Free Operating Agreement Template for the State of Arizona

Form Breakdown

| Fact Name | Details |

|---|---|

| Governing Law | The Arizona Operating Agreement is governed by Arizona Revised Statutes, Title 29, Chapter 4. |

| Purpose | This form outlines the management structure and operational guidelines for a limited liability company (LLC) in Arizona. |

| Member Rights | The agreement specifies the rights and responsibilities of members within the LLC. |

| Management Structure | It can establish a member-managed or manager-managed structure, depending on the members' preferences. |

| Capital Contributions | The agreement details the initial capital contributions required from each member. |

| Profit Distribution | It defines how profits and losses will be allocated among the members. |

| Amendments | The form outlines the process for making amendments to the agreement in the future. |

| Dispute Resolution | It may include provisions for resolving disputes among members, such as mediation or arbitration. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a defined term. |

| Filing Requirements | While the operating agreement itself does not need to be filed with the state, it is recommended to keep it with the LLC’s records. |

Sample - Arizona Operating Agreement Form

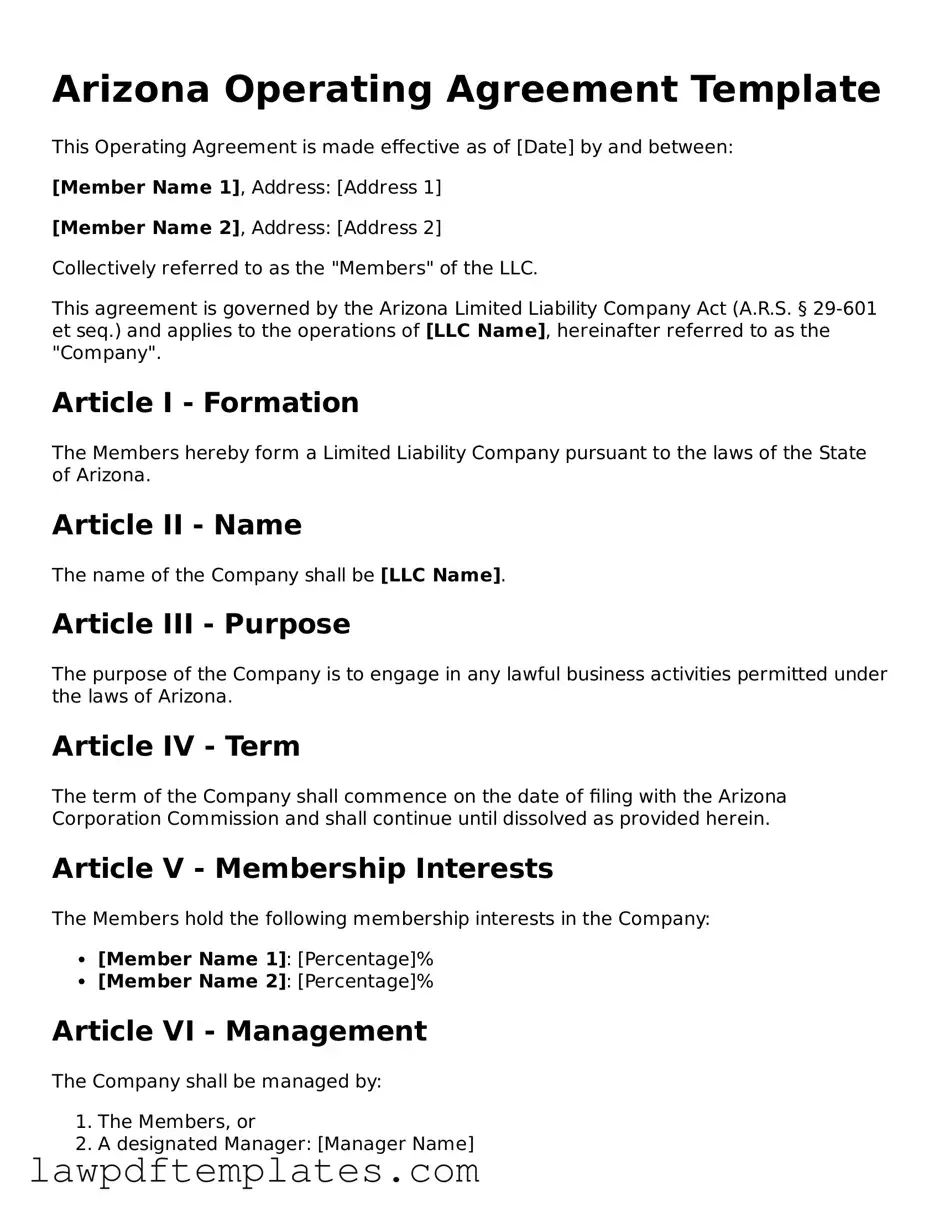

Arizona Operating Agreement Template

This Operating Agreement is made effective as of [Date] by and between:

