Free Promissory Note Template for the State of Arizona

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | An Arizona Promissory Note is a written promise to pay a specified amount of money to a designated person at a certain time. |

| Governing Law | The Arizona Uniform Commercial Code (UCC) governs promissory notes in Arizona. |

| Parties Involved | The note involves two primary parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, and it should be clearly stated in the note. |

| Payment Terms | Payment terms must specify the amount due, the due date, and any installment payments if applicable. |

| Security | A promissory note can be unsecured or secured by collateral, which should be outlined in the document. |

| Signatures | Both parties must sign the note for it to be legally binding. Witnesses or notarization may enhance its enforceability. |

| Default Provisions | The note should include terms that address what happens in case of default, such as late fees or acceleration of payment. |

Sample - Arizona Promissory Note Form

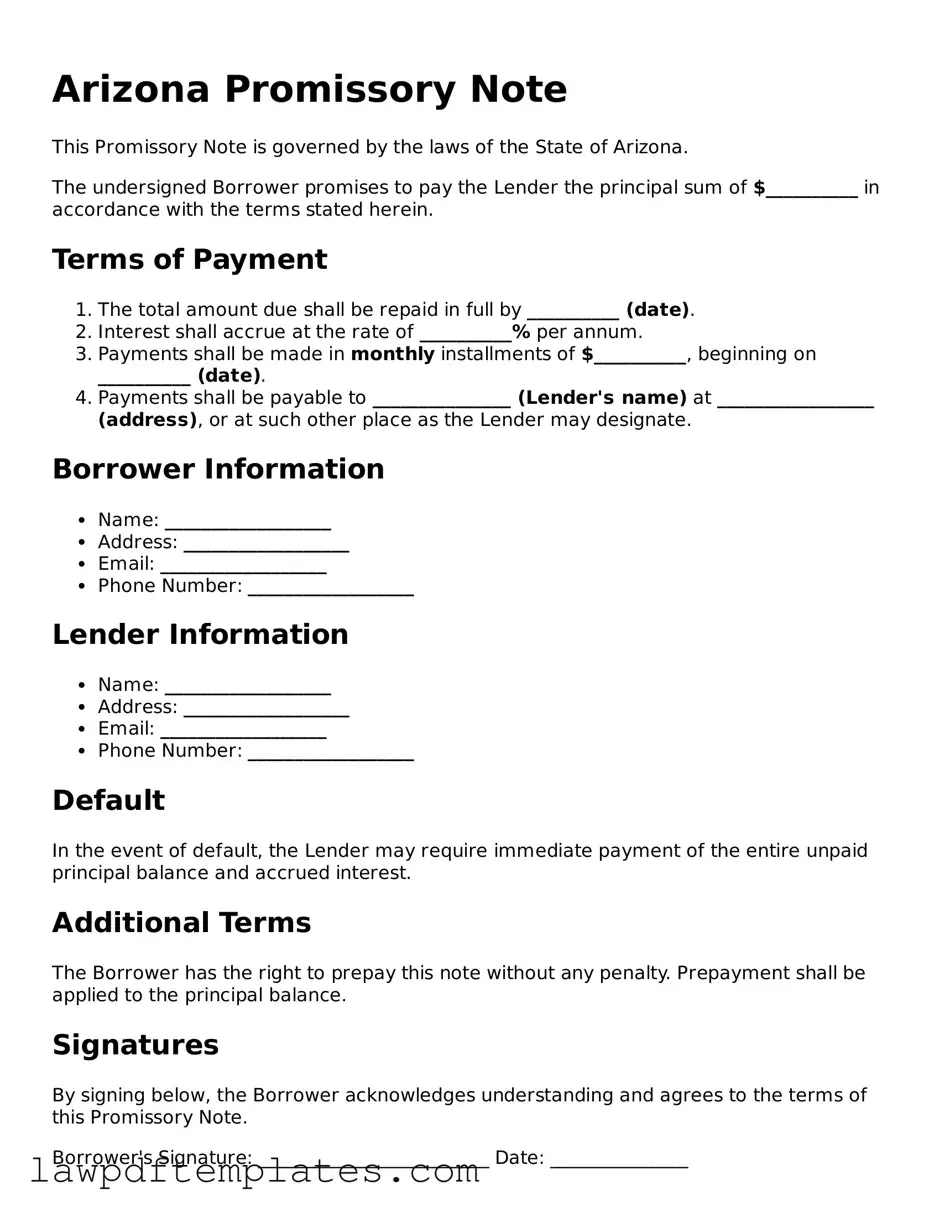

Arizona Promissory Note

This Promissory Note is governed by the laws of the State of Arizona.

The undersigned Borrower promises to pay the Lender the principal sum of $__________ in accordance with the terms stated herein.

Terms of Payment

- The total amount due shall be repaid in full by __________ (date).

- Interest shall accrue at the rate of __________% per annum.

- Payments shall be made in monthly installments of $__________, beginning on __________ (date).

- Payments shall be payable to _______________ (Lender's name) at _________________ (address), or at such other place as the Lender may designate.

Borrower Information

- Name: __________________

- Address: __________________

- Email: __________________

- Phone Number: __________________

Lender Information

- Name: __________________

- Address: __________________

- Email: __________________

- Phone Number: __________________

Default

In the event of default, the Lender may require immediate payment of the entire unpaid principal balance and accrued interest.

Additional Terms

The Borrower has the right to prepay this note without any penalty. Prepayment shall be applied to the principal balance.

Signatures

By signing below, the Borrower acknowledges understanding and agrees to the terms of this Promissory Note.

Borrower's Signature: _________________________ Date: _______________

Lender's Signature: _________________________ Date: _______________

Common mistakes

Filling out the Arizona Promissory Note form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is neglecting to include all necessary information. For example, forgetting to write down the full names of both the borrower and the lender can create confusion and potential legal issues later. Always ensure that both parties are clearly identified.

