Fillable Auto Insurance Card Template

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Auto Insurance Card serves as proof of insurance coverage for a vehicle. |

| State-Specific Forms | Each state may have its own version of the insurance card, governed by state insurance laws. |

| Company Number | This number identifies the insurance company that issued the policy. |

| Policy Number | The policy number is unique to the insured individual and is crucial for claims processing. |

| Effective and Expiration Dates | These dates indicate the period during which the insurance coverage is valid. |

| Vehicle Information | The card includes details about the vehicle, such as make, model, and VIN (Vehicle Identification Number). |

| Agency Issuing Card | The name of the agency or company that issued the insurance card is prominently displayed. |

| Important Notice | Instructions on what to do in case of an accident are provided on the card. |

| Watermark Feature | The front of the card contains an artificial watermark, which can be viewed by holding it at an angle. |

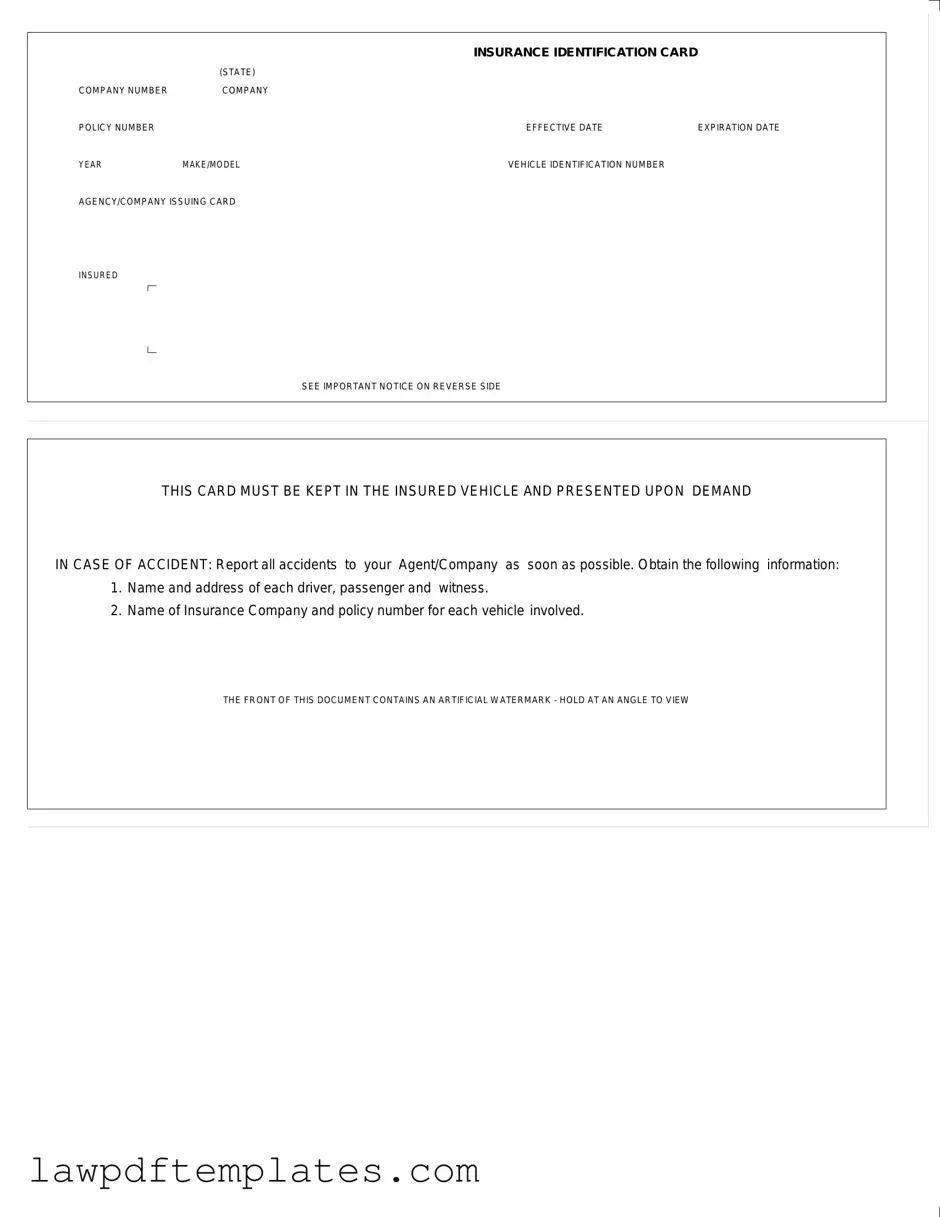

Sample - Auto Insurance Card Form

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Common mistakes

When filling out the Auto Insurance Card form, many individuals inadvertently make mistakes that can lead to complications down the road. One common error is failing to include the effective date of the policy. This date is crucial, as it indicates when coverage begins. Without it, the card may be deemed invalid, potentially leaving drivers without proper insurance during an accident.

Another frequent mistake is omitting the expiration date. It’s essential to provide this information to ensure that anyone reviewing the card can quickly determine if the policy is still active. An expired card can lead to penalties or complications when filing a claim.

People often overlook the vehicle identification number (VIN), which is unique to each vehicle. Missing or incorrect VINs can cause significant issues, especially if the vehicle is involved in an accident. This number helps verify that the insurance policy covers the specific vehicle in question.

Additionally, some individuals mistakenly enter the company number or policy number incorrectly. These numbers are vital for identifying the specific insurance policy and the company providing coverage. Errors here can lead to confusion and delays when trying to access benefits or file claims.

Many also fail to include the correct year, make, and model of the vehicle. This information is necessary for the insurance company to assess risk and coverage accurately. Incorrect details can result in complications during an accident or when seeking repairs.

Some people neglect to check the agency or company issuing the card. It’s important to ensure that the name is clearly stated and matches the insurance provider. This helps avoid any disputes regarding coverage when it is needed most.

Another common oversight is not keeping the card in the insured vehicle. The form explicitly states that it must be present in the car. Failing to do so can lead to fines or legal issues if stopped by law enforcement or involved in an accident.

Individuals sometimes disregard the important notice on the reverse side of the card. This notice often contains critical information about reporting accidents and obtaining necessary details from involved parties. Ignoring this can lead to missed steps that are vital for a smooth claims process.

Finally, many people do not take the time to review the card for accuracy before submitting it. A quick check can catch errors that might otherwise go unnoticed. Taking this extra step can save time and hassle later on.

Common PDF Documents

Roof Warranty - MCS Roofing is not liable for damages beyond the terms of the warranty.

Roof Certification Form Florida - Inspect drains and downspouts for cleanliness and obstruction.

To facilitate the use of the FedEx Release Form, many individuals and businesses turn to resources like Fast PDF Templates, which provide templates and guidance to ensure the form is filled out correctly and submitted without errors, ultimately helping prevent any delivery complications.

Progressive Supplements - Document any unusual smells or fluid leaks noticed.