[Member Name 1], Address: [Address 1]

[Member Name 2], Address: [Address 2]

Collectively referred to as the "Members" of the LLC.

This agreement is governed by the Arizona Limited Liability Company Act (A.R.S. § 29-601 et seq.) and applies to the operations of [LLC Name], hereinafter referred to as the "Company".

Article I - Formation

The Members hereby form a Limited Liability Company pursuant to the laws of the State of Arizona.

Article II - Name

The name of the Company shall be [LLC Name].

Article III - Purpose

The purpose of the Company is to engage in any lawful business activities permitted under the laws of Arizona.

Article IV - Term

The term of the Company shall commence on the date of filing with the Arizona Corporation Commission and shall continue until dissolved as provided herein.

Article V - Membership Interests

The Members hold the following membership interests in the Company:

- [Member Name 1]: [Percentage]%

- [Member Name 2]: [Percentage]%

Article VI - Management

The Company shall be managed by:

- The Members, or

- A designated Manager: [Manager Name]

Article VII - Capital Contributions

Each Member has made the following initial capital contributions:

- [Member Name 1]: $[Amount]

- [Member Name 2]: $[Amount]

Article VIII - Distributions

Distributions shall be made to the Members in proportion to their membership interests unless otherwise agreed in writing.

Article IX - Dissolution

The Company shall be dissolved upon the occurrence of any of the following events:

- By the unanimous agreement of the Members.

- As required by law.

Article X - Miscellaneous

This Operating Agreement may be amended only by a written agreement signed by all Members. This agreement constitutes the entire agreement among the Members.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

_____________________________ _____________________________

[Member Name 1] [Member Name 2]

Common mistakes

Filling out the Arizona Operating Agreement form is a critical step for any limited liability company (LLC) in the state. However, many individuals make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure that your form is completed correctly.

One frequent mistake is failing to include all members of the LLC. Each member's name and address should be clearly listed. Omitting a member can create confusion regarding ownership and responsibilities. It’s essential to ensure that all current members are accounted for to avoid future disputes.

Another common error is neglecting to specify the management structure of the LLC. Arizona allows for both member-managed and manager-managed structures. If this choice is not clearly stated, it can lead to misunderstandings about who has the authority to make decisions for the company.

Some individuals also overlook the importance of detailing the capital contributions of each member. This section outlines what each member has invested in the company, whether in cash, property, or services. Without this information, it may be challenging to determine each member’s share of profits and losses later on.

In addition, many people fail to address the distribution of profits and losses. This section should clearly outline how profits and losses will be shared among members. If this is not specified, disputes may arise regarding financial distributions, leading to potential legal issues.

Another mistake involves not including a process for adding or removing members. An operating agreement should outline the procedure for admitting new members or handling the exit of existing ones. Without this clarity, the LLC may face challenges in managing its membership effectively.

Some individuals also make the error of not having the agreement reviewed by legal counsel. While it may seem straightforward, legal documents can have significant implications. A review by an attorney can help ensure that the agreement complies with state laws and adequately protects all members’ interests.

Finally, failing to keep the operating agreement updated can lead to issues over time. Changes in membership, business structure, or operations should prompt a review and revision of the agreement. Regular updates can help maintain clarity and prevent misunderstandings among members.

Discover More Operating Agreement Templates for Specific States

Operating Agreement Llc Ohio Template - The Operating Agreement is a good practice for any business.

Llc Operating Agreement Massachusetts - The agreement can outline the process for member withdrawal.

In addition to understanding the essential elements of the contract, you can access a convenient online resource for assistance by visiting https://texasformspdf.com/fillable-texas-trec-residential-contract-online/, which provides guidance on how to fill out the Texas TREC Residential Contract form effectively.

Operating Agreement Llc Nc Template - It provides guidelines for resolving member disputes.