Attorney-Approved Bill of Sale Document

State-specific Bill of Sale Forms

Bill of Sale Form Types

- All-Purpose Bill of Sale

- Bill of Sale for a Four Wheeler

- Bill of Sale for a Golf Cart

- Bill of Sale for a Manufactured Home

- Bill of Sale for a Motor Vehicle

- Bill of Sale for a Motorcycle

- Bill of Sale for a Trailer

- Bill of Sale for an RV Purchase

- Bill of Sale for Artwork

- Bill of Sale for Dogs

- Bill of Sale for Horses

- Bill of Sale for Snowmobiles

- Bill of Sale for Watercraft

- Dirtbike Bill of Sale

- Enterprise Sale Document

- FAA Aircraft Bill of Sale

- Farm Tractor Bill of Sale

- Furniture Purchase Document

- Machinery Bill of Sale

- Personal Watercraft Transaction Document

- Weapon Bill of Sale

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Purpose | This form serves as proof of purchase and can be used for various types of property, including vehicles and equipment. |

| State-Specific Forms | Some states require specific formats or additional information, such as vehicle identification numbers for car sales. |

| Governing Laws | In many states, the Bill of Sale is governed by the Uniform Commercial Code (UCC), which standardizes sales transactions. |

| Notarization | While notarization is not always required, it can add an extra layer of authenticity to the document. |

| Consideration | For the Bill of Sale to be valid, there must be consideration, meaning something of value is exchanged. |

| Retention | Both the buyer and seller should keep a copy of the Bill of Sale for their records. |

| Usage in Disputes | If a dispute arises, the Bill of Sale can serve as evidence of the terms agreed upon by both parties. |