Another mistake is failing to specify the loan amount accurately. Some individuals may round numbers or write estimates instead of the exact figure. This can lead to disputes about the actual terms of the agreement. It’s crucial to double-check that the amount is correct and clearly stated.

People often overlook the importance of including a date on the form. Without a date, it can be difficult to establish when the loan was made or when payments are due. This can create complications if either party needs to reference the agreement in the future. Always remember to include the date when the note is signed.

Many individuals also forget to outline the repayment terms clearly. This includes specifying the interest rate, payment schedule, and any penalties for late payments. If these terms are vague or missing, it can lead to misunderstandings. Take the time to detail how and when payments should be made.

Additionally, some people do not provide a clear description of what happens in the event of default. It’s essential to outline the consequences if the borrower fails to make payments. This can protect the lender’s interests and clarify expectations for both parties.

Another common mistake is failing to sign the document. It may seem obvious, but without signatures from both the borrower and the lender, the note may not be legally binding. Ensure that both parties sign and date the document to validate the agreement.

People sometimes neglect to keep copies of the completed Promissory Note. After signing, it’s important for both parties to retain a copy for their records. This can help avoid disputes and serve as a reference if questions arise later.

Finally, individuals may not seek legal advice when necessary. While it might seem tempting to fill out the form without assistance, consulting with a legal professional can provide clarity and ensure that the document meets all legal requirements. Taking this step can help prevent future issues and protect both parties involved.

Discover More Promissory Note Templates for Specific States

Promissory Note Ohio - It can be essential for recording the terms of payment extensions or modifications.

Illinois Promissory Note - Loan servicing companies often rely on promissory notes for managing debts.

For those looking to acquire a vehicle in Texas, utilizing the Texas Vehicle Purchase Agreement is essential for a clear understanding between buyer and seller, and additional resources can be found at PDF Documents Hub, which provides necessary documentation to assist with the process.

Blank Promissory Note - Promissory notes can be transferred between parties, subject to certain conditions.