Attorney-Approved Business Bill of Sale Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. |

| Purpose | This document serves as proof of the transaction and outlines the terms of the sale. |

| Components | Typically includes details such as the names of the buyer and seller, a description of the business or assets, and the sale price. |

| State-Specific Forms | Some states may have specific forms or requirements for a Business Bill of Sale. Always check local laws. |

| Governing Laws | In the U.S., the Uniform Commercial Code (UCC) often governs the sale of business assets. |

| Notarization | Some states require the Bill of Sale to be notarized for it to be legally binding. |

| Tax Implications | Sales tax may apply depending on the nature of the assets being sold and state laws. |

| Liabilities | The Bill of Sale can specify whether the buyer assumes any liabilities associated with the business. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records and future reference. |

| Legal Advice | It is often recommended to consult with a legal professional before completing a Business Bill of Sale. |

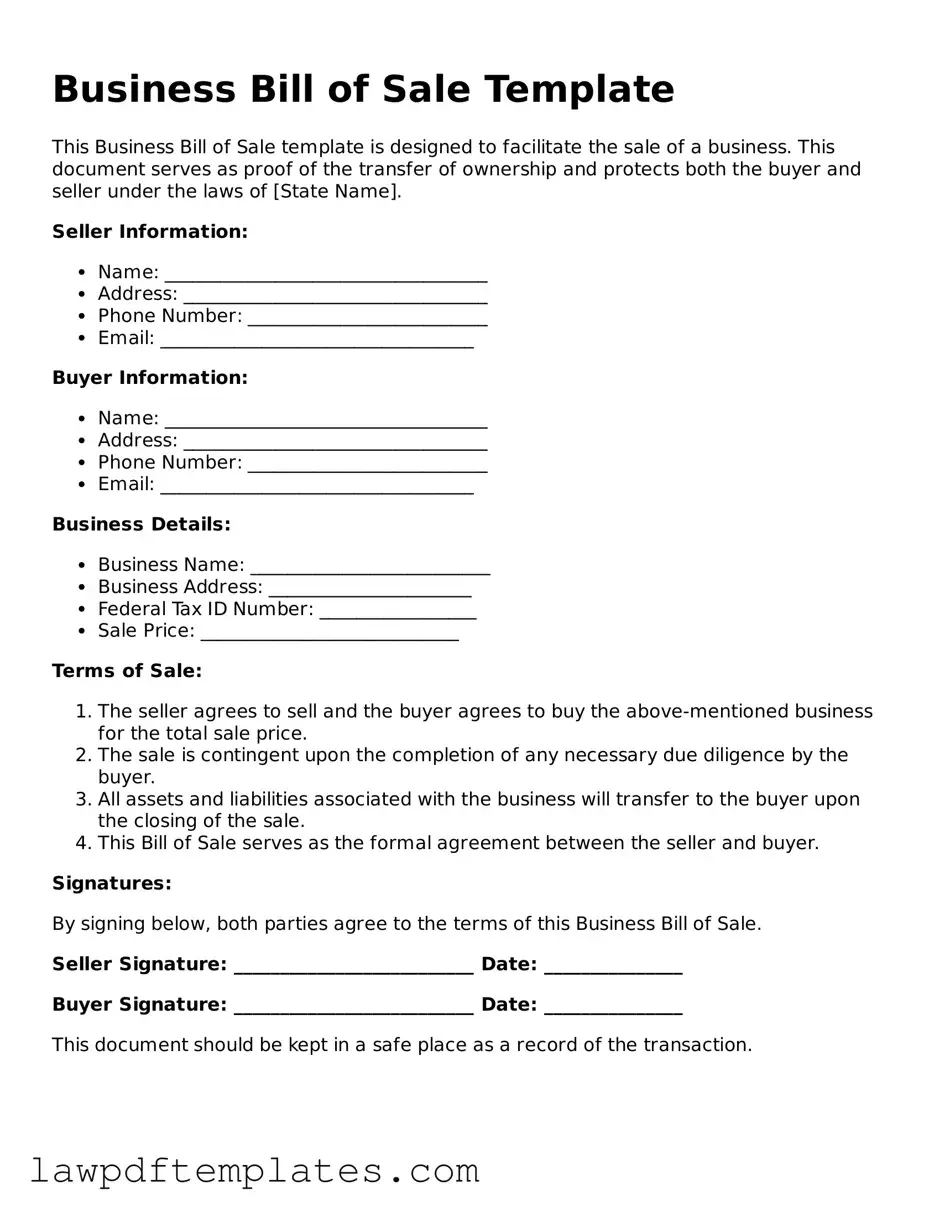

Sample - Business Bill of Sale Form

Business Bill of Sale Template

This Business Bill of Sale template is designed to facilitate the sale of a business. This document serves as proof of the transfer of ownership and protects both the buyer and seller under the laws of [State Name].

Seller Information:

- Name: ___________________________________

- Address: _________________________________

- Phone Number: __________________________

- Email: __________________________________

Buyer Information:

- Name: ___________________________________

- Address: _________________________________

- Phone Number: __________________________

- Email: __________________________________

Business Details:

- Business Name: __________________________

- Business Address: ______________________

- Federal Tax ID Number: _________________

- Sale Price: ____________________________

Terms of Sale:

- The seller agrees to sell and the buyer agrees to buy the above-mentioned business for the total sale price.

- The sale is contingent upon the completion of any necessary due diligence by the buyer.

- All assets and liabilities associated with the business will transfer to the buyer upon the closing of the sale.

- This Bill of Sale serves as the formal agreement between the seller and buyer.

Signatures:

By signing below, both parties agree to the terms of this Business Bill of Sale.

Seller Signature: __________________________ Date: _______________

Buyer Signature: __________________________ Date: _______________

This document should be kept in a safe place as a record of the transaction.

Common mistakes

Completing a Business Bill of Sale form requires attention to detail. One common mistake is failing to include all necessary information about the business being sold. This includes the legal name of the business, the address, and the type of business entity. Omitting any of these details can lead to confusion and potential legal issues down the line.

Another frequent error is neglecting to accurately describe the assets being sold. Buyers need a clear understanding of what they are acquiring. If the description is vague or incomplete, it could result in disputes or misunderstandings between the buyer and seller. Clarity is essential to ensure both parties are on the same page.

Many individuals also overlook the importance of including the purchase price. Stating the amount clearly is crucial for both tax purposes and to establish the terms of the sale. Without this information, there could be complications regarding payment and ownership transfer.

Signatures are vital in validating the Business Bill of Sale. Some people forget to have both parties sign the document. Incomplete signatures can render the form ineffective. Ensuring that both the seller and buyer sign the document is necessary to finalize the transaction legally.

Finally, failing to retain copies of the completed form is a mistake that can lead to future complications. Both parties should keep a signed copy for their records. This documentation serves as proof of the transaction and can be important for tax records or in case of any disputes.

Consider Popular Types of Business Bill of Sale Documents

Bill of Sale for Farm Equipment - Includes important sale details such as date and location.

For those looking to safeguard their transactions, understanding the importance of a reliable document is crucial. You can find an informative resource about the standard general bill of sale that aids in accurately documenting the sale of personal property. This can help ensure that both parties are protected during their exchange.

Faa 8050-2 - The AC 8050-2 can streamline future ownership transfers by maintaining accurate records.

Free Printable Bill of Sale for Mobile Home - This form is beneficial for documenting the date of sale, which can be important for tax purposes.