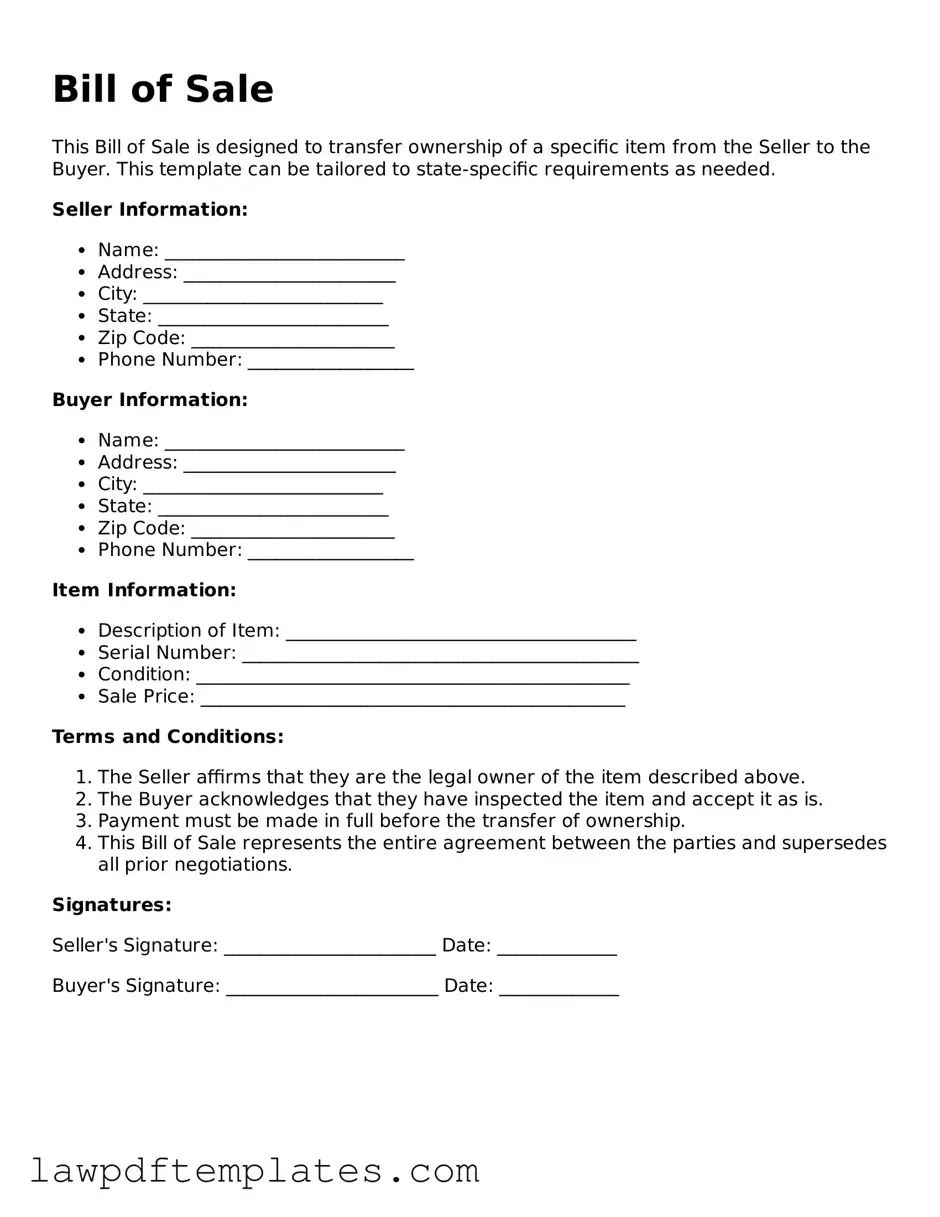

Sample - Bill of Sale Form

Bill of Sale

This Bill of Sale is designed to transfer ownership of a specific item from the Seller to the Buyer. This template can be tailored to state-specific requirements as needed.

Seller Information:

- Name: __________________________

- Address: _______________________

- City: __________________________

- State: _________________________

- Zip Code: ______________________

- Phone Number: __________________

Buyer Information:

- Name: __________________________

- Address: _______________________

- City: __________________________

- State: _________________________

- Zip Code: ______________________

- Phone Number: __________________

Item Information:

- Description of Item: ______________________________________

- Serial Number: ___________________________________________

- Condition: _______________________________________________

- Sale Price: ______________________________________________

Terms and Conditions:

- The Seller affirms that they are the legal owner of the item described above.

- The Buyer acknowledges that they have inspected the item and accept it as is.

- Payment must be made in full before the transfer of ownership.

- This Bill of Sale represents the entire agreement between the parties and supersedes all prior negotiations.

Signatures:

Seller's Signature: _______________________ Date: _____________

Buyer's Signature: _______________________ Date: _____________

Common mistakes

When completing a Bill of Sale form, people often overlook critical details that can lead to complications down the road. One common mistake is failing to include the correct date of the transaction. The date serves as a legal reference point. Without it, disputes may arise regarding when ownership was transferred.

Another frequent error is neglecting to provide accurate descriptions of the item being sold. A vague description can lead to misunderstandings. For example, simply stating “car” instead of including the make, model, year, and VIN can create confusion about what was actually sold.

Many individuals also forget to include the full names and addresses of both the buyer and the seller. This information is essential for establishing the identities of the parties involved. Omitting this detail can complicate matters if a dispute arises later.

Additionally, people sometimes fail to specify the payment method. Whether the buyer pays in cash, check, or another form, documenting this helps clarify the transaction. Without this information, it can be challenging to prove that payment was made.

Another mistake is not having both parties sign the document. A Bill of Sale is not valid without the signatures of both the buyer and seller. This requirement solidifies the agreement and ensures that both parties acknowledge the terms.

Lastly, individuals may overlook the need for witnesses or notarization, depending on their state’s requirements. Some states mandate that a Bill of Sale be witnessed or notarized to be legally binding. Ignoring this step can render the document unenforceable.

Popular Templates:

Letter of Permission to Travel - This form often requires various details about the child, including special needs or medical conditions.

For individuals looking to secure a straightforward transaction, a reliable bill of sale is crucial. Our guide on the "step-by-step process for creating a General Bill of Sale" will provide you with the necessary templates and insights to ensure your sale is documented efficiently. Visit this link for more information.

Power of Attorney Florida for Child - The form can be beneficial in situations where parents are deployed or working away from home.