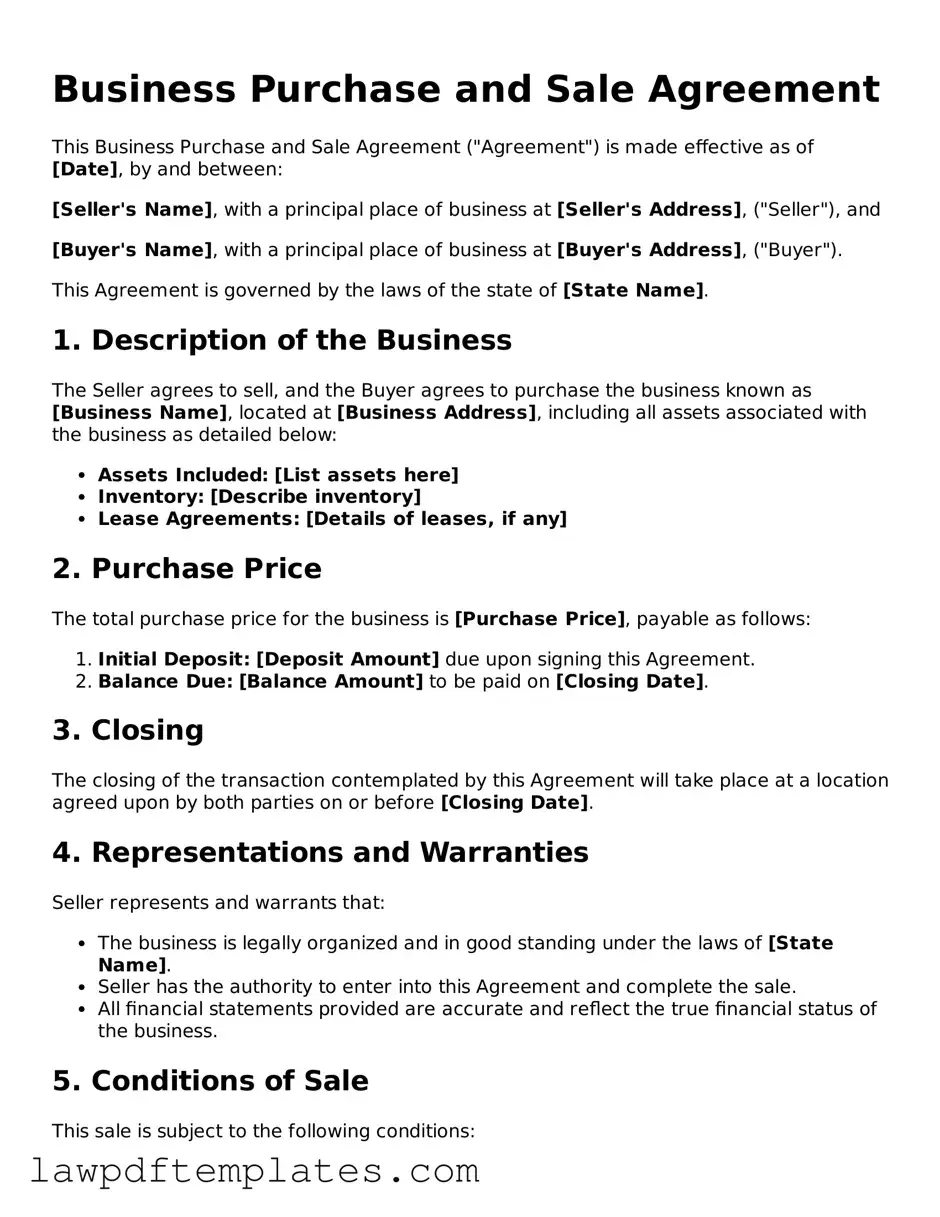

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made effective as of [Date], by and between:

[Seller's Name], with a principal place of business at [Seller's Address], ("Seller"), and

[Buyer's Name], with a principal place of business at [Buyer's Address], ("Buyer").

This Agreement is governed by the laws of the state of [State Name].

1. Description of the Business

The Seller agrees to sell, and the Buyer agrees to purchase the business known as [Business Name], located at [Business Address], including all assets associated with the business as detailed below:

- Assets Included: [List assets here]

- Inventory: [Describe inventory]

- Lease Agreements: [Details of leases, if any]

2. Purchase Price

The total purchase price for the business is [Purchase Price], payable as follows:

- Initial Deposit: [Deposit Amount] due upon signing this Agreement.

- Balance Due: [Balance Amount] to be paid on [Closing Date].

3. Closing

The closing of the transaction contemplated by this Agreement will take place at a location agreed upon by both parties on or before [Closing Date].

4. Representations and Warranties

Seller represents and warrants that:

- The business is legally organized and in good standing under the laws of [State Name].

- Seller has the authority to enter into this Agreement and complete the sale.

- All financial statements provided are accurate and reflect the true financial status of the business.

5. Conditions of Sale

This sale is subject to the following conditions:

- Buyer’s satisfactory review of the business financials.

- Buyer obtaining necessary financing.

- Completion of any required inspections.

6. Miscellaneous

This Agreement constitutes the entire understanding between the parties and supersedes any prior agreements regarding the subject matter.

Any amendments to this Agreement must be in writing and signed by both parties.

7. Signatures

IN WITNESS WHEREOF, the parties have executed this Business Purchase and Sale Agreement as of the date first above written.

_____________________________

[Seller's Name]

Seller

_____________________________

[Buyer's Name]

Buyer

Common mistakes

When filling out a Business Purchase and Sale Agreement, many individuals make common mistakes that can lead to complications down the road. One frequent error is failing to clearly define the terms of the sale. This includes not specifying what exactly is being sold, whether it be inventory, equipment, or intellectual property. Without clear definitions, misunderstandings can arise, creating confusion for both parties.

Another mistake is neglecting to include all necessary parties in the agreement. It’s essential to ensure that all individuals or entities involved in the transaction are named in the document. Omitting a party can lead to disputes later, especially if that party has a claim to the business or its assets.

People often overlook the importance of outlining payment terms. Not specifying how and when payments will be made can lead to disagreements. For instance, will the payment be made in a lump sum or in installments? Additionally, what are the consequences if a payment is missed? These details should be clearly articulated to avoid future conflicts.

Another common oversight is failing to address contingencies. Contingencies are conditions that must be met for the sale to proceed. If these are not included, buyers and sellers may find themselves in a difficult situation if certain conditions, like financing or inspections, are not met.

Some individuals also make the mistake of not reviewing the agreement thoroughly before signing. Rushing through the process can lead to missed errors or unclear language that could affect the transaction. It’s crucial to read the document carefully and consider having a professional review it to catch any potential issues.

Additionally, people sometimes forget to include a timeline for the transaction. Establishing a clear timeline helps both parties understand the process and sets expectations for when certain actions should take place. Without this, delays can occur, leading to frustration and potential financial loss.

Lastly, individuals may not consider the implications of warranties and representations. Not addressing what warranties are being made can leave one party vulnerable. If one party claims that the business is in a certain condition and that turns out to be false, the other party may have little recourse. It’s vital to be clear about what is being guaranteed in the agreement.

Popular Templates:

Work Incident Report Sample - Ensures that all relevant parties are notified about the incident in a timely manner.

In addition to its importance in facilitating a smooth transaction, you can access a comprehensive version of the General Bill of Sale form online, making the process even easier. For convenience, consider using Fillable Forms that allow you to create a tailored document suited to your needs.

Roof Certification Form Florida - Enter the unique ID assigned to the structure.