Free Transfer-on-Death Deed Template for the State of Arizona

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | The Arizona Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Arizona Revised Statutes, Title 33, Chapter 4, specifically § 33-405. |

| Revocation | The deed can be revoked or changed at any time by the property owner, provided the revocation is executed in the same manner as the original deed. |

| Requirements | The deed must be signed by the property owner and recorded with the county recorder's office to be valid. |

Sample - Arizona Transfer-on-Death Deed Form

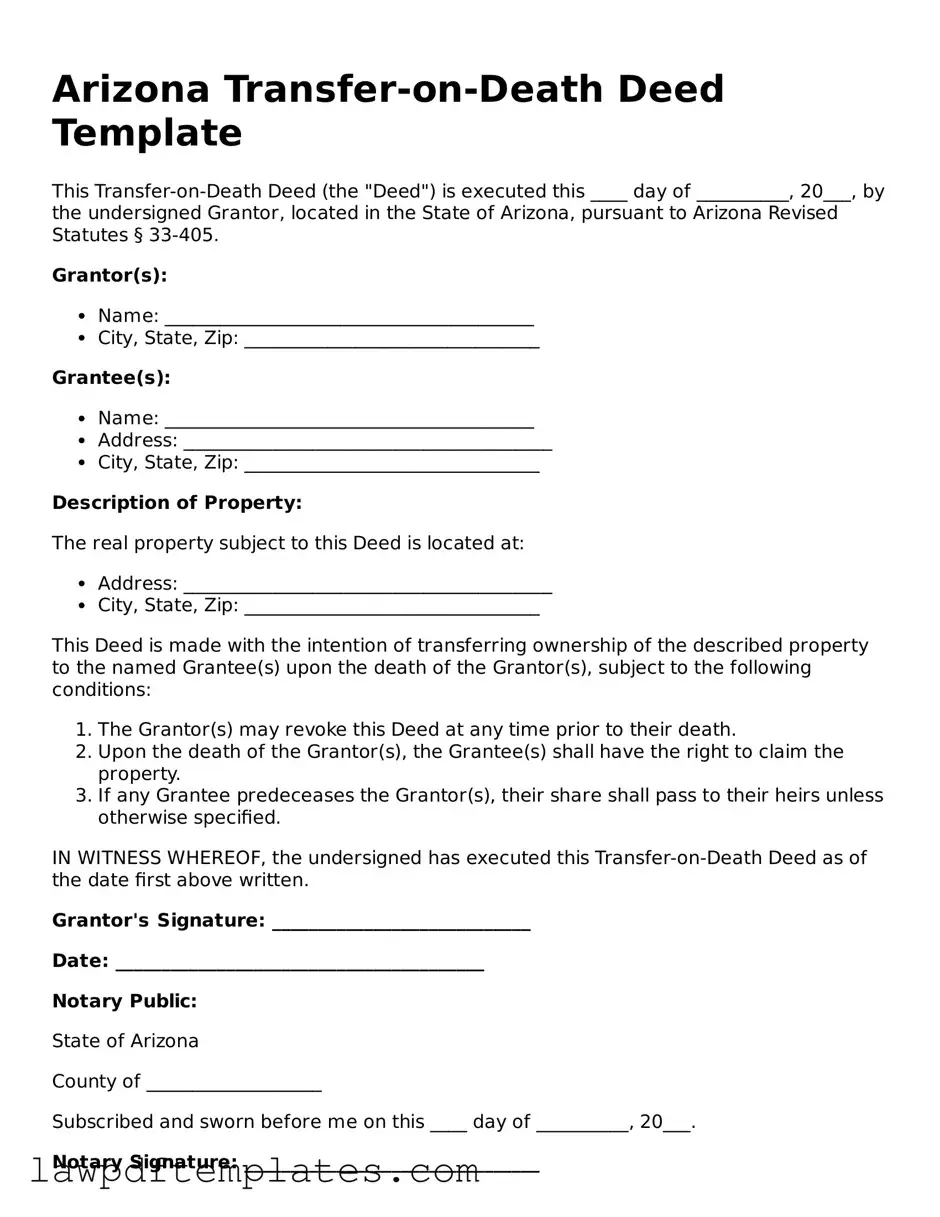

Arizona Transfer-on-Death Deed Template

This Transfer-on-Death Deed (the "Deed") is executed this ____ day of __________, 20___, by the undersigned Grantor, located in the State of Arizona, pursuant to Arizona Revised Statutes § 33-405.

Grantor(s):

- Name: ________________________________________

- City, State, Zip: ________________________________

Grantee(s):

- Name: ________________________________________

- Address: ________________________________________

- City, State, Zip: ________________________________

Description of Property:

The real property subject to this Deed is located at:

- Address: ________________________________________

- City, State, Zip: ________________________________

This Deed is made with the intention of transferring ownership of the described property to the named Grantee(s) upon the death of the Grantor(s), subject to the following conditions:

- The Grantor(s) may revoke this Deed at any time prior to their death.

- Upon the death of the Grantor(s), the Grantee(s) shall have the right to claim the property.

- If any Grantee predeceases the Grantor(s), their share shall pass to their heirs unless otherwise specified.

IN WITNESS WHEREOF, the undersigned has executed this Transfer-on-Death Deed as of the date first above written.

Grantor's Signature: ____________________________

Date: ________________________________________

Notary Public:

State of Arizona

County of ___________________

Subscribed and sworn before me on this ____ day of __________, 20___.

Notary Signature: ________________________________

My commission expires: _________________________

Common mistakes

Filling out the Arizona Transfer-on-Death Deed form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One of the most frequent errors is failing to include all required information. This includes not only the names of the property owners but also the names of the beneficiaries. Omitting any details can result in the deed being invalidated or contested later, which can create unnecessary stress for your loved ones.

Another mistake often made is not properly identifying the property. When completing the deed, it’s essential to provide a clear and accurate description of the property being transferred. This means including the address and legal description, which can usually be found on the property’s tax documents. If the property is not clearly identified, it may lead to confusion or disputes among beneficiaries.

Many individuals overlook the importance of signing the deed correctly. In Arizona, the deed must be signed by the property owner in front of a notary public. Failing to do this step can render the deed ineffective. It’s crucial to ensure that the signature matches the name on the property title and that the notary’s acknowledgment is included. This step adds a layer of protection against future challenges.

Finally, some people neglect to record the Transfer-on-Death Deed with the county recorder’s office. Even if the form is filled out correctly, it must be filed to be legally recognized. Recording the deed ensures that it is part of the public record and can be easily accessed when needed. Without this step, your wishes regarding the transfer of property may not be honored, leaving your beneficiaries in a difficult position.

Discover More Transfer-on-Death Deed Templates for Specific States

California Transfer on Death Deed - It does not require the consent of the beneficiaries during your lifetime.

To complete the sale of a trailer in Washington, it's crucial to utilize the Trailer Bill of Sale form, which provides a clear record of the transaction and ensures both parties are protected during the ownership transfer.

New Jersey Transfer on Death Deed - This option provides flexibility for property owners in planning for the future.