Free Deed in Lieu of Foreclosure Template for the State of Arizona

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is an agreement where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure proceedings. |

| Governing Law | In Arizona, the deed in lieu of foreclosure is governed by the Arizona Revised Statutes, specifically Title 33, which covers property and real estate transactions. |

| Benefits | This process can help borrowers avoid the lengthy and costly foreclosure process, allowing for a quicker resolution and potentially less impact on their credit score. |

| Considerations | Borrowers should understand that they may still be liable for any deficiency balance if the property’s value is less than the outstanding mortgage debt. |

Sample - Arizona Deed in Lieu of Foreclosure Form

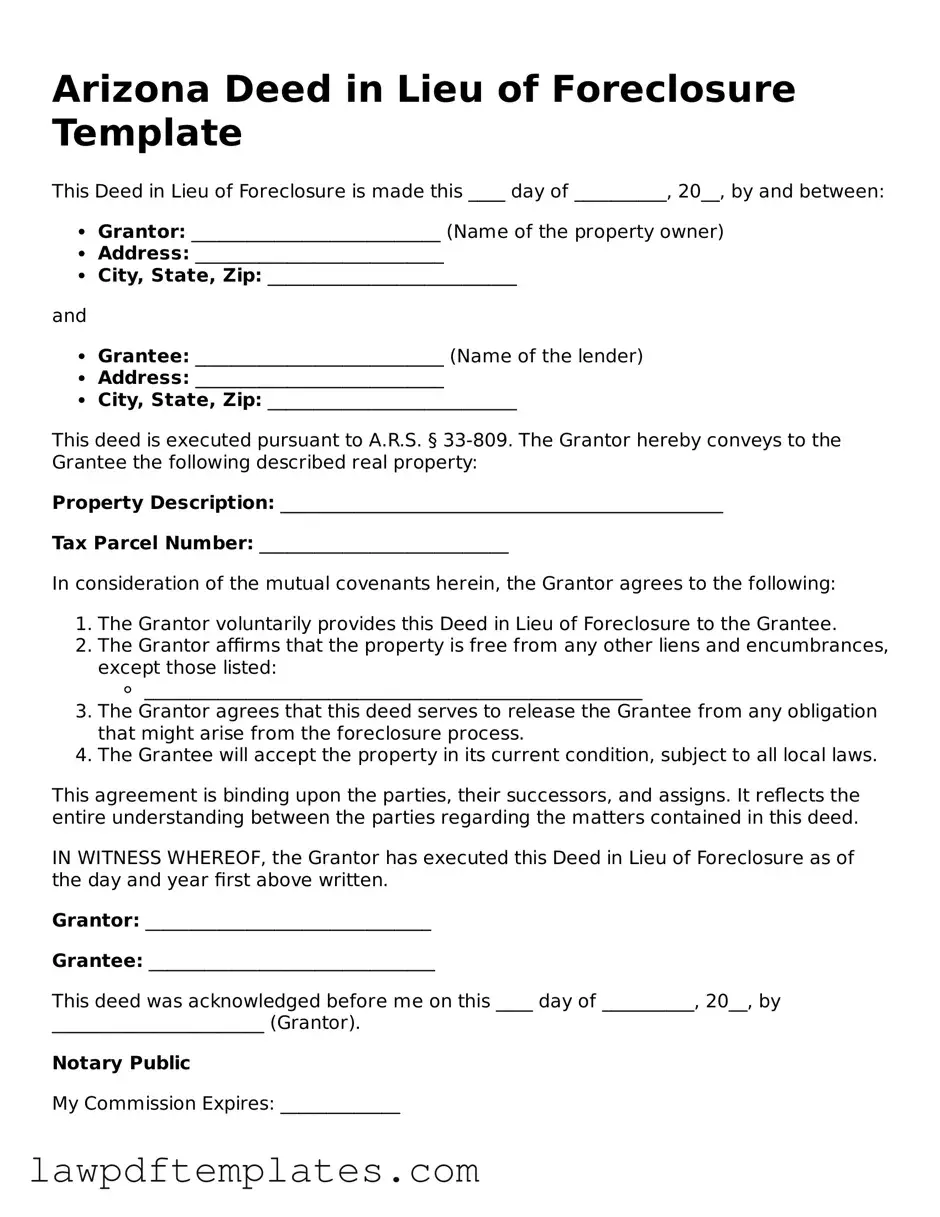

Arizona Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ____ day of __________, 20__, by and between:

