Fillable Business Credit Application Template

File Details

| Fact Name | Description |

|---|---|

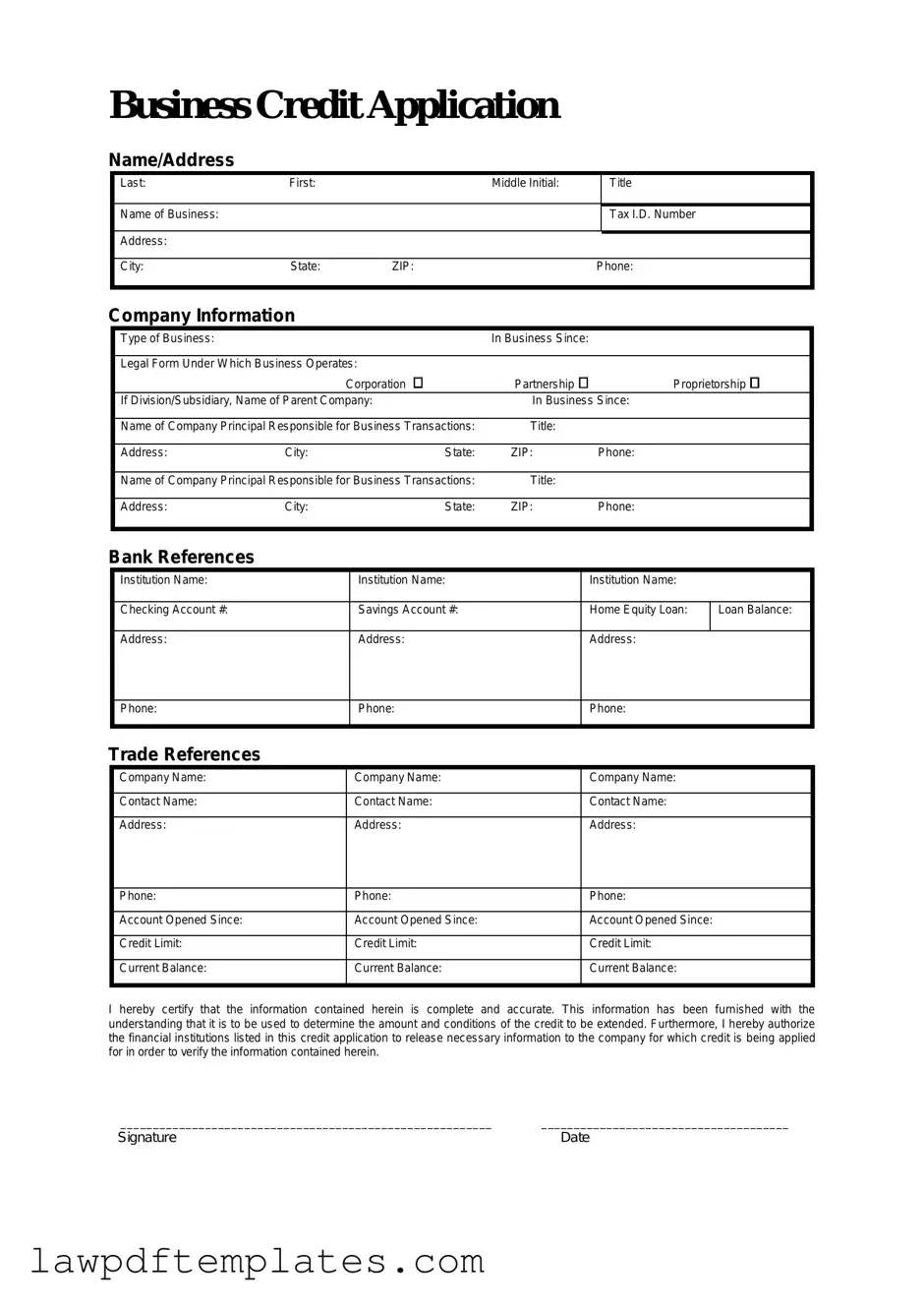

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or lenders. |

| Information Required | This form typically requires details such as business name, address, tax ID, and ownership information. |

| Governing Law | The application is subject to state-specific laws governing credit agreements, which may vary by state. |

| Credit History | Applicants may need to provide information about their business credit history and any existing debts. |

| Personal Guarantee | In some cases, a personal guarantee from business owners may be required to secure credit. |

| Approval Process | The approval process may involve a review of the application, credit checks, and financial assessments. |

| Confidentiality | Information submitted on the form is generally kept confidential and used solely for credit evaluation. |

Sample - Business Credit Application Form

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Common mistakes

Filling out a Business Credit Application form can be a daunting task, and many individuals make common mistakes that can hinder their chances of obtaining credit. One frequent error is providing incomplete information. When applicants skip sections or leave out crucial details, it raises red flags for lenders. They might view the application as lacking seriousness or thoroughness. Always ensure that every section of the form is filled out completely.

Another mistake is not being honest about financial information. Some applicants may inflate their income or downplay their debts in hopes of appearing more favorable to lenders. This approach can backfire. If a lender discovers discrepancies during the verification process, it could lead to denial of credit or even legal consequences. Transparency is key.

Many applicants also fail to check their credit history before applying. A poor credit score can significantly impact the chances of approval. By reviewing their credit reports in advance, individuals can identify any issues that need addressing. This proactive step can also help them present a stronger case to potential lenders.

Neglecting to provide references is another common oversight. Lenders often look for references to validate the applicant’s credibility and business history. Without these, the application may seem incomplete or untrustworthy. Including reliable references can bolster the application and improve the chances of approval.

Some individuals mistakenly think that the business structure does not matter when filling out the application. Whether operating as a sole proprietorship, partnership, or corporation, the structure affects how credit is evaluated. Different entities have different implications for liability and creditworthiness, so it’s essential to accurately represent the business type.

Additionally, failing to read the terms and conditions of the credit application can lead to misunderstandings. Some applicants rush through the fine print, not realizing the implications of interest rates, fees, or repayment terms. Taking the time to understand these details can prevent future financial complications.

Lastly, many people overlook the importance of a professional presentation. A messy or poorly organized application can create a negative impression. Ensuring that the form is neat, well-organized, and free of errors demonstrates professionalism and attention to detail. A polished application can set the tone for a positive relationship with the lender.

Common PDF Documents

Panel Schedule - It provides a framework for training new electricians on the system.

Shared Well Agreement - Termination requires filing a written notice at the county office, effecting a clear end to water access.

The Illinois Durable Power of Attorney form is an essential document that empowers individuals to select representatives for making crucial decisions on their behalf regarding both financial and healthcare issues. To learn more about this important legal tool, follow this link: how to effectively use a Durable Power of Attorney.

Ubc Designated Learning Institution Number - Contact information is collected for correspondence regarding the application.