- Grantor: ___________________________ (Name of the property owner)

- Address: ___________________________

- City, State, Zip: ___________________________

and

- Grantee: ___________________________ (Name of the lender)

- Address: ___________________________

- City, State, Zip: ___________________________

This deed is executed pursuant to A.R.S. § 33-809. The Grantor hereby conveys to the Grantee the following described real property:

Property Description: ________________________________________________

Tax Parcel Number: ___________________________

In consideration of the mutual covenants herein, the Grantor agrees to the following:

- The Grantor voluntarily provides this Deed in Lieu of Foreclosure to the Grantee.

- The Grantor affirms that the property is free from any other liens and encumbrances, except those listed:

- ______________________________________________________

- The Grantor agrees that this deed serves to release the Grantee from any obligation that might arise from the foreclosure process.

- The Grantee will accept the property in its current condition, subject to all local laws.

This agreement is binding upon the parties, their successors, and assigns. It reflects the entire understanding between the parties regarding the matters contained in this deed.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor: _______________________________

Grantee: _______________________________

This deed was acknowledged before me on this ____ day of __________, 20__, by _______________________ (Grantor).

Notary Public

My Commission Expires: _____________

Common mistakes

Filling out the Arizona Deed in Lieu of Foreclosure form can be a daunting task. Many individuals make common mistakes that can complicate or delay the process. Understanding these pitfalls can help ensure a smoother experience.

One frequent mistake is failing to provide accurate property information. The legal description of the property must be precise. Omitting details or using incorrect data can lead to issues down the line. It’s essential to double-check the property’s address and legal description to avoid complications.

Another common error is neglecting to include all necessary signatures. All parties involved must sign the document for it to be valid. This includes both the borrower and any co-borrowers. Missing a signature can render the deed ineffective, which can prolong the foreclosure process.

Some individuals overlook the importance of notarization. The Deed in Lieu of Foreclosure must be notarized to be legally binding. Failing to have the document notarized can lead to rejection by the lender. It’s crucial to schedule a notarization appointment to ensure compliance.

People often forget to review the terms of the deed carefully. Understanding what rights and obligations are being relinquished is vital. Some may not realize that signing the deed may affect their credit score or future ability to obtain loans. A thorough review helps clarify these implications.

Another mistake is assuming that a Deed in Lieu of Foreclosure will automatically prevent a deficiency judgment. In Arizona, lenders may still pursue a deficiency judgment unless explicitly stated otherwise in the agreement. It’s important to negotiate terms with the lender to avoid this potential issue.

Inaccurate dates are another common oversight. The date of execution must match the date of signing. Discrepancies can lead to confusion and legal complications. Always ensure that dates are filled out correctly to maintain clarity.

Some individuals fail to communicate with their lender before submitting the form. A lack of communication can lead to misunderstandings about the process. Engaging with the lender can clarify expectations and requirements, making the process smoother.

Another mistake involves not providing supporting documentation. Lenders may require proof of hardship or other financial documents. Omitting these can slow down the process or lead to denial of the deed. Gather all necessary paperwork before submission to streamline the process.

Lastly, many people do not seek legal advice before signing the deed. Consulting with a legal expert can provide valuable insights and help avoid potential pitfalls. Understanding the full implications of the deed can protect one’s interests and ensure informed decision-making.

Discover More Deed in Lieu of Foreclosure Templates for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - The process typically requires the borrower to be current or close to current on their mortgage payments.

Deed in Lieu of Foreclosure Form - Documenting the agreement is crucial for protecting both parties’ interests.

For additional resources and guidance on the process, you can refer to the PDF Documents Hub, which offers valuable information regarding the Texas Vehicle Purchase Agreement form and its proper completion.

California Pre-foreclosure Property Transfer - The lender typically agrees to forgive some or all of the remaining mortgage